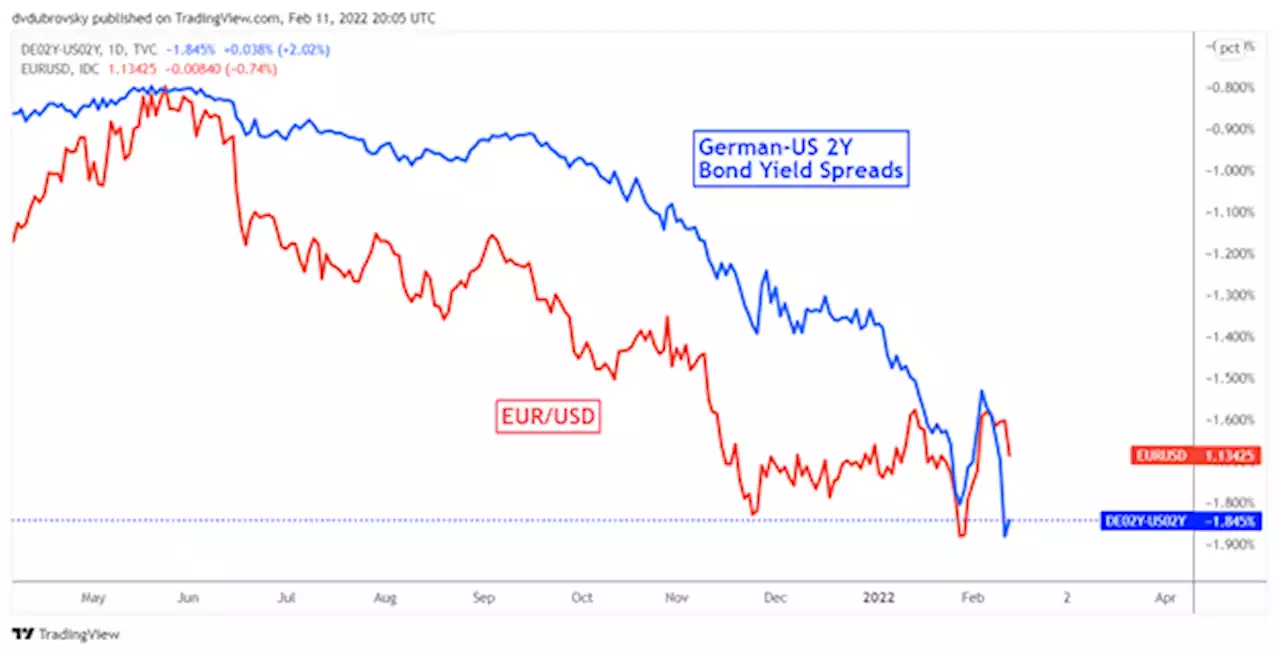

EUR/USD to trace out a 1.10/1.12 to 1.15 trading range – ING EURUSD Fed ECB Banks

h turn from the European Central Bank suggests the pair will probably play out a broad 1.10-1.15 range this year.release new inflation forecasts and potentially opens the door for a 4Q rate hike. 16 March sees the Fed release new Dot Plots and possibly starts off the cycle with a 50bp hike. We currently look for five hikes in total from the Fed in 2022.”traces out something like a 1.10/1.12 to 1.15 trading range as we brace for major central bank tightening.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Binance Extends the Zero Trading Fee Promotion to All USD Stablecoin Trading Pairs | Binance SupportFellow Binancians , To further enhance the liquidity on the stablecoin trading pairs and provide a better trading experience for all users, Binance is extending the Zero Trading Fee Promotion to in...

Binance Extends the Zero Trading Fee Promotion to All USD Stablecoin Trading Pairs | Binance SupportFellow Binancians , To further enhance the liquidity on the stablecoin trading pairs and provide a better trading experience for all users, Binance is extending the Zero Trading Fee Promotion to in...

Read more »

EUR/USD Price Analysis: Stays defensive above 1.1330 support confluenceEUR/USD Price Analysis: Stays defensive above 1.1330 support confluence By anilpanchal7 EURUSD Technical Analysis ChartPatterns TrendFollowing SupportResistance

EUR/USD Price Analysis: Stays defensive above 1.1330 support confluenceEUR/USD Price Analysis: Stays defensive above 1.1330 support confluence By anilpanchal7 EURUSD Technical Analysis ChartPatterns TrendFollowing SupportResistance

Read more »

EUR/USD Weekly Forecast: Taming inflation, the new global challengeThe USD struggled to recover some of the ground lost post-ECB’s announcement, succeeding partially. The US reported the January Consumer Price Index (CPI), which soared to 7.5% YoY, its highest since February 1982.

EUR/USD Weekly Forecast: Taming inflation, the new global challengeThe USD struggled to recover some of the ground lost post-ECB’s announcement, succeeding partially. The US reported the January Consumer Price Index (CPI), which soared to 7.5% YoY, its highest since February 1982.

Read more »

Euro Forecast: EUR/USD on Edge Over Russia-Ukraine Risks, Lagarde Cools ECB Hike BetsThe Euro is increasingly vulnerable despite a hawkish pivot from the ECB earlier this month. Russia-Ukraine tensions risk destabilizing the single currency as Lagarde plays down hawkish bets. Get your weekly Euro forecast from ddubrovskyFX here:

Euro Forecast: EUR/USD on Edge Over Russia-Ukraine Risks, Lagarde Cools ECB Hike BetsThe Euro is increasingly vulnerable despite a hawkish pivot from the ECB earlier this month. Russia-Ukraine tensions risk destabilizing the single currency as Lagarde plays down hawkish bets. Get your weekly Euro forecast from ddubrovskyFX here:

Read more »

Canadian Dollar Forecast: USD/CAD Range Set up to Break SoonUSD/CAD has been a choppy range environment, but could soon change; levels and lines to watch in the days ahead. Get your weekly Canadian Dollar forecast from PaulRobinsonFX here:

Canadian Dollar Forecast: USD/CAD Range Set up to Break SoonUSD/CAD has been a choppy range environment, but could soon change; levels and lines to watch in the days ahead. Get your weekly Canadian Dollar forecast from PaulRobinsonFX here:

Read more »

Report: Kyler Frustrated by Cards; Team Expects Situation to Calm DownKyler Murray is reportedly frustrated by the Cardinals and the team’s blowout playoff loss

Report: Kyler Frustrated by Cards; Team Expects Situation to Calm DownKyler Murray is reportedly frustrated by the Cardinals and the team’s blowout playoff loss

Read more »