The EUR/USD pair struggles to capitalize on the previous day's goodish rebound from the 1.0800 mark, or a three-week low and oscillates in a narrow range during the Asian session on Tuesday.

EUR/USD oscillates in a narrow range and is influenced by a combination of diverging forces. The Fed’s projected three rate cuts in 2024 undermine the USD and lend support to the pair. Rising bets for a June ECB rate cut keep the Euro bulls on the defensive and act as a headwind. The EUR/USD pair struggles to capitalize on the previous day's goodish rebound from the 1.0800 mark, or a three-week low and oscillates in a narrow range during the Asian session on Tuesday.

In fact, Bank of Italy Governor Fabio Panetta said on Monday that the ECB is moving towards an interest rate cut as inflation is falling rapidly and approaching the 2% target. Separately, ECB chief economist Philip Lane noted that the central bank can consider reversing interest rates once it becomes more confident that wage growth is slowing and inflation is heading back to the 2% target as projected. This further contributes to capping the upside for the EUR/USD pair.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

EUR/USD finds floor in 1.0800s as Fed meeting slides into viewEUR/USD has taken a step lower and is now trading within a new range in the 1.0800s following last week’s warmer-than-expected US inflation data, which increased the probability the Federal Reserve (Fed) will need to keep interest rates higher for longer.

EUR/USD finds floor in 1.0800s as Fed meeting slides into viewEUR/USD has taken a step lower and is now trading within a new range in the 1.0800s following last week’s warmer-than-expected US inflation data, which increased the probability the Federal Reserve (Fed) will need to keep interest rates higher for longer.

Read more »

EUR/USD remains under pressure above the mid-1.0800s, Fed rate decision eyedThe EUR/USD pair edges lower to multi-day lows around 1.0870 on the firmer US Dollar (USD) during the early Asian session on Tuesday.

EUR/USD remains under pressure above the mid-1.0800s, Fed rate decision eyedThe EUR/USD pair edges lower to multi-day lows around 1.0870 on the firmer US Dollar (USD) during the early Asian session on Tuesday.

Read more »

EUR/USD flat-lines above the mid-1.0800s, all eyes on Fed rate decisionThe EUR/USD pair trades on a flat note above the mid-1.0800s during the early Asian session on Wednesday.

EUR/USD flat-lines above the mid-1.0800s, all eyes on Fed rate decisionThe EUR/USD pair trades on a flat note above the mid-1.0800s during the early Asian session on Wednesday.

Read more »

EUR/USD Price Analysis: Holds steady above mid-1.0800s, lacks follow-through ahead of FedThe EUR/USD pair edges higher during the Asian session on Wednesday and for now, seems to have snapped a two-day losing streak to a nearly two-week low, around the 1.0835 region touched the previous day.

EUR/USD Price Analysis: Holds steady above mid-1.0800s, lacks follow-through ahead of FedThe EUR/USD pair edges higher during the Asian session on Wednesday and for now, seems to have snapped a two-day losing streak to a nearly two-week low, around the 1.0835 region touched the previous day.

Read more »

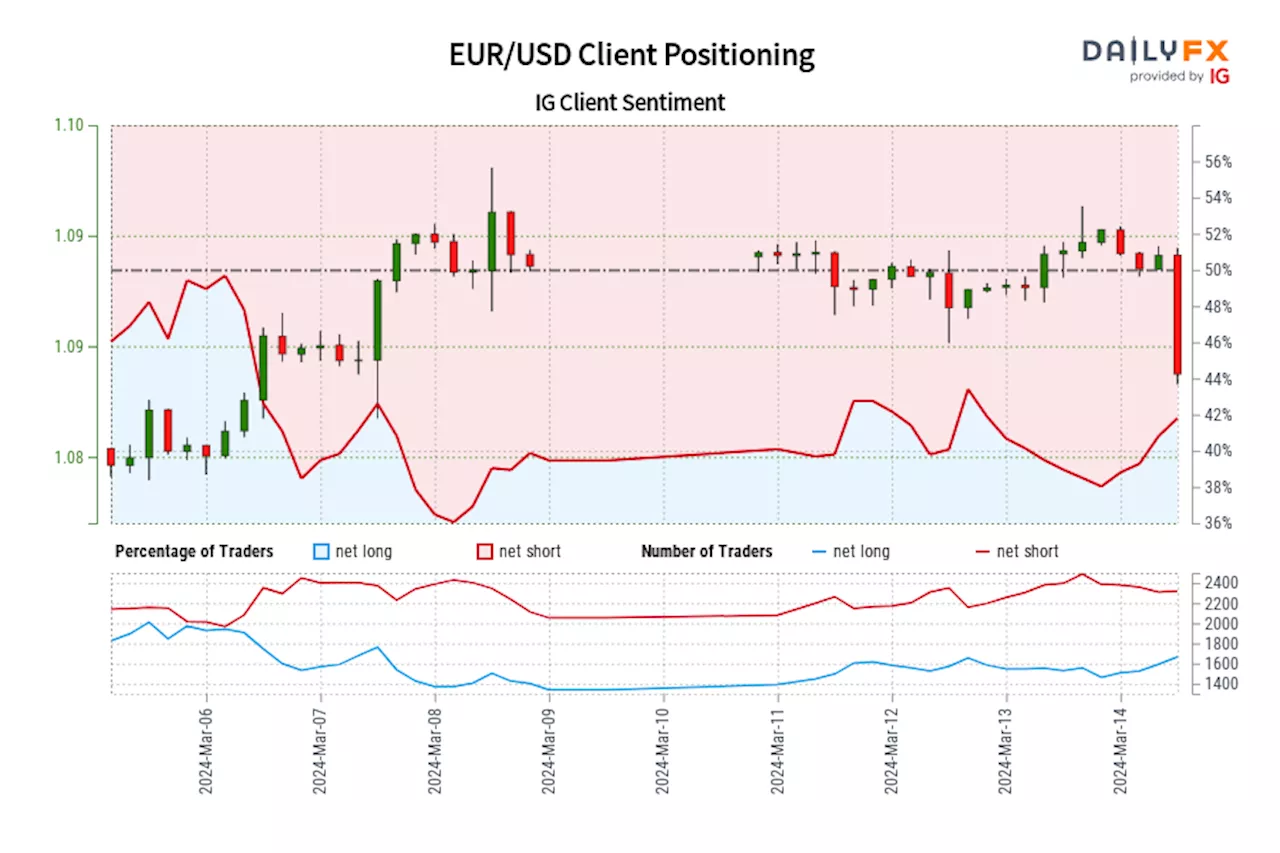

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Mar 06, 2024 03:00 GMT when EUR/USD traded near 1.09.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Mar 06, 2024 03:00 GMT when EUR/USD traded near 1.09.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Read more »

EUR/USD seesaws in range ahead of Fed decisionEUR/USD seesaws between tepid gains and losses on Wednesday, forming a range in the upper 1.0800s after rebounding from Tuesday’s 1.0830 lows on increased probabilities the Federal Reserve (Fed) will cut interest rates by June.

EUR/USD seesaws in range ahead of Fed decisionEUR/USD seesaws between tepid gains and losses on Wednesday, forming a range in the upper 1.0800s after rebounding from Tuesday’s 1.0830 lows on increased probabilities the Federal Reserve (Fed) will cut interest rates by June.

Read more »