EUR/USD edges higher to near 1.0940 in Thursday’s European session.

EUR/USD rises as the US Dollar corrects on firm Fed rate-cut prospects. Investors see the Fed cutting interest rates aggressively this year. The ECB is expected to reduce its key borrowing rates two times more by the year-end. The major currency pair rises as the US Dollar corrects from a three-day high. The US Dollar Index , which tracks the Greenback’s value against six major currencies, drops to near 103.00.

0800, acted as major support for the Euro bulls. The 14-day Relative Strength Index indicator in the daily chart climbs above 60.00. If the RSI sustains above that level, bullish momentum will be triggered. More upside would appear if the major currency pair breaks above Monday’s high of 1.1009. This would drive EUR/USD towards the August 10, 2023, high at 1.1065, followed by the round-level resistance at 1.1100. In an alternate scenario, a downside move below the August 1 low at 1.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

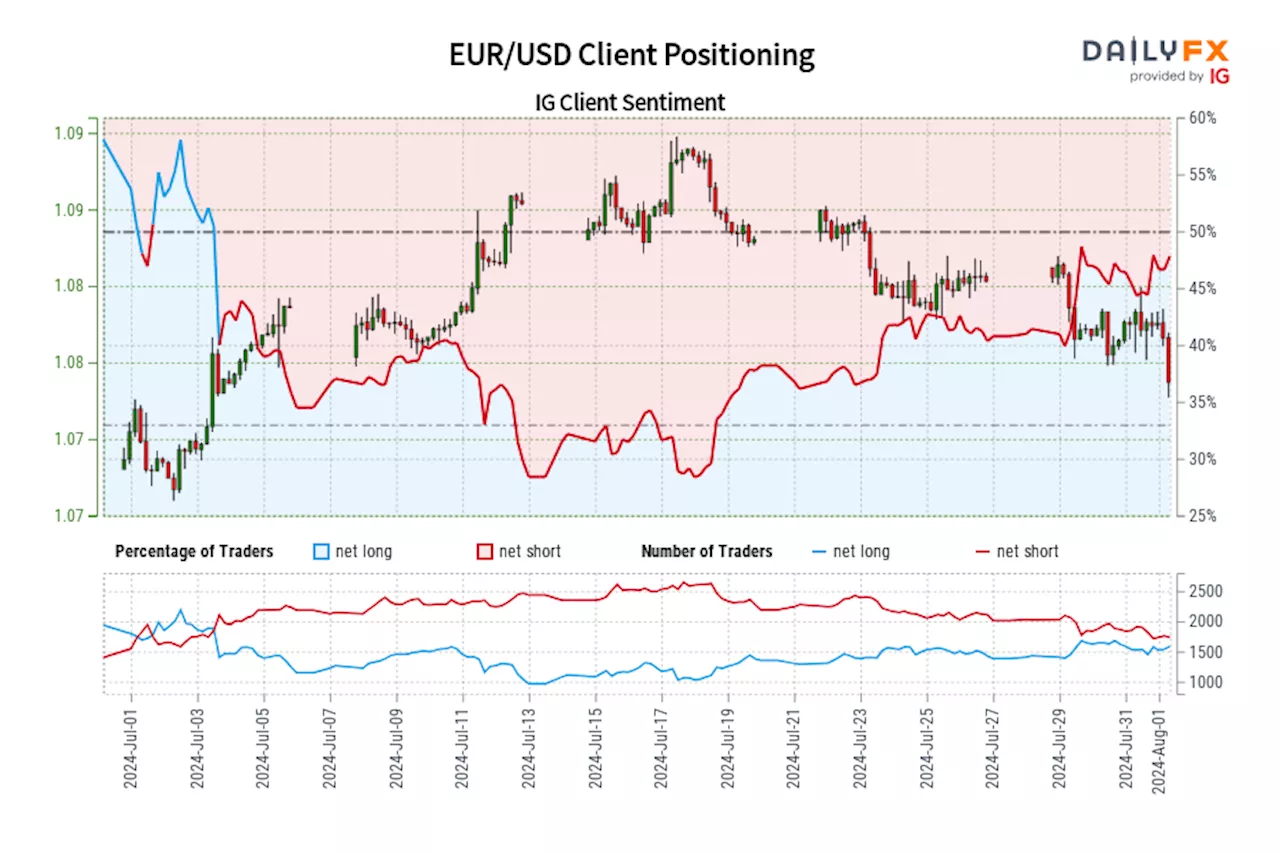

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Jul 03, 2024 when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Jul 03, 2024 when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Read more »

EUR/USD extends its recovery above 1.0800 amid Fed September rate cut signalThe EUR/USD pair rebounds to nearly 1.0835 during the Asian session on Thursday.

EUR/USD extends its recovery above 1.0800 amid Fed September rate cut signalThe EUR/USD pair rebounds to nearly 1.0835 during the Asian session on Thursday.

Read more »

EUR/USD: Dovish Fed Could Spark a Breakout Above 1.09 ResistanceForex Analysis by Fawad Razaqzada covering: EUR/USD, US Dollar Index Futures, US Dollar Index. Read Fawad Razaqzada's latest article on Investing.com

EUR/USD: Dovish Fed Could Spark a Breakout Above 1.09 ResistanceForex Analysis by Fawad Razaqzada covering: EUR/USD, US Dollar Index Futures, US Dollar Index. Read Fawad Razaqzada's latest article on Investing.com

Read more »

EUR/USD recovers above 1.0800 as US Dollar declines ahead of US NFPEUR/USD hovers near the round-level figure of 1.0800 in Friday’s European session.

EUR/USD recovers above 1.0800 as US Dollar declines ahead of US NFPEUR/USD hovers near the round-level figure of 1.0800 in Friday’s European session.

Read more »

EUR/USD extends upside above 1.0850, eyes on Eurozone GDP, Fed rate decisionThe EUR/USD pair trades with mild gains around 1.0860 during the early Asian trading hours on Monday.

EUR/USD extends upside above 1.0850, eyes on Eurozone GDP, Fed rate decisionThe EUR/USD pair trades with mild gains around 1.0860 during the early Asian trading hours on Monday.

Read more »

EUR/USD Price Analysis: Moves above 1.0850 toward the upper boundary of channelEUR/USD advances for the third consecutive day, trading around 1.0860 during the Asian session on Monday.

EUR/USD Price Analysis: Moves above 1.0850 toward the upper boundary of channelEUR/USD advances for the third consecutive day, trading around 1.0860 during the Asian session on Monday.

Read more »