EUR/USD edges higher on Wednesday after European Central Bank (ECB) Executive Board member Piero Cipollone said that there was room to cut interest rates swiftly despite elevated wage inflation.

EUR/USD resumesits short-term downtrend, perhaps due to diverging commentary from central bankers. ECB officials are coming across as more dovish than their Federal Reserve peers. EUR/USD edges loweron Wednesday on the back of diverging commentary from rate-setters at the US Federal Reserve and European Central Bank . Commentary from ECB officials is now indicating a high likelihood it will cut interest rates in June, whilst a delay from the Fed is still possible.

0860s and plunged back down, falling in line with the dominant short-term downtrend. Euro versus US Dollar: 4-hour chart A decisive break below the B-wave lows at roughly 1.0795 would signal a continuation of the downtrend to the next target at 1.0750 – then the February lows at roughly 1.0700. A decisive break is one characterized by a long red bearish candle that breaks cleanly through the level and closes near its low, or three down candles in a row that breach the level.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

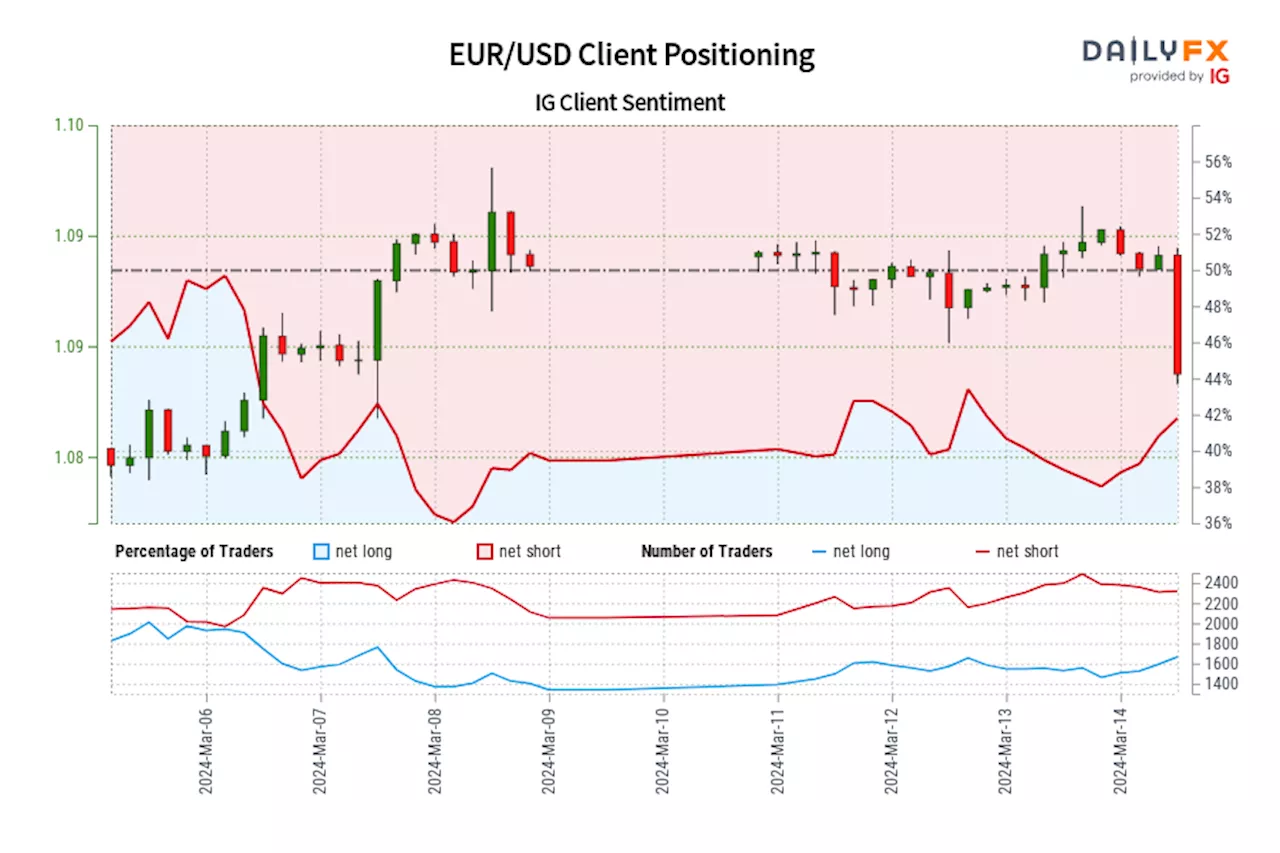

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Mar 06, 2024 03:00 GMT when EUR/USD traded near 1.09.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Mar 06, 2024 03:00 GMT when EUR/USD traded near 1.09.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Read more »

EUR/USD edges high amid soft US Dollar, central bank speculationsThe EUR/USD registered solid gains of 0.19% on Wednesday, courtesy of a softer US Dollar amidst high US Treasury bond yields.

EUR/USD edges high amid soft US Dollar, central bank speculationsThe EUR/USD registered solid gains of 0.19% on Wednesday, courtesy of a softer US Dollar amidst high US Treasury bond yields.

Read more »

EUR/USD Forecast: Limited bullish potential ahead of central banks’ frenzyThe EUR/USD pair trades uneventfully around the 1.0900 mark, up roughly 20 pips in the day.

EUR/USD Forecast: Limited bullish potential ahead of central banks’ frenzyThe EUR/USD pair trades uneventfully around the 1.0900 mark, up roughly 20 pips in the day.

Read more »

EUR/USD Forecast: US Dollar surges after the first round of central banks’ decisionsThe EUR/USD pair fell to 1.0834 on Tuesday as the US Dollar gathered momentum following a busy Asian session.

EUR/USD Forecast: US Dollar surges after the first round of central banks’ decisionsThe EUR/USD pair fell to 1.0834 on Tuesday as the US Dollar gathered momentum following a busy Asian session.

Read more »

EUR/USD tests 200-day average with key Central bank speakers waiting in the wingsEUR/USD is trading a quarter of a percent down on Friday, in the lower 1.0800s just below the 200-day Simple Moving Average (SMA).

EUR/USD tests 200-day average with key Central bank speakers waiting in the wingsEUR/USD is trading a quarter of a percent down on Friday, in the lower 1.0800s just below the 200-day Simple Moving Average (SMA).

Read more »

EUR/USD Weekly Forecast: Central banks paving the way for June rate cutsThe EUR/USD pair surged to 1.0981, its highest in almost two months, on Friday, ending the week at around 1.0950.

EUR/USD Weekly Forecast: Central banks paving the way for June rate cutsThe EUR/USD pair surged to 1.0981, its highest in almost two months, on Friday, ending the week at around 1.0950.

Read more »