EUR/USD extends its gains for the second session, trading around 1.1190 during the Asian session on Monday.

EUR/USD gains ground due to rising expectations of a Fed rate cut in September. Fed Chair Powell stated at the Jackson Hole Symposium, The time has come for policy to adjust.” ECB official Olli Rehn stated that the recent slowdown in inflation bolsters the case for a rate cut next month. This upside of the EUR/USD pair is attributed to the lower US Dollar following the dovish speech from the US Federal Reserve Chairman Jerome Powell at the Jackson Hole Symposium on Friday.

What is the ECB and how does it impact the Euro? The European Central Bank in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

Majors Macroeconomics Eurozone

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

EUR/USD slides yet clings to 1.1100 as market awaits Powell’s speechThe EUR/USD is set to finish Thursday’s session with losses of over 0.30% after the Greenback was bolstered by high US Treasury yields, even though Fed officials support a rate cut at the upcoming meeting in September.

EUR/USD slides yet clings to 1.1100 as market awaits Powell’s speechThe EUR/USD is set to finish Thursday’s session with losses of over 0.30% after the Greenback was bolstered by high US Treasury yields, even though Fed officials support a rate cut at the upcoming meeting in September.

Read more »

EUR/USD holds above 1.1100 mark amid fresh USD selling, ahead of Fed’s PowellThe EUR/USD pair regains positive traction on the last day of the week and for now, seems to have stalled its pullback from the vicinity of over a one-year high touched on Wednesday.

EUR/USD holds above 1.1100 mark amid fresh USD selling, ahead of Fed’s PowellThe EUR/USD pair regains positive traction on the last day of the week and for now, seems to have stalled its pullback from the vicinity of over a one-year high touched on Wednesday.

Read more »

EUR/USD holds 1.1100 ahead of Powell speech at Jackson HoleEUR/USD recovers mildly to near 1.1120 in Friday’s European session after correcting from a fresh year-to-date high of 1.1174 on Thursday.

EUR/USD holds 1.1100 ahead of Powell speech at Jackson HoleEUR/USD recovers mildly to near 1.1120 in Friday’s European session after correcting from a fresh year-to-date high of 1.1174 on Thursday.

Read more »

EUR/USD surges toward 1.1200 as Powell turns dovishThe EUR/USD rallied sharply after hitting a daily low of 1.1105 after Federal Reserve Chairman Jerome Powell said, “The time has come for policy to adjust,” opening the door to ease policy.

EUR/USD surges toward 1.1200 as Powell turns dovishThe EUR/USD rallied sharply after hitting a daily low of 1.1105 after Federal Reserve Chairman Jerome Powell said, “The time has come for policy to adjust,” opening the door to ease policy.

Read more »

EUR/USD touches 1.13 after Fed’s Powell signals ready to cut ratesEUR/USD rallied into its second-best day of August, climbing seven-tenths of one percent as the US Dollar tumbles across the board.

EUR/USD touches 1.13 after Fed’s Powell signals ready to cut ratesEUR/USD rallied into its second-best day of August, climbing seven-tenths of one percent as the US Dollar tumbles across the board.

Read more »

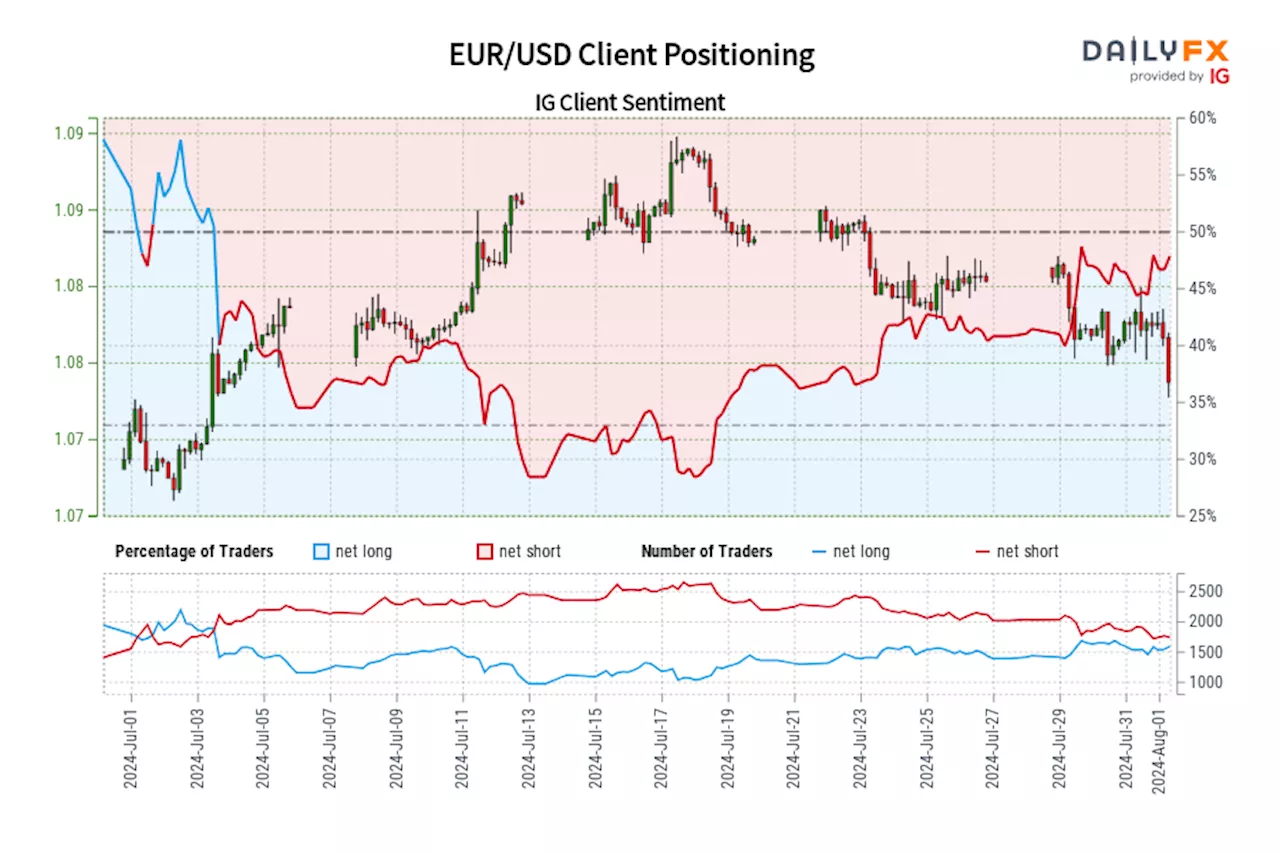

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Jul 03, 2024 when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Jul 03, 2024 when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Read more »