The EUR/USD remains barely unchanged on thin trading after the US Bureau of Economic Analysis (BEA) revealed the Federal Reserve’s preferred gauge for inflation, the Core Personal Consumption Expenditure (PCE) price index for February was aligned with estimates.

EUR/USD nudges up slightly to 1.0788 after Core PCE inflation data for February aligns with market forecasts. Headline PCE inflation for February shows a modest increase, maintaining market anticipation for the Federal Reserve's next moves. Upcoming speeches by Fed Chair Jerome Powell and Mary Daly are eyed by EUR/USD traders.

According to BBH analysts, Fed Chair Jerome Powell's speech will be important. They noted, “Other Fed speakers have tilted hawkish after last week’s FOMC meeting, and markets will be watching to see if Powell follows suit or maintains the dovish tone from his press conference. With Powell, it’s always a coin toss but as we’ve said countless times before, the data will ultimately decide the timing of the first cut.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

EUR/USD Forecast: Sellers maintain the pressure ahead of US PCE inflationThe EUR/USD pair broke below the 1.0800 threshold on Thursday, reaching a fresh March low of 1.0774 during European trading hours.

EUR/USD Forecast: Sellers maintain the pressure ahead of US PCE inflationThe EUR/USD pair broke below the 1.0800 threshold on Thursday, reaching a fresh March low of 1.0774 during European trading hours.

Read more »

US Dollar Forecast: PCE Data to Steal Show; EUR/USD, USD/JPY, GBP/USD SetupsThis article analyzes the outlook for the U.S. dollar, focusing on three of the most traded currency pairs: EUR/USD, USD/JPY and GBP/USD. Key tech levels worth keeping an eye on in the coming days are discussed in depth.

US Dollar Forecast: PCE Data to Steal Show; EUR/USD, USD/JPY, GBP/USD SetupsThis article analyzes the outlook for the U.S. dollar, focusing on three of the most traded currency pairs: EUR/USD, USD/JPY and GBP/USD. Key tech levels worth keeping an eye on in the coming days are discussed in depth.

Read more »

EUR/USD Forecast: Little progress as focus remains on US PCE inflationThe US Dollar maintained a weak tone throughout the first half of the day, helping the EUR/USD extend its modest advance towards the 1.0860 region during the European session.

EUR/USD Forecast: Little progress as focus remains on US PCE inflationThe US Dollar maintained a weak tone throughout the first half of the day, helping the EUR/USD extend its modest advance towards the 1.0860 region during the European session.

Read more »

Markets on Edge Before US PCE Data; Outlook – Gold, EUR/USD, USD/JPY, GBP/USDThis article provides an in-depth analysis of the outlook for EUR/USD, USD/JPY, GBP/USD and gold prices, exploring various potential scenarios that may manifest over the coming days and weeks.

Markets on Edge Before US PCE Data; Outlook – Gold, EUR/USD, USD/JPY, GBP/USDThis article provides an in-depth analysis of the outlook for EUR/USD, USD/JPY, GBP/USD and gold prices, exploring various potential scenarios that may manifest over the coming days and weeks.

Read more »

– EU Core Inflation Remains Sticky, EUR/USD Testing 1.0800 AgainEU core inflation y/y dipped to 3.1% in February from 3.3% in January but came in above market expectations of 2.9%. EUR/USD eyeing a break below 1.0800.

– EU Core Inflation Remains Sticky, EUR/USD Testing 1.0800 AgainEU core inflation y/y dipped to 3.1% in February from 3.3% in January but came in above market expectations of 2.9%. EUR/USD eyeing a break below 1.0800.

Read more »

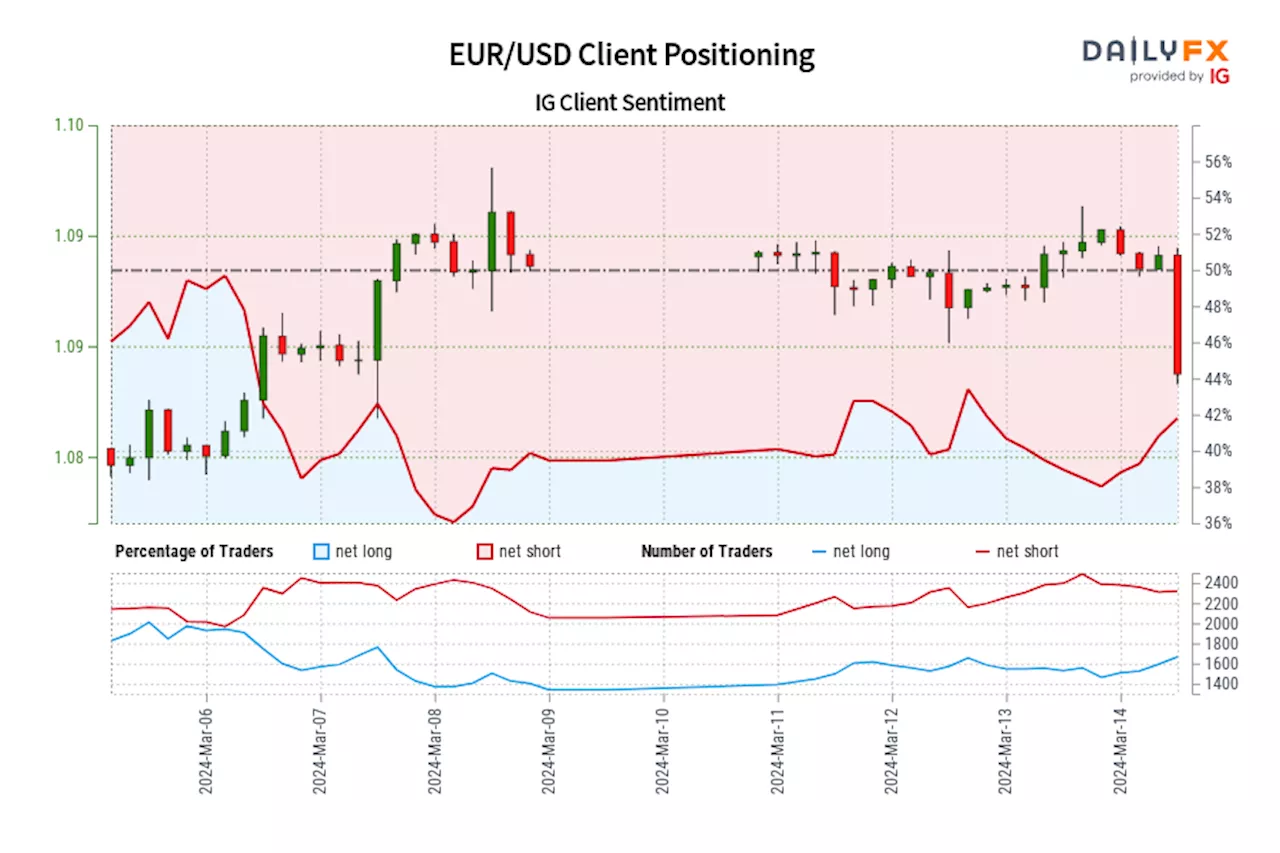

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Mar 06, 2024 03:00 GMT when EUR/USD traded near 1.09.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Mar 06, 2024 03:00 GMT when EUR/USD traded near 1.09.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Read more »