The EUR/USD pair consolidates its gains near 1.1010 after retracing from the fresh seven-month top during the early European session on Thursday.

EUR/USD hovers around 1.1010 in Thursday’s Asian session. Eurozone GDP climbed 0.3% in the three months to June, matching the estimate. US CPI inflation was in line with market consensus. The Eurozone Gross Domestic Product growth figure for the second quarter printed exactly as expected, which lifted the Euro against the Greenback. Data released by Eurostat on Wednesday revealed that the Eurozone economy grew 0.3% QoQ in Q2 compared with the first three months of this year.

What is the ECB and how does it impact the Euro? The European Central Bank in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Retail Sentiment Analysis – EUR/USD, GBP/USD and USD/JPY LatestTrack trader positions, sentiment shifts, and market signals. See long vs short ratios, percentage changes, and bullish/bearish indicators to gauge overall market sentiment and trading trends.

Retail Sentiment Analysis – EUR/USD, GBP/USD and USD/JPY LatestTrack trader positions, sentiment shifts, and market signals. See long vs short ratios, percentage changes, and bullish/bearish indicators to gauge overall market sentiment and trading trends.

Read more »

Retail Sentiment Analysis – EUR/USD, GBP/USD LatestView current IG trader sentiment and discover who is going long and short, the percentage change over time, and whether market signals are bullish or bearish.

Retail Sentiment Analysis – EUR/USD, GBP/USD LatestView current IG trader sentiment and discover who is going long and short, the percentage change over time, and whether market signals are bullish or bearish.

Read more »

Retail Sentiment Analysis – EUR/USD, USD/JPY LatestView current trader sentiment and discover who is going long and short, the percentage change over time, and whether market signals are bullish or bearish.

Retail Sentiment Analysis – EUR/USD, USD/JPY LatestView current trader sentiment and discover who is going long and short, the percentage change over time, and whether market signals are bullish or bearish.

Read more »

Retail Sentiment Analysis – GBP/USD, EUR/USD, and AUD/USD UpdatesMonitor market sentiment, analyse position ratios, track percentage changes, and assess trading indicators to identify current bullish or bearish momentum.

Retail Sentiment Analysis – GBP/USD, EUR/USD, and AUD/USD UpdatesMonitor market sentiment, analyse position ratios, track percentage changes, and assess trading indicators to identify current bullish or bearish momentum.

Read more »

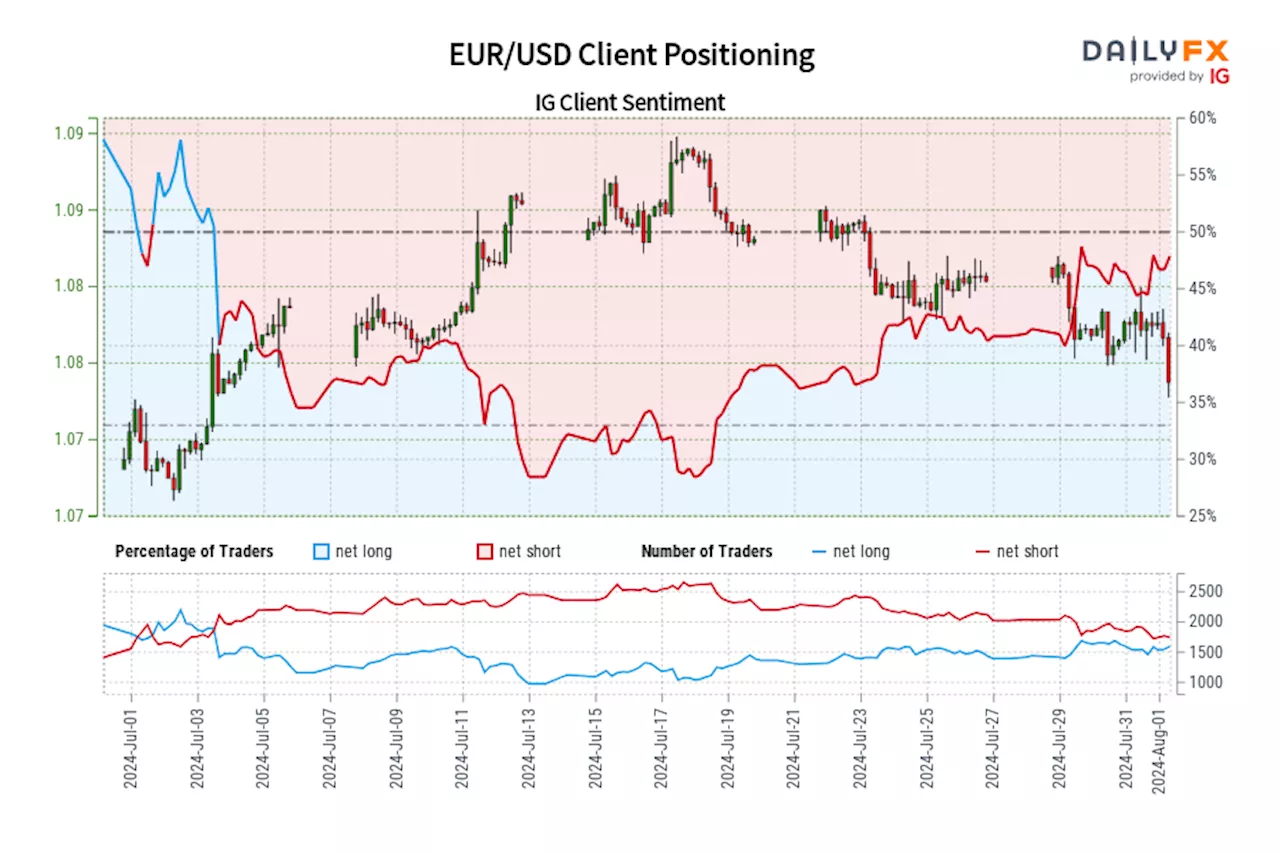

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Jul 03, 2024 when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Jul 03, 2024 when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Read more »

EUR/USD holds position above 1.0900 after breaking its losing streakEUR/USD halts its three-day losing streak, trading around 1.0920 during the Asian session on Friday.

EUR/USD holds position above 1.0900 after breaking its losing streakEUR/USD halts its three-day losing streak, trading around 1.0920 during the Asian session on Friday.

Read more »