The EUR/USD pair remains depressed for the third straight day on Monday and trades around the 1.0690-1.0685 region during the Asian session, just above its lowest level since early May.

EUR/USD struggles to attract any meaningful buyers and is undermined by a combination of factors. Political uncertainty in Europe, along with Friday’s dismal Eurozone PMIs, seems to weigh on the Euro. The Fed ’s relatively hawkish stance lifts the USD to a multi-week top and further acts as a headwind.

This might hold back the USD bulls from placing aggressive bets and help limit any further depreciating move for the EUR/USD pair. Traders might also prefer to wait for this week's release of the US Personal Consumption Expenditures Price Index data on Friday for cues about the Fed's rate-cut path. This, in turn, will play a key role in influencing the near-term USD price dynamics and provide some meaningful impetus to the EUR/USD pair.

Politics Economichealth Fed Currencies

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

EUR/USD Forecast: EUR/USD holds in range after a disappointing US ADP surveyFinancial markets were mostly quiet throughout the first half of the day, with the US Dollar achieving modest intraday gains amid prevalent caution.

EUR/USD Forecast: EUR/USD holds in range after a disappointing US ADP surveyFinancial markets were mostly quiet throughout the first half of the day, with the US Dollar achieving modest intraday gains amid prevalent caution.

Read more »

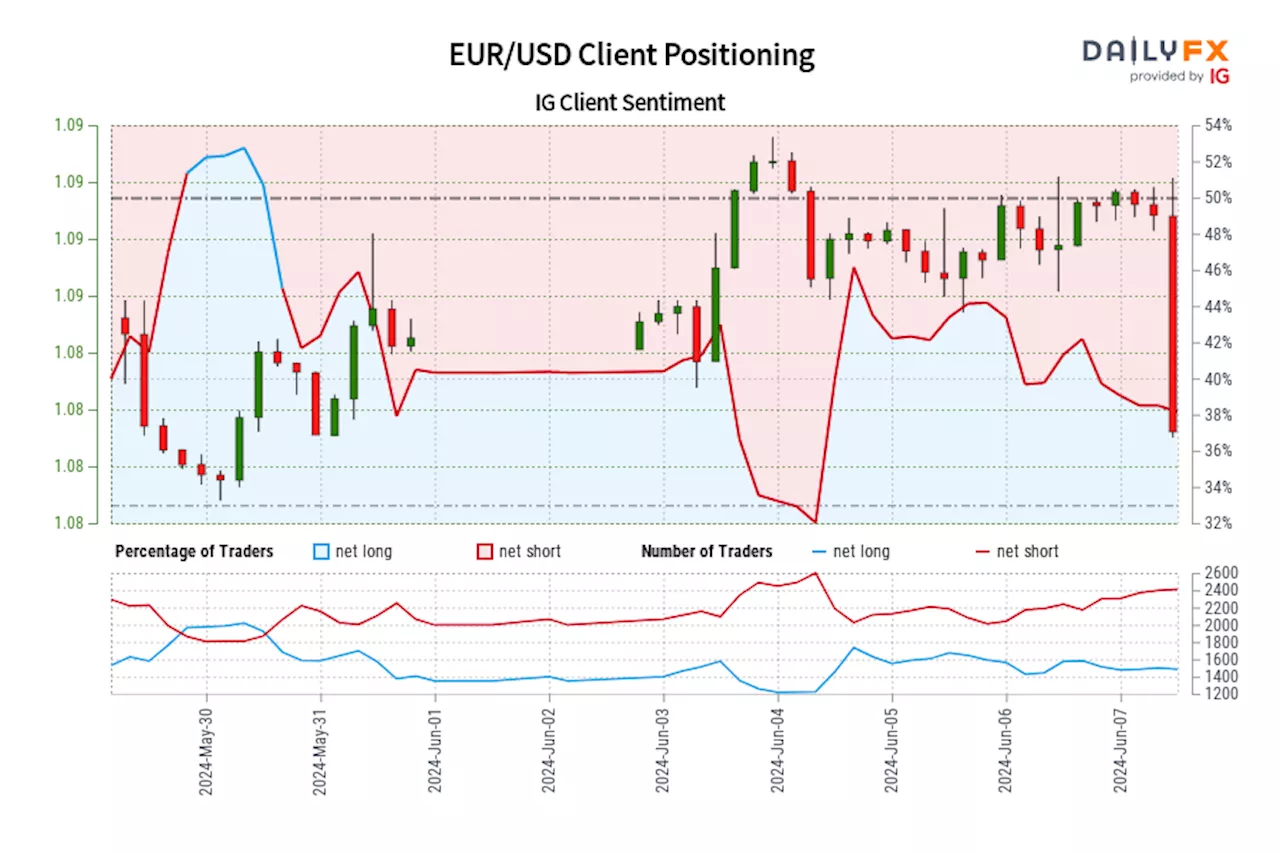

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since May 30, 2024 13:00 GMT when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since May 30, 2024 13:00 GMT when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Read more »

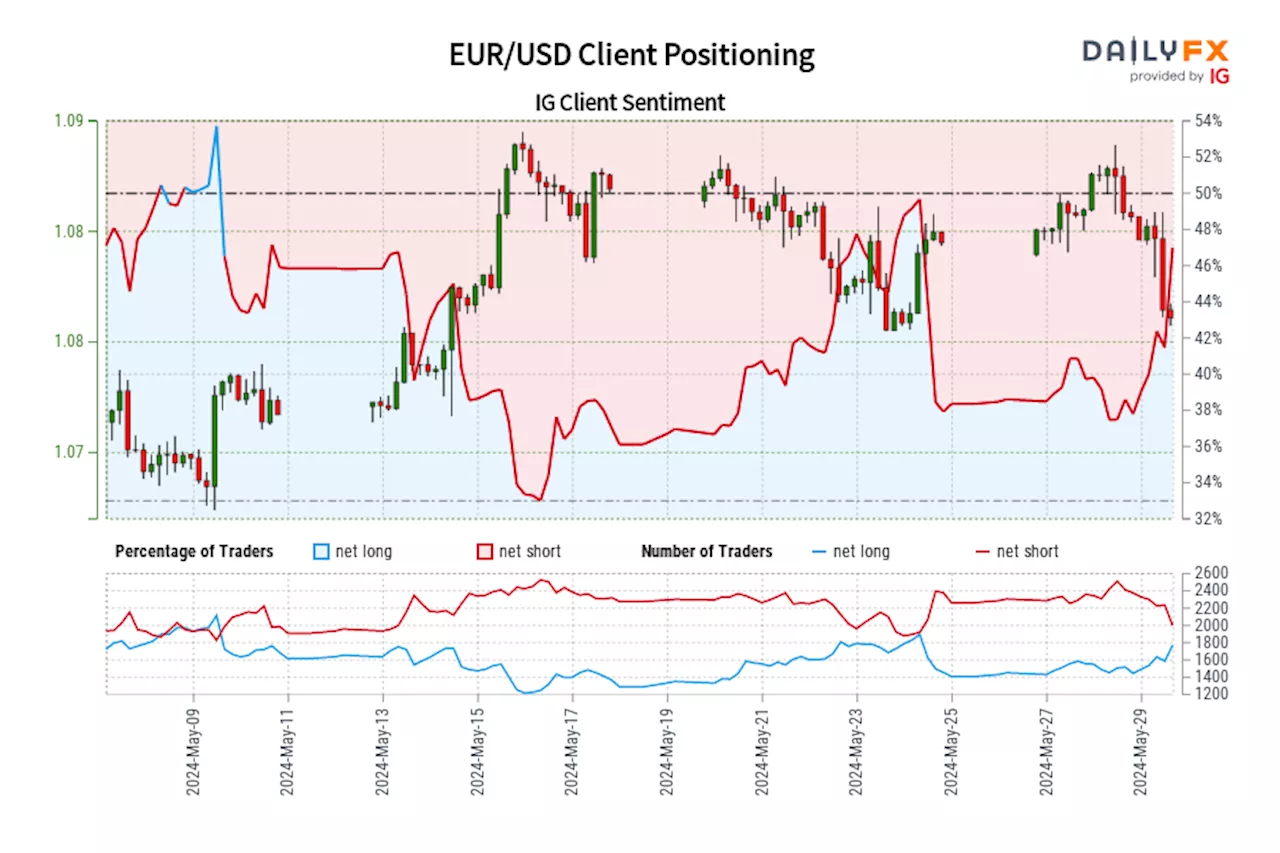

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since May 09, 2024 when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since May 09, 2024 when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Read more »

EUR/USD Forecast: Buyers may push it towards 1.0800The US Dollar is under mild selling pressure in a quiet Wednesday, helping EUR/USD advance towards the 1.0750 price zone.

EUR/USD Forecast: Buyers may push it towards 1.0800The US Dollar is under mild selling pressure in a quiet Wednesday, helping EUR/USD advance towards the 1.0750 price zone.

Read more »

EUR/USD stands tall near its highest level since March, just above 1.0900 markThe EUR/USD pair attracts some buyers for the fourth straight day and climbs beyond the 1.0900 mark – its highest level since March 21 during the Asian session on Tuesday.

EUR/USD stands tall near its highest level since March, just above 1.0900 markThe EUR/USD pair attracts some buyers for the fourth straight day and climbs beyond the 1.0900 mark – its highest level since March 21 during the Asian session on Tuesday.

Read more »

EUR/USD Forecast: Buyers could take action once Euro stabilizes above 1.0900EUR/USD rose sharply and reached its highest level since late March above 1.0900 on Monday.

EUR/USD Forecast: Buyers could take action once Euro stabilizes above 1.0900EUR/USD rose sharply and reached its highest level since late March above 1.0900 on Monday.

Read more »