EUR/USD technical analysis: 1.0700 support in focus, with 1.0600 and 1.0450 levels on the radar amid downside risks in the run up to elections

IG Client Sentiment Update: Our data shows the vast majority of traders in Silver are long at 79.21%, while traders in USD/JPY are...Focus returns to Europe and France in particular in the lead up to the electionsout of the way, the focus returns to Europe and France in particular. The campaign effort is in full swing ahead of the first round of parliamentary elections on the 30th of this month where representatives across the entire political spectrum campaign for votes.

The resounding rise in popularity for Marine Le pen’s National Rally party in the European elections has spooked markets ahead of the snap election. Markets seek stability and certainty and broadly view the Eurosceptic National Rally as an unpredictable force weighing on European bond markets currently.

French-German spreads reveal a notable risk premium that has been applied to riskier nations with higher debt loads like Italy and France, while investors have piled into safer German bonds. A sell-off in periphery nations’ bonds tends to be followed by a weakerJust yesterday the ECB’s Chief Economist Philip Lane characterised the recent move in the bond market as ‘repricing’ and not being in the world of ‘disorderly market dynamics’.

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Information presented by DailyFX Limited should be construed as market commentary, merely observing economical, political and market conditions. This information is made available for informational purposes only. It is not a solicitation or a recommendation to trade derivatives contracts or securities and should not be construed or interpreted as financial advice.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

EUR/USD Forecast: EUR/USD holds in range after a disappointing US ADP surveyFinancial markets were mostly quiet throughout the first half of the day, with the US Dollar achieving modest intraday gains amid prevalent caution.

EUR/USD Forecast: EUR/USD holds in range after a disappointing US ADP surveyFinancial markets were mostly quiet throughout the first half of the day, with the US Dollar achieving modest intraday gains amid prevalent caution.

Read more »

EUR/USD Forecast: EUR/USD steady sub-1.0900 ahead of fresh cluesThe EUR/USD saw little action on Monday, hovering around the 1.0860 mark for most of the day.

EUR/USD Forecast: EUR/USD steady sub-1.0900 ahead of fresh cluesThe EUR/USD saw little action on Monday, hovering around the 1.0860 mark for most of the day.

Read more »

EUR/USD Forecast: Euro could stretch lower if 1.0830 support failsEUR/USD continues to move sideways at around 1.0850 in the European session on Monday after closing the previous week virtually unchanged.

EUR/USD Forecast: Euro could stretch lower if 1.0830 support failsEUR/USD continues to move sideways at around 1.0850 in the European session on Monday after closing the previous week virtually unchanged.

Read more »

EUR/USD Forecast: Euro sellers could take action if 1.0800 support failsAfter rising above 1.0850 during the European trading hours on Thursday, EUR/USD reversed its direction and fell toward 1.0820, closing the fourth consecutive day in negative territory.

EUR/USD Forecast: Euro sellers could take action if 1.0800 support failsAfter rising above 1.0850 during the European trading hours on Thursday, EUR/USD reversed its direction and fell toward 1.0820, closing the fourth consecutive day in negative territory.

Read more »

EUR/USD eased from 1.0880 on Monday as looming rate differential weighsEUR/USD eased back from 1.0880 on Monday as talking points from Federal Reserve (Fed) officials weighed on otherwise quiet market flows.

EUR/USD eased from 1.0880 on Monday as looming rate differential weighsEUR/USD eased back from 1.0880 on Monday as talking points from Federal Reserve (Fed) officials weighed on otherwise quiet market flows.

Read more »

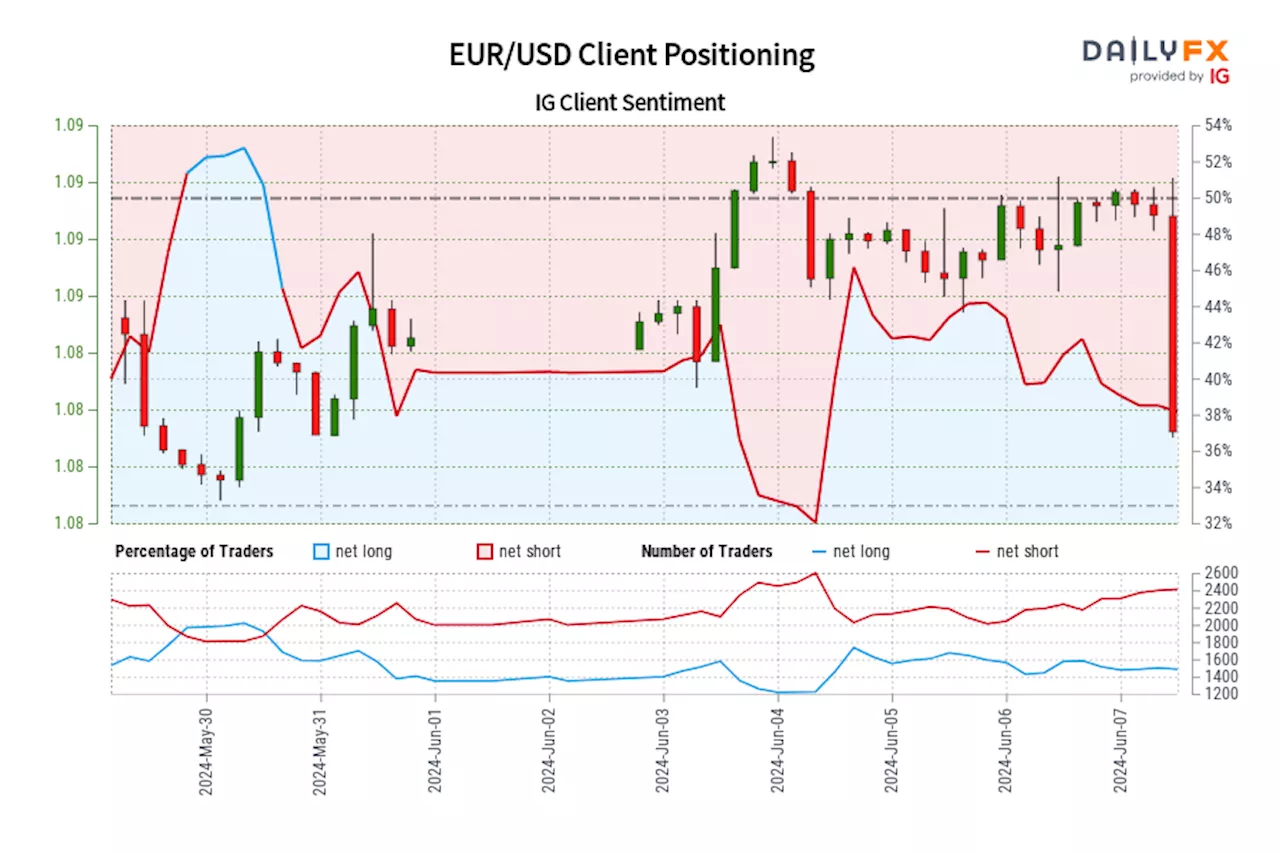

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since May 30, 2024 13:00 GMT when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since May 30, 2024 13:00 GMT when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Read more »