EUR/USD trades slightly down on Wednesday in the lower 1.0600s, as it clocks up a sixth consecutive day of losses.

EUR/USD edges down ahead of HICP inflation data for the Eurozone. Speeches by several key ECB governing council members could also impact EUR/USD. EUR/USD enters oversold levels on the daily chart, indicating risk of a pullback. The pair is entering the oversold zone on charts, suggesting traders may be operating with more caution. Whilst this does not definitively indicate an end to the downtrend itself, it does up the odds of an upward correction potentially evolving on the horizon.

At the moment this is only a warning for short-traders not to add to their positions, however, if the RSI were to exit oversold and rise back above 30, it would be a sign the pair was correcting and for short-traders to close their positions and open longs. As things stand it is still possible the pair could continue lower and even if there is a correction the dominant downtrend is still likely to resume. The next key downside target for the pair is the 2023 lows at 1.0446.

SEO Technical Analysis Fundamental Analysis

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

EUR/USD holds up around 1.0650 ahead of Eurozone Industrial ProductionEUR/USD rebounds from a five-month low of 1.0622 reached last Friday, hovering around 1.0660 during early European trading hours on Monday.

EUR/USD holds up around 1.0650 ahead of Eurozone Industrial ProductionEUR/USD rebounds from a five-month low of 1.0622 reached last Friday, hovering around 1.0660 during early European trading hours on Monday.

Read more »

EUR/USD clings to mild losses below 1.0770, investors await Eurozone inflation, US PMI dataThe EUR/USD pair clings to mild losses near 1.0765 after bouncing off the multi-week lows near 1.0720 on Wednesday.

EUR/USD clings to mild losses below 1.0770, investors await Eurozone inflation, US PMI dataThe EUR/USD pair clings to mild losses near 1.0765 after bouncing off the multi-week lows near 1.0720 on Wednesday.

Read more »

EUR/USD rebounds from oversold lows as Eurozone inflation data loomsEUR/USD is rebounding from intraday-chart oversold lows. Eurozone inflation data on Wednesday could impact interest-rate expectations and the exchange rate. The recovery could rise a little further but the short-term trend remains bearish.

EUR/USD rebounds from oversold lows as Eurozone inflation data loomsEUR/USD is rebounding from intraday-chart oversold lows. Eurozone inflation data on Wednesday could impact interest-rate expectations and the exchange rate. The recovery could rise a little further but the short-term trend remains bearish.

Read more »

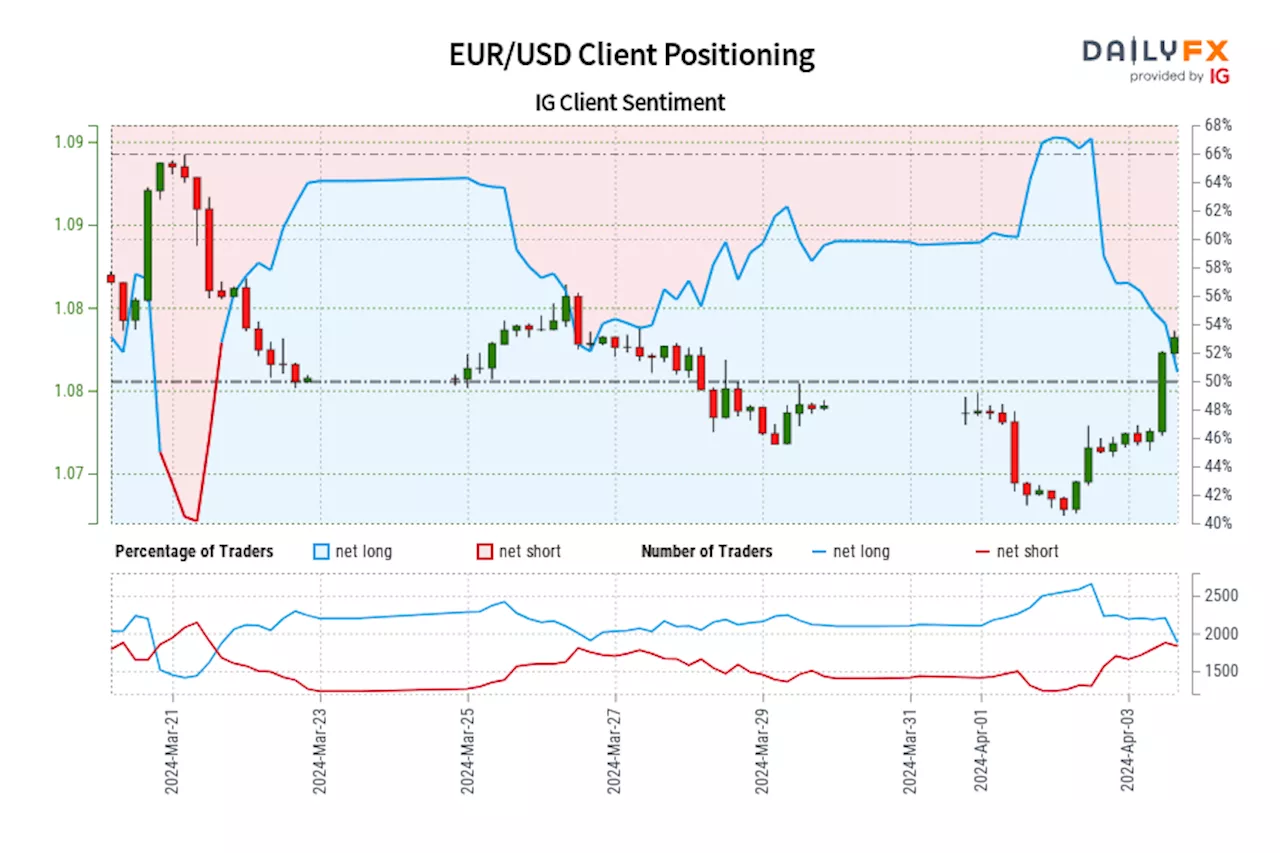

EUR/USD IG Client Sentiment: Our data shows traders are now net-short EUR/USD for the first time since Mar 21, 2024 when EUR/USD traded near 1.09.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-short EUR/USD for the first time since Mar 21, 2024 when EUR/USD traded near 1.09.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

Read more »

EUR/USD Forecast: Limited bullish potential ahead of central banks’ frenzyThe EUR/USD pair trades uneventfully around the 1.0900 mark, up roughly 20 pips in the day.

EUR/USD Forecast: Limited bullish potential ahead of central banks’ frenzyThe EUR/USD pair trades uneventfully around the 1.0900 mark, up roughly 20 pips in the day.

Read more »

EUR/USD Price Analysis: Holds steady above mid-1.0800s, lacks follow-through ahead of FedThe EUR/USD pair edges higher during the Asian session on Wednesday and for now, seems to have snapped a two-day losing streak to a nearly two-week low, around the 1.0835 region touched the previous day.

EUR/USD Price Analysis: Holds steady above mid-1.0800s, lacks follow-through ahead of FedThe EUR/USD pair edges higher during the Asian session on Wednesday and for now, seems to have snapped a two-day losing streak to a nearly two-week low, around the 1.0835 region touched the previous day.

Read more »