The EUR/GBP currency pair climbed following a positive GfK Consumer Confidence Survey from Germany. However, the Euro's gains are capped by expectations of continued interest rate cuts from the European Central Bank, while the Pound Sterling strengthens as traders anticipate the Bank of England to maintain its rates.

EUR/GBP gains ground following the improved GfK Consumer Confidence Survey from Germany. The Euro may struggle due to rising odds of the ECB reducing rates at every meeting until June 2025. The Pound Sterling may appreciate as traders expect the BoE to keep rates unchanged on Thursday. EUR/GBP halts its three-day losing streak, trading around 0.8250 during the early European hours on Thursday.

The EUR/GBP cross remains in positive territory after the release of Germany's GfK Consumer Confidence Survey, which improved to -21.3 for January, up from the previously revised -23.1. The index was expected to come in at -22.5. The upside of the EUR/GBP cross could be limited as the Euro receives downward pressure from the rising odds that the European Central Bank (ECB) will reduce interest rates at every meeting until June 2025. This sentiment is bolstered by policymakers' concerns over mounting economic risks in the Eurozone. Speaking at the Annual Economics Conference, ECB President Christine Lagarde signaled the central bank’s readiness to implement additional rate cuts if incoming data confirms that disinflation remains on course. Lagarde also remarked that the earlier emphasis on maintaining sufficiently restrictive rates is no longer justified. Additionally, the EUR/GBP cross may face challenges as the Pound Sterling (GBP) appreciates due to the increased likelihood of the Bank of England (BoE) keeping interest rates unchanged later in the day while remaining focused on addressing elevated domestic inflation. On Wednesday, data showed that the UK Consumer Price Index (CPI) increased by 2.6% year-over-year in November following October’s 2.3% growth. Core CPI, excluding volatile food and energy items, rose 3.5% YoY in November, against its previous rise of 3.3%. Meanwhile, the annual services inflation steadied at 5.0%, below forecasts of 5.1% but above the BoE's estimate of 4.9%

EUR/GBP Eurozone ECB Bank Of England Interest Rates Consumer Confidence

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

US consumer confidence ticks higher on better outlook for hiringWASHINGTON (AP) — Americans’ outlook on the economy improved modestly in November, lifted by expectations for lower inflation and more hiring. The

US consumer confidence ticks higher on better outlook for hiringWASHINGTON (AP) — Americans’ outlook on the economy improved modestly in November, lifted by expectations for lower inflation and more hiring. The

Read more »

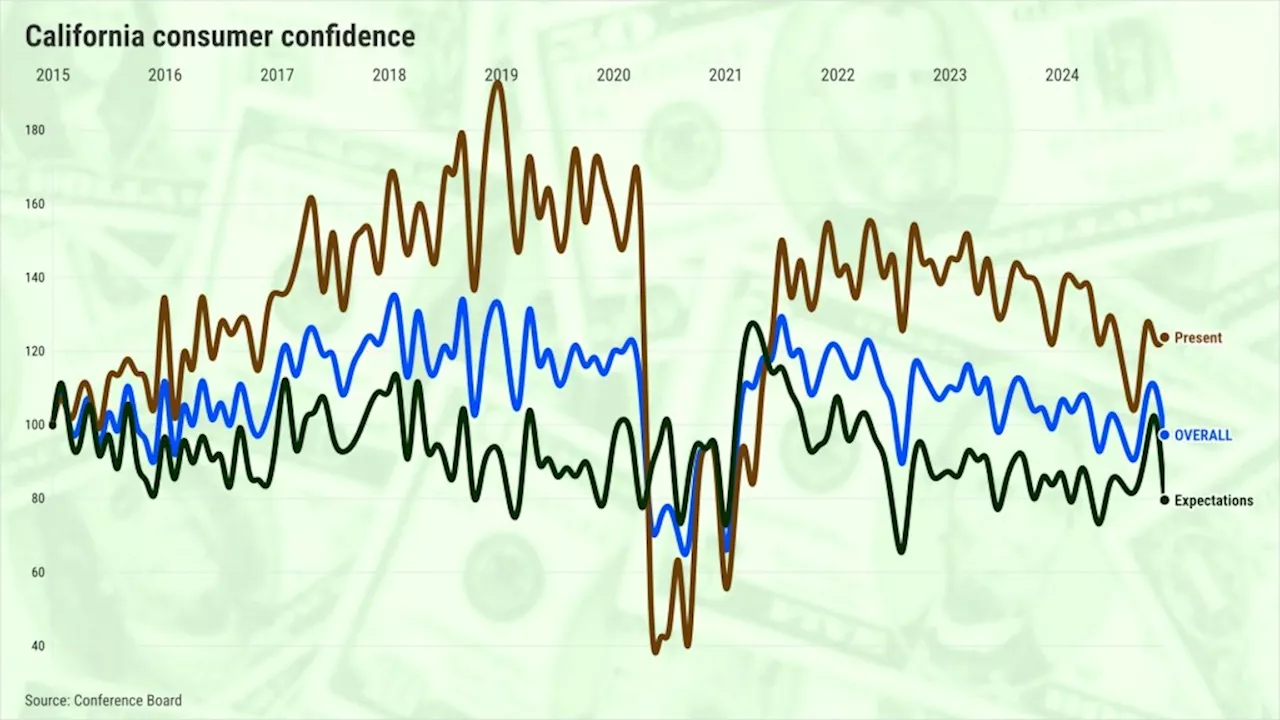

California consumer confidence tumbles after Donald Trump’s electionStatewide optimism off 12% in a month, by this polling, the biggest tumble since May 2023.

California consumer confidence tumbles after Donald Trump’s electionStatewide optimism off 12% in a month, by this polling, the biggest tumble since May 2023.

Read more »

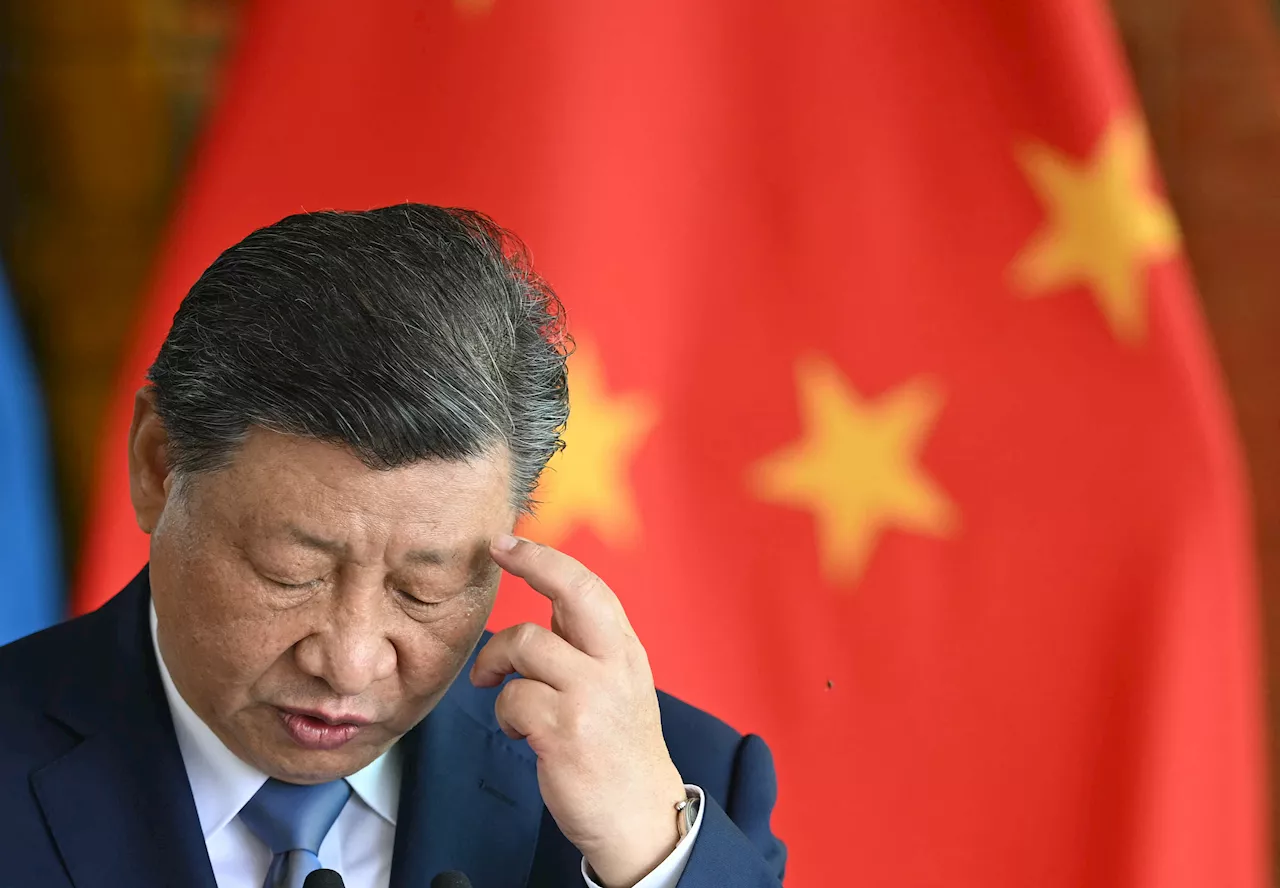

China's Fiscal Easing 'Still Lacking' to Boost Consumer ConfidenceChinese policymakers' plans for more fiscal easing are considered insufficient to address the country's low consumer confidence, according to an analyst. China's economic recovery after COVID-19 lockdowns has been slower than expected, facing challenges like tepid consumer spending, a struggling real estate sector, high youth unemployment, and external pressures. While the government has implemented stimulus packages and shifted towards monetary easing, these efforts haven't significantly boosted consumer spending.

China's Fiscal Easing 'Still Lacking' to Boost Consumer ConfidenceChinese policymakers' plans for more fiscal easing are considered insufficient to address the country's low consumer confidence, according to an analyst. China's economic recovery after COVID-19 lockdowns has been slower than expected, facing challenges like tepid consumer spending, a struggling real estate sector, high youth unemployment, and external pressures. While the government has implemented stimulus packages and shifted towards monetary easing, these efforts haven't significantly boosted consumer spending.

Read more »

Mexican Peso wavers as Consumer Confidence dips, US yields riseThe Mexican Peso erased its earlier gains and dropped to a four-day low before recovering some ground against the Greenback on Tuesday after Consumer Confidence figures in Mexico deteriorated, while US Treasury bond yields rose.

Mexican Peso wavers as Consumer Confidence dips, US yields riseThe Mexican Peso erased its earlier gains and dropped to a four-day low before recovering some ground against the Greenback on Tuesday after Consumer Confidence figures in Mexico deteriorated, while US Treasury bond yields rose.

Read more »

Consumer Confidence Rises to 16-Month High Following Trump Election VictorySource of breaking news and analysis, insightful commentary and original reporting, curated and written specifically for the new generation of independent and conservative thinkers.

Consumer Confidence Rises to 16-Month High Following Trump Election VictorySource of breaking news and analysis, insightful commentary and original reporting, curated and written specifically for the new generation of independent and conservative thinkers.

Read more »

US consumer confidence ticks higher on better outlook for hiringAmericans' outlook on the economy improved modestly in November, lifted by expectations for lower inflation and more hiring.The Conference Board, a business res

US consumer confidence ticks higher on better outlook for hiringAmericans' outlook on the economy improved modestly in November, lifted by expectations for lower inflation and more hiring.The Conference Board, a business res

Read more »