Energy & precious metals - weekly review and outlook

Investing.com -- The economy and geopolitics basically rule supply and demand of commodities. The economy dictates demand more than supply. Geopolitics, conversely, controls supply rather than demand. If what transpired in the just-ended week was economic worry depressing the price of oil, then you’re likely to get some of the opposite this week: geopolitics, in the form of the Israel-Hamas war, driving crude prices up.

That’s for the dollar. Now for the Israel-Hamas conflict, which threatens to redraw power stakes in the Middle East more forcefully than any singular event of the past 30 years. “Even if Israel doesn’t immediately respond to Iran, the repercussions will likely affect Iranian oil production,” Blas wrote. “Since late 2022, Washington has turned a blind eye to surging Iranian oil exports, bypassing American sanctions. The priority in Washington was an informal détente with Tehran.”

“In turn, Venezuela could also benefit, with the White House relaxing sanctions to ease market pressure,” Blas added, referring to another country which the United States has complicated ties with, due to oil. But the Saudis have become the main driver of the supply squeeze in oil now, carrying out some of the deepest production cuts ever in the history of the kingdom, ostensibly to get $100 or more for a barrel. They almost got there two weeks ago, when global crude benchmark Brent went above $97.

Like WTI, the global crude benchmark printed a five week low in the latest session, falling to $83.50. “RSI and Stochastics begin to turn north, hinting at strong rebound which immediately targets 4 Hour 50 EMA $1,846 and 100 Week SMA $1,855. Above this zone, the bullish rebound is expected to continue with targets $1,863-$1,869, followed by $1,881. Any correction to $1928-$1820 may be considered a buying opportunity.”

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Solar Energy Industries Association Expands Board of Directors with Leading Clean Energy Finance Firm & Wire ManufacturerSolar Energy Industries Association Expands Board of Directors with Leading Clean Energy Finance Firm and Wire Manufacturer

Solar Energy Industries Association Expands Board of Directors with Leading Clean Energy Finance Firm & Wire ManufacturerSolar Energy Industries Association Expands Board of Directors with Leading Clean Energy Finance Firm and Wire Manufacturer

Read more »

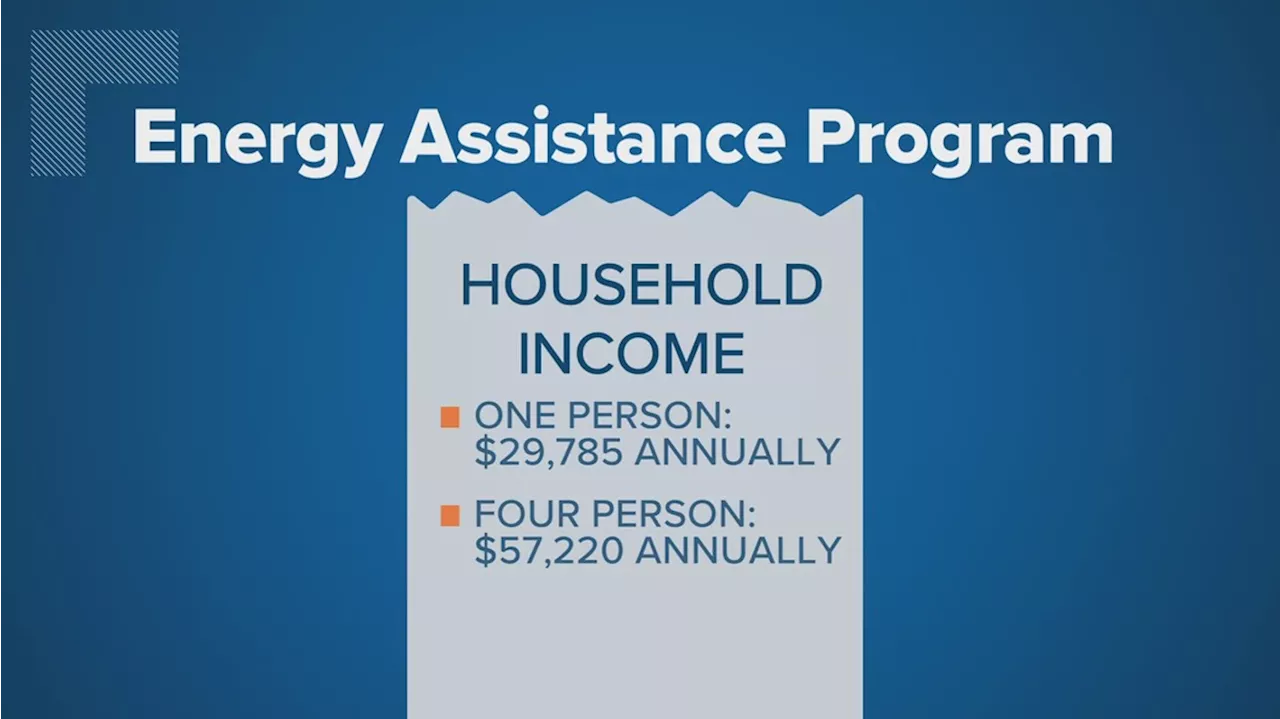

Applications open for winter energy assistance program in IndianaYou can apply right now in-person online by mail or calling 211.

Applications open for winter energy assistance program in IndianaYou can apply right now in-person online by mail or calling 211.

Read more »

Eagles Expect ‘Energy, Passion, & Fire’ From Backups Amid InjuriesThe Philadelphia Eagles want a little more than 'next man up' with defensive tackle Fletcher Cox set to miss Sunday's game against the Los Angeles Rams.

Read more »

Mavs’ Jaden Hardy Relishing Abu Dhabi Experience, Bringing ‘Life & Energy’ to TeamAlthough the Dallas Mavericks started off the preseason with a loss to the Minnesota Timberwolves, second-year guard Jaden Hardy showed out by scoring 13 points in 20 minutes off the bench while being

Read more »

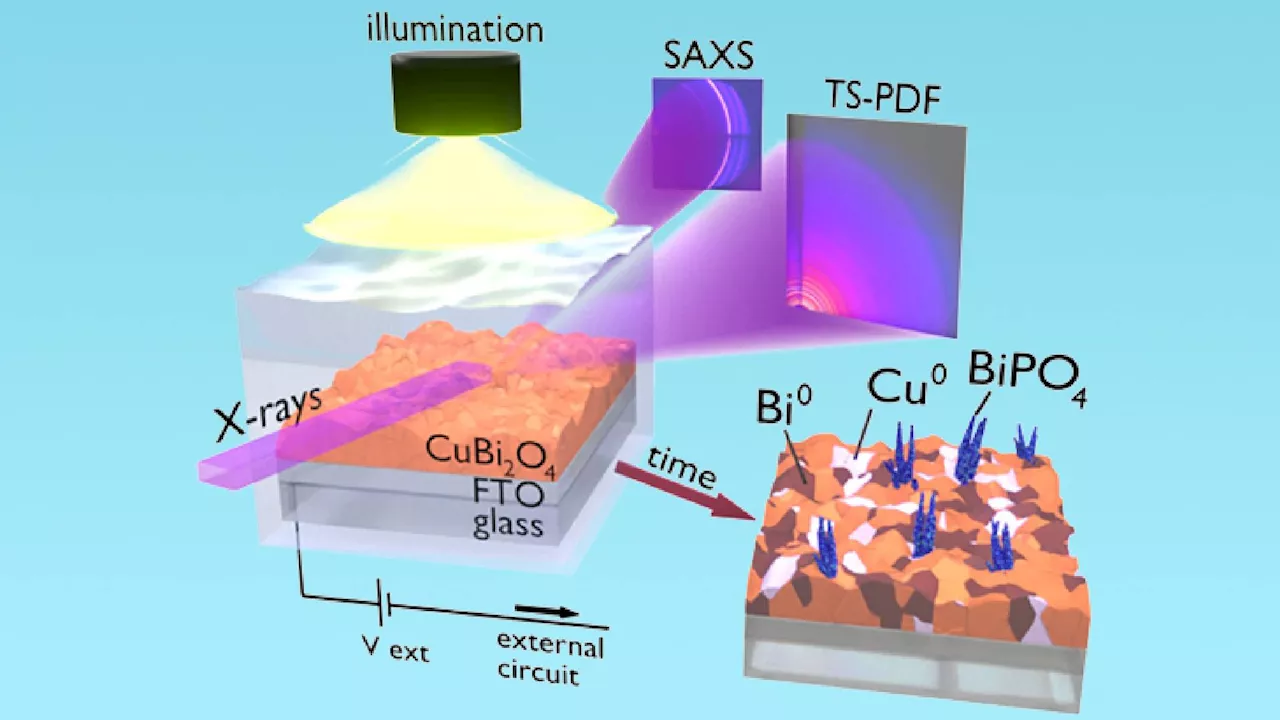

How photo-electrochemistry can produce clean limitless energyInteresting Engineering is a cutting edge, leading community designed for all lovers of engineering, technology and science.

How photo-electrochemistry can produce clean limitless energyInteresting Engineering is a cutting edge, leading community designed for all lovers of engineering, technology and science.

Read more »

Energy Efficiency & Electrification Take Center Stage in New JerseyClean Tech News & Views: EVs, Solar Energy, Batteries

Energy Efficiency & Electrification Take Center Stage in New JerseyClean Tech News & Views: EVs, Solar Energy, Batteries

Read more »