The author argues that the federal tax credit for electric vehicle purchases is ineffective, primarily benefits the wealthy, and burdens taxpayers. They call for Congress to end the credit, citing the growing budget deficit and the unfairness to those who cannot afford EVs.

Hundreds of new Tesla electric vehicles, including Cybertrucks, stand in a storage lot in an industrial area near a rail yard in Seattle. (Scott Brauer/Zuma Press Wire/TNS) The federal tax credit for electric vehicle purchases has far outlived its purpose and now stands as a glaring example of government overreach and economic inequity.

Originally introduced in 2008 to stimulate a fledgling market, and then renewed and expanded in 2022 as part of the Inflation Reduction Act, this credit remains what it has been from the start: an ineffective subsidy primarily benefiting the wealthy. Congress should end it. On the fiscal side, we face a $2-trillion budget deficit, and it’s growing. According to the Treasury, the credits for electric vehicles in the Inflation Reduction Act, which can be up to $7,500 on certain new EVs and up to $4,000 on certain previously owned EVs, representIn addition, the EV credits are part of an industrial policy package of energy tax credits, mandates and “buy American” requirements under the IRA that will costBeyond the price tag that burdens taxpayers, the credit is unfair to the vast majority, who — being less well off than EV purchasers — drive relatively affordable gasoline-powered vehicles and do not reap any financial benefit from the credit.“For vehicles purchased in 2021, taxpayers with adjusted gross income (AGI) greater than $100,000 represented 22% of all filers and received 84% of the credit benefits.” The IRA tax credit’s income limit ($150,000 for single filers, $300,000 for joint filers) and refundability may tilt some benefits to low-income taxpayers. However, EVs have higher purchase prices than comparable gas vehicles, even with tax credits, and installing home charging equipment is easier for homeowners, who tend to have higher incomes, versus renters. As a result, EV tax credits will probably remain a higher-income taxpayer boondoggl

Electric Vehicle Tax Credit Government Spending Economic Inequality Inflation Reduction Act High-Income Taxpayers

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

End the Electric Vehicle Tax Credit: A Burden on Taxpayers and a Privilege for the WealthyThis article argues that the federal tax credit for electric vehicle purchases should be ended due to its high cost, economic inequity, and ineffectiveness.

End the Electric Vehicle Tax Credit: A Burden on Taxpayers and a Privilege for the WealthyThis article argues that the federal tax credit for electric vehicle purchases should be ended due to its high cost, economic inequity, and ineffectiveness.

Read more »

Washington State Democrats Leak Tax Plan With Proposed Firearms Tax and Property Tax IncreasesWashington state Democrats accidentally emailed their sweeping revenue plans, including proposals for an 11% tax on firearms and ammunition, reclassifying storage unit rentals as retail transactions, and lifting property tax levy lids for some residents, to all members of the state Senate. The leak included a PowerPoint presentation with talking points advising lawmakers on how to communicate the tax plan to constituents.

Washington State Democrats Leak Tax Plan With Proposed Firearms Tax and Property Tax IncreasesWashington state Democrats accidentally emailed their sweeping revenue plans, including proposals for an 11% tax on firearms and ammunition, reclassifying storage unit rentals as retail transactions, and lifting property tax levy lids for some residents, to all members of the state Senate. The leak included a PowerPoint presentation with talking points advising lawmakers on how to communicate the tax plan to constituents.

Read more »

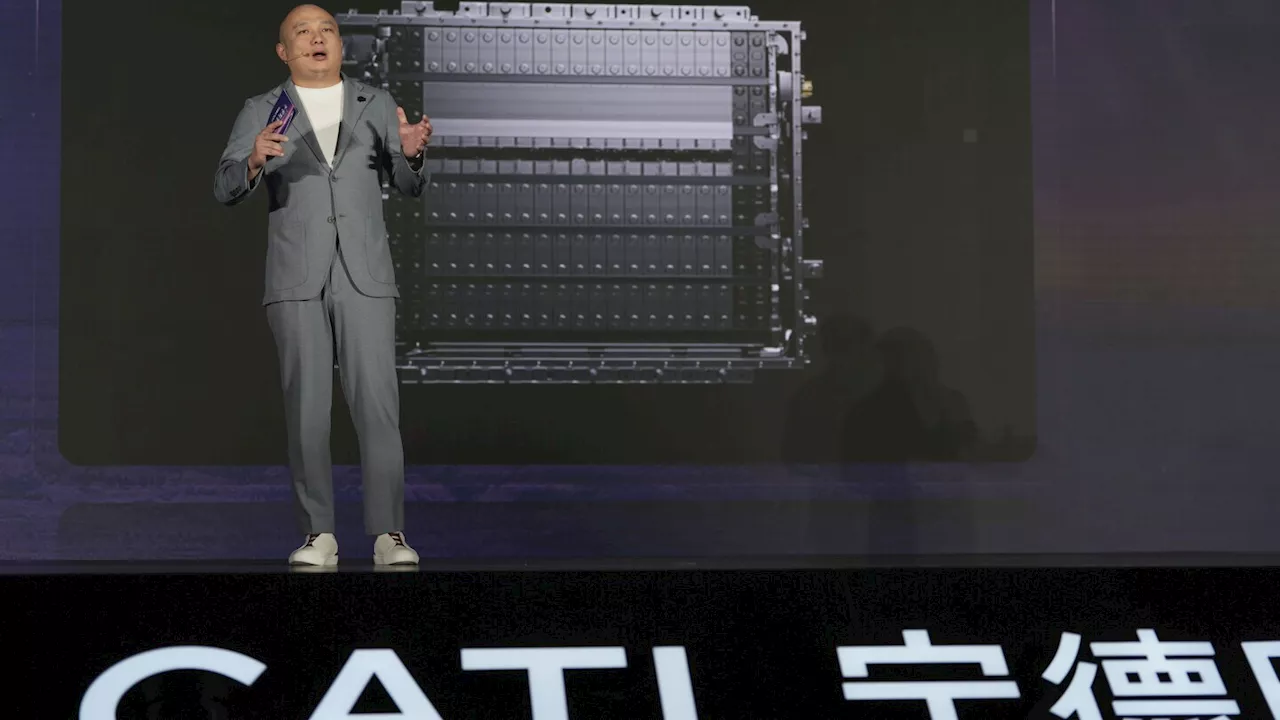

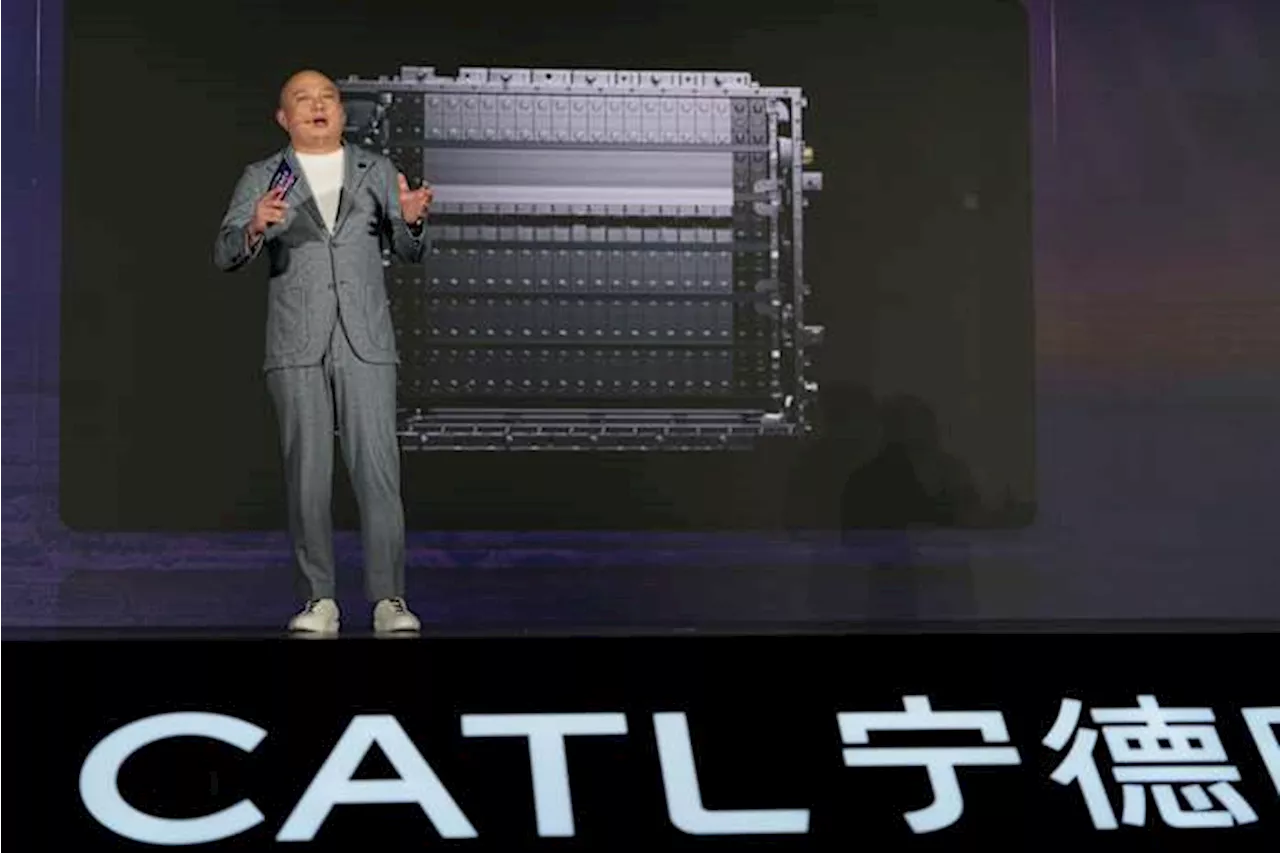

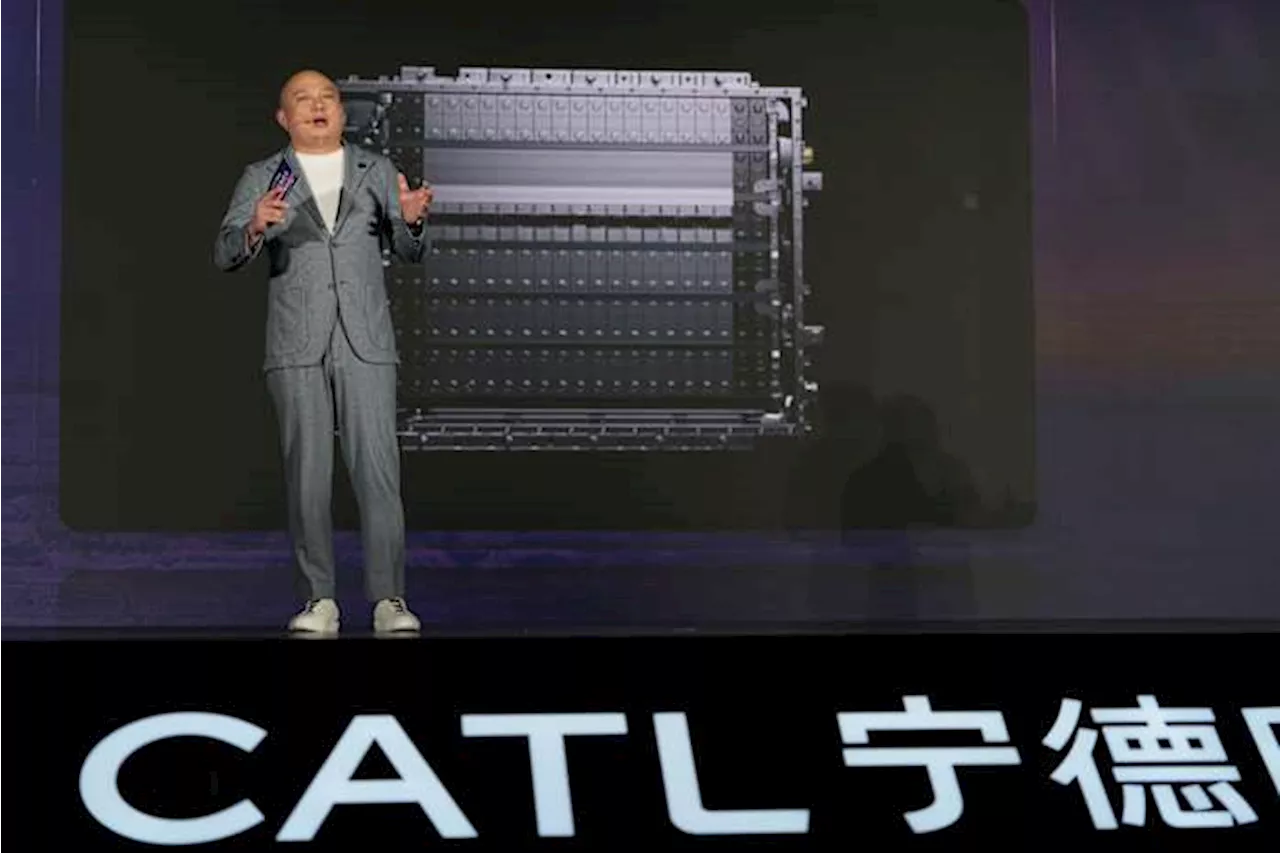

China's CATL forms joint venture with Stellantis to build electric vehicle battery factory in SpainChinese electric battery giant CATL and automaker Stellantis say they will build a major battery factory in northern Spain. The partners said Tuesday that the plant to make lithium iron phosphate batteries will be located in Zaragoza and start production by the end of 2026.

China's CATL forms joint venture with Stellantis to build electric vehicle battery factory in SpainChinese electric battery giant CATL and automaker Stellantis say they will build a major battery factory in northern Spain. The partners said Tuesday that the plant to make lithium iron phosphate batteries will be located in Zaragoza and start production by the end of 2026.

Read more »

China's CATL forms joint venture with Stellantis to build electric vehicle battery factory in SpainChinese electric battery giant CATL and automaker Stellantis say they will build a major battery factory in northern Spain.

China's CATL forms joint venture with Stellantis to build electric vehicle battery factory in SpainChinese electric battery giant CATL and automaker Stellantis say they will build a major battery factory in northern Spain.

Read more »

China's CATL forms joint venture with Stellantis to build electric vehicle battery factory in SpainChinese electric battery giant CATL and automaker Stellantis say they will build a major battery factory in northern Spain.

China's CATL forms joint venture with Stellantis to build electric vehicle battery factory in SpainChinese electric battery giant CATL and automaker Stellantis say they will build a major battery factory in northern Spain.

Read more »

China’s CATL, Stellantis to jointly build electric vehicle battery factoryChinese electric battery giant CATL and automaker Stellantis say they will build a major battery factory in northern Spain

China’s CATL, Stellantis to jointly build electric vehicle battery factoryChinese electric battery giant CATL and automaker Stellantis say they will build a major battery factory in northern Spain

Read more »