As its settlement debacle with Ayo shows, the corporation is again serving up the opposite of what is needed — accountability and transparency.

As its settlement debacle with Ayo shows, the corporation is again serving up the opposite of what is needed from the country’s largest asset manager — accountability and transparencyIt says much that it took the JSE to remind South Africa’s largest investor, the Public Investment Corp , that it couldn’t keep the details of its “settlement” with Iqbal Survé-controlled Ayo Technology Solutions secret from 1.3-million government employees on whose behalf it invests.

Chastened, the PIC then took Ayo to court to reclaim the R4.3bn, arguing that the agreement was “unlawful”, that Ayo had made “misrepresentations” and that its pie-in-the-sky profit projections “didThe import was immense: for the state-owned asset manager to be duped into ploughing billions into a thumb-suck valuation has implications for its stewardship of state pensions, the state balance sheet and governance at Africa’s largest asset manager.

Yet how did the PIC and its “advisers” think it could take everyone for fools, given that this settlement was an order of court, and hence public? After all, the PIC is an institution that claims it is “accountable to our stakeholders in everything we do, as well as for every decision we make”. It’s senseless obfuscation; Daily Maverick had spilt the terms of that settlement into the public domain more than a week before. Had Ayo, and the PIC, any real commitment to investment transparency, they would have released the terms themselves. Daily Maverick can be commended for filling in the gaps.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

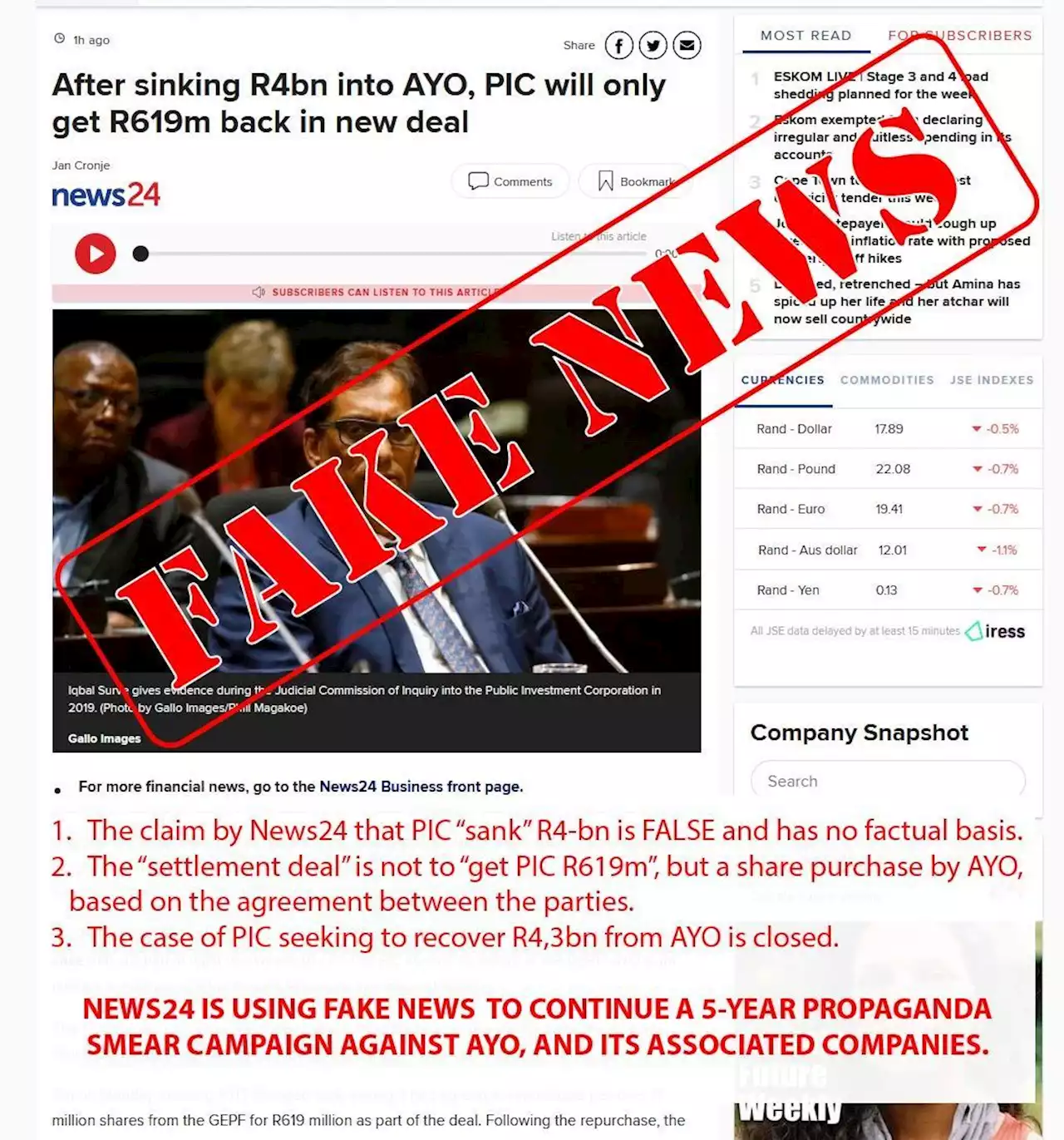

After sinking R4bn into AYO, PIC will only get R619m back in new deal | BusinessIT group AYO has revealed the details of its confidential settlement with the Public Investment Corporation, saying it will repurchase R619 million in shares from the Government Employees Pension Fund and grant it two seats on its board.

After sinking R4bn into AYO, PIC will only get R619m back in new deal | BusinessIT group AYO has revealed the details of its confidential settlement with the Public Investment Corporation, saying it will repurchase R619 million in shares from the Government Employees Pension Fund and grant it two seats on its board.

Read more »

Ayo to repurchase R619m in shares from government pension fundThe Iqbal Survé-controlled company has confirmed some terms and conditions of its settlement deal with the PIC

Read more »

After sinking R4bn into AYO, PIC will get R619m back in new deal | BusinessIT group AYO has revealed the details of its confidential settlement with the Public Investment Corporation, saying it will repurchase R619 million in shares from the Government Employees Pension Fund and grant it two seats on its board.

After sinking R4bn into AYO, PIC will get R619m back in new deal | BusinessIT group AYO has revealed the details of its confidential settlement with the Public Investment Corporation, saying it will repurchase R619 million in shares from the Government Employees Pension Fund and grant it two seats on its board.

Read more »

BILLIONS WASTED: AYO Technology finally reveals full details of PIC settlementNine days after Daily Maverick revealed the shocking details of the settlement reached between the Public Investment Corporation (PIC) and AYO Technology, the company has finally come clean and revealed full details to shareholders.

BILLIONS WASTED: AYO Technology finally reveals full details of PIC settlementNine days after Daily Maverick revealed the shocking details of the settlement reached between the Public Investment Corporation (PIC) and AYO Technology, the company has finally come clean and revealed full details to shareholders.

Read more »

PIC still gambling on AyoThe R4.3bn was partly used to prop up underlying companies – and the PIC has now agreed that the GEPF will not ‘unreasonably withhold approval’ for this to happen again. Moneyweb

PIC still gambling on AyoThe R4.3bn was partly used to prop up underlying companies – and the PIC has now agreed that the GEPF will not ‘unreasonably withhold approval’ for this to happen again. Moneyweb

Read more »

PICS: About 4 000 resting places at Braamfontein Cemetery torn apart by looters | The Citizen🤯Who would do that? The ⚱️ final resting places of an estimated 4 000 people in Braamfontein, Johannesburg, have been desecrated and destroyed. Full story here ➡️

PICS: About 4 000 resting places at Braamfontein Cemetery torn apart by looters | The Citizen🤯Who would do that? The ⚱️ final resting places of an estimated 4 000 people in Braamfontein, Johannesburg, have been desecrated and destroyed. Full story here ➡️

Read more »