CNBC Pro identifies S&P 500 companies reporting next week with strong earnings momentum, potentially presenting investment opportunities. Amazon, Visa, and Synchrony Financial are highlighted for their positive analyst ratings, price target upside, and recent share performance.

Next week will be a significant period for fourth-quarter earnings reports, with 90 companies from the S&P 500 index and eight members of the Dow Jones Industrial Average scheduled to announce their quarterly results. This flurry of corporate earnings will provide valuable insights into the state of the U.S. consumer. CNBC Pro has identified S&P 500 companies reporting next week that demonstrate strong earnings momentum, potentially presenting opportunities for investors to capitalize.

Companies included in the analysis met specific criteria: at least 55% of analysts covering the stock must have buy ratings, the average analyst price target should indicate at least a 10% upside, and earnings estimates must have been revised upwards by at least 15% in both the past three and six months.Amazon stands out as a company with considerable earnings momentum. Nearly 80% of analysts covering the e-commerce giant and web services provider rate it a buy. Amazon's shares have surged 25% over the past three months, and the average price target still implies a potential upside of nearly 31%. JPMorgan analyst Doug Anmuth has identified Amazon as one of his top picks for this earnings season, citing factors such as accelerating growth in Amazon Web Services and Stores, expanding operating income margins in North America and internationally, strong AWS margins, and disciplined cost management supporting free cash flow growth despite significant capital expenditures projected for 2025.Visa, a leading digital payments and credit card processor, also exhibits strong earnings momentum. Shares have climbed 29% in just the past six months. Approximately 61% of analysts covering Visa rate the stock a buy, while the average price target suggests a 16% upside from current trading levels. Morgan Stanley analyst James Faucette has named Visa his top pick in the payments and processing sector heading into 2025, highlighting its attractive valuation, benefits from travel and value-added services, easing regulatory scrutiny, and favorable tactical trading dynamics. Synchrony Financial, a consumer financial services provider, is another company reporting earnings next week with positive earnings momentum. Nearly 61% of analysts covering Synchrony rate it a buy, and the consensus price target implies a 24% upside. Synchrony Financial has experienced impressive growth, surging 41% over the past six months and 85% over the past year. Barclays analyst Terry Ma recently upgraded Synchrony to overweight from equal weight, citing its inexpensive valuation and other catalysts

EARNINGS INVESTING AMAZON VISA SYNCHRONY FINANCIAL STOCK MARKET ANALYST RATINGS PRICE TARGETS CONSUMER FINANCE TECHNOLOGY DIGITAL PAYMENTS

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Earnings playbook: Stocks set to make the biggest moves this week on earningsThese stocks could see sharp moves on the back of their latest earnings results, including a large group of banks.

Earnings playbook: Stocks set to make the biggest moves this week on earningsThese stocks could see sharp moves on the back of their latest earnings results, including a large group of banks.

Read more »

Quantum Stocks Tumble, Managed Care Rises, Boot Barn Soars: Stocks to WatchQuantum stocks dropped sharply after Mark Zuckerberg's comments on the long-term viability of quantum computing. In contrast, managed care stocks surged following a proposed increase in Medicare Advantage reimbursement rates. Other notable movers include Boot Barn, Pinterest, and Lululemon.

Quantum Stocks Tumble, Managed Care Rises, Boot Barn Soars: Stocks to WatchQuantum stocks dropped sharply after Mark Zuckerberg's comments on the long-term viability of quantum computing. In contrast, managed care stocks surged following a proposed increase in Medicare Advantage reimbursement rates. Other notable movers include Boot Barn, Pinterest, and Lululemon.

Read more »

Stocks Start 2025 with Gains on Hopes for Continued MomentumThe stock market opened 2025 with gains, fueled by hopes for continued momentum after the S&P 500 saw two consecutive years of strong performance. Energy stocks led the charge, while some tech giants from 2024 struggled. Despite a late-year dip, the market ended 2024 on a high note.

Stocks Start 2025 with Gains on Hopes for Continued MomentumThe stock market opened 2025 with gains, fueled by hopes for continued momentum after the S&P 500 saw two consecutive years of strong performance. Energy stocks led the charge, while some tech giants from 2024 struggled. Despite a late-year dip, the market ended 2024 on a high note.

Read more »

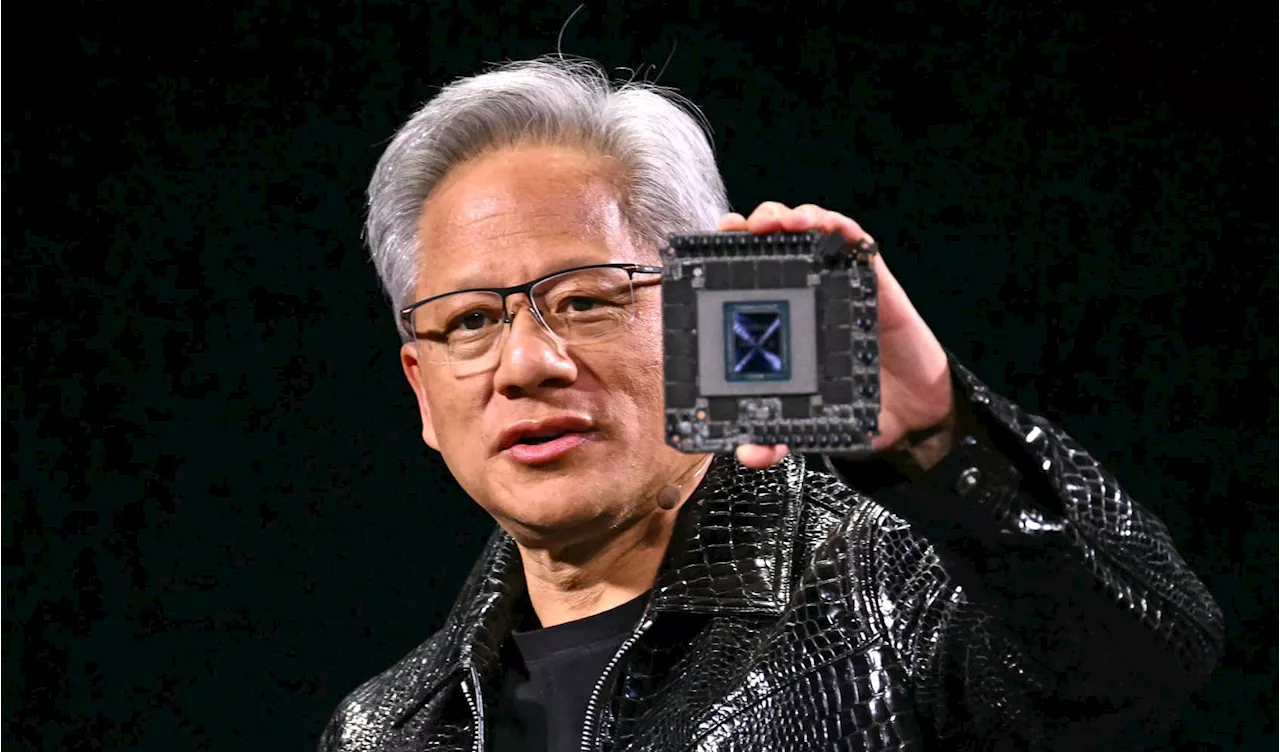

AI Stocks Surge on Strong Earnings and InvestmentNvidia's AI chips continue to drive strong performance, with record revenue reported by Foxconn. Semiconductor stocks rise as AI investment remains robust. Meanwhile, the Dow Jones Industrial Average dips after earlier gains fueled by potential tariff softening.

AI Stocks Surge on Strong Earnings and InvestmentNvidia's AI chips continue to drive strong performance, with record revenue reported by Foxconn. Semiconductor stocks rise as AI investment remains robust. Meanwhile, the Dow Jones Industrial Average dips after earlier gains fueled by potential tariff softening.

Read more »

Q4 Earnings Season Preview: S&P 500 Stocks Poised for Strongest Growth in 3 YearsStocks Analysis by Investing.com (Jesse Cohen) covering: S&P 500, Boeing Co, Chevron Corp, Citigroup Inc. Read Investing.com (Jesse Cohen)'s latest article on Investing.com

Q4 Earnings Season Preview: S&P 500 Stocks Poised for Strongest Growth in 3 YearsStocks Analysis by Investing.com (Jesse Cohen) covering: S&P 500, Boeing Co, Chevron Corp, Citigroup Inc. Read Investing.com (Jesse Cohen)'s latest article on Investing.com

Read more »

US Stocks Retreat After Jobs Report; Focus Shifts to Bank Earnings and Inflation DataUS stocks experienced a decline on Monday, extending the previous week's sell-off triggered by a strong jobs report. Investor attention is now focused on upcoming earnings releases from major banks and key inflation data.

US Stocks Retreat After Jobs Report; Focus Shifts to Bank Earnings and Inflation DataUS stocks experienced a decline on Monday, extending the previous week's sell-off triggered by a strong jobs report. Investor attention is now focused on upcoming earnings releases from major banks and key inflation data.

Read more »