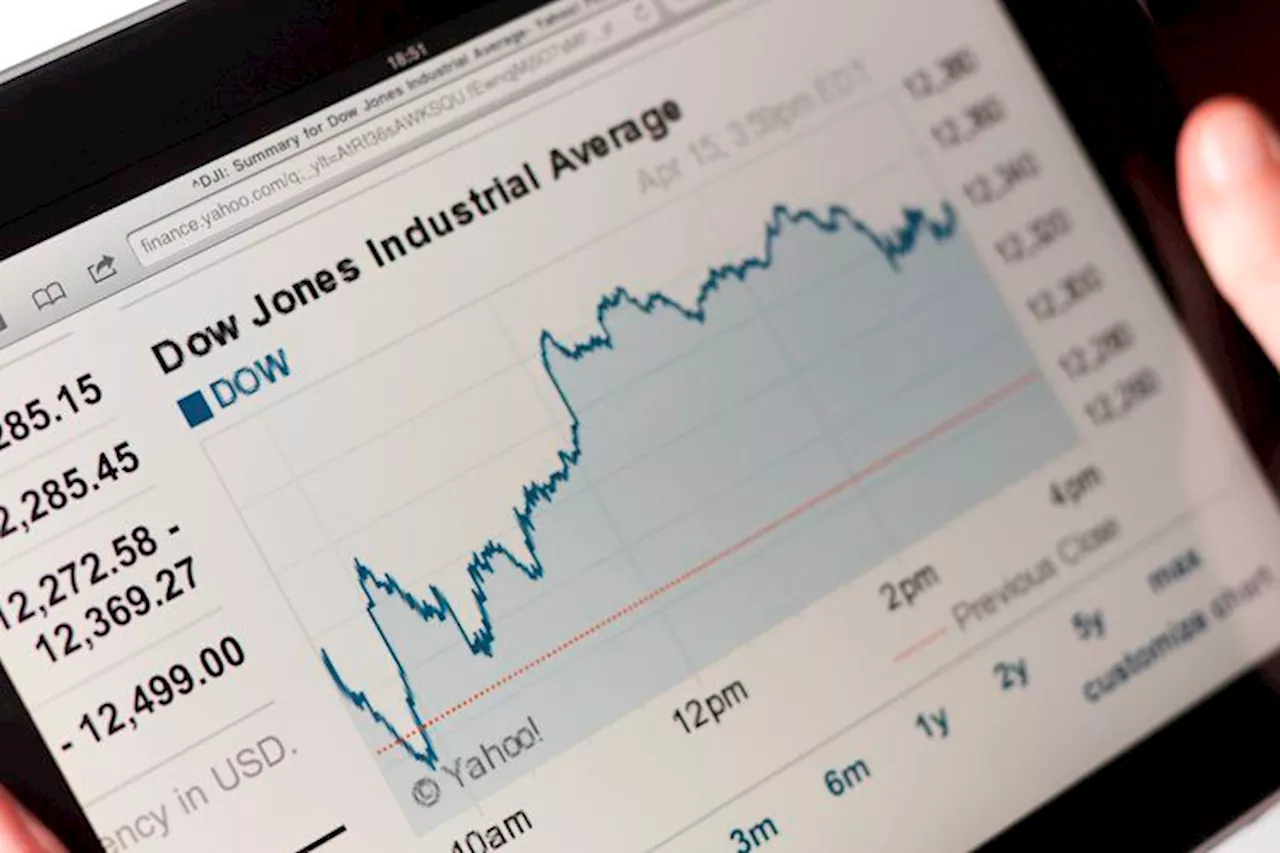

Investor uncertainty ahead of the Federal Reserve's latest meeting fueled a decline in the Dow Jones Industrial Average, marking its longest losing streak since 1978. While a quarter-point rate cut is anticipated, investors await clues on the Fed's future policy stance and potential for aggressive rate reductions in 2025.

The Dow Jones Industrial Average slid to its worst losing streak in more than four decades as investor hopes that the Federal Reserve will aggressively cut interest rates next year continued to diminish. The central bankers wrap up their last two-day meeting of the year Wednesday, when they are widely expected to announce another quarter-point rate cut — the third this year.

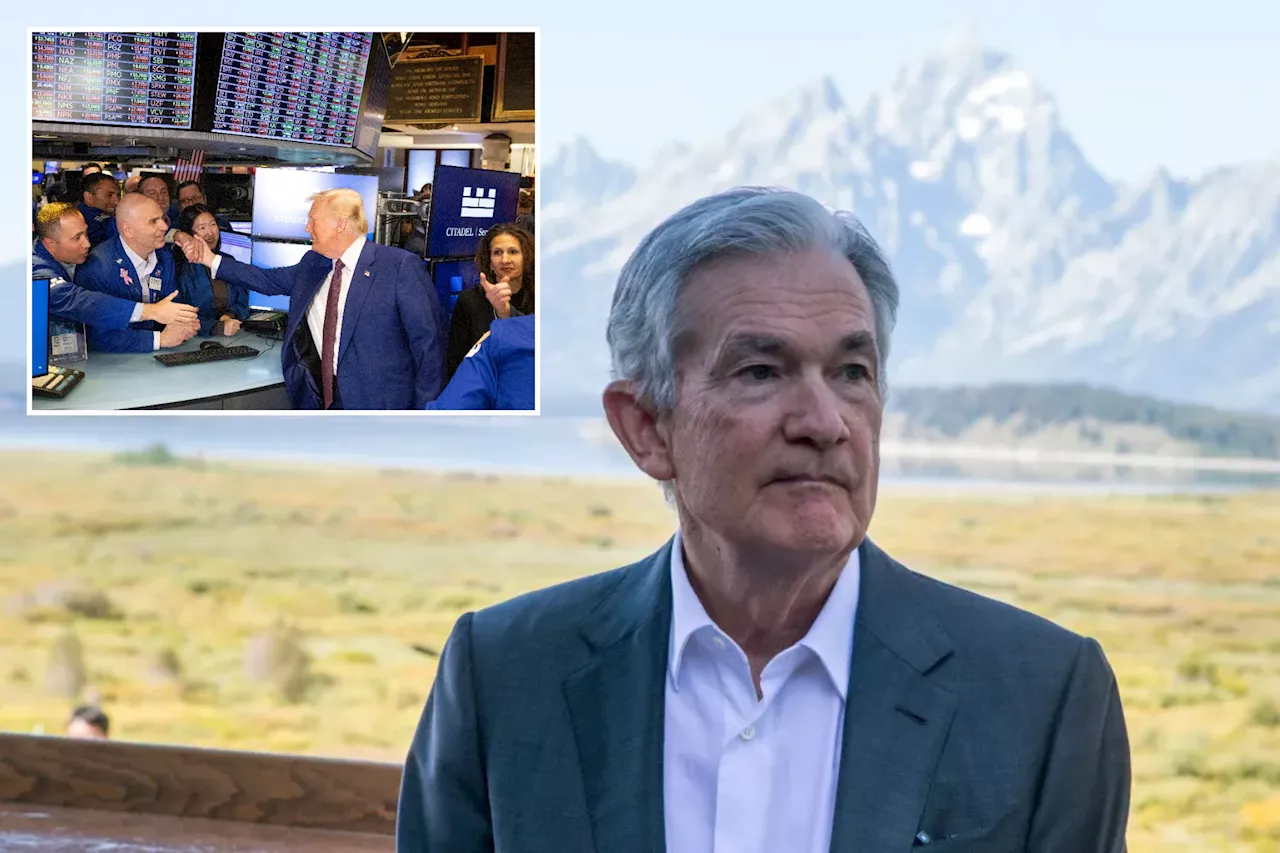

But particular attention will paid to the Fed’s summary of economic projections (SEP) and comments from Chair Jerome Powell, which may indicate how aggressive the central bank will be in cutting rates in 2025. Fed Chair Jerome Powell is widely expected to announce a further quarter percentage point cut to the key borrowing rate. in an economy that appears to have solid momentum and sticky inflation, and as the incoming Trump administration is expected to impose policies to stimulate growth and potentially reignite rising prices. “This is just kind of standard fare for a pre-Fed day market where you have just a little bit of uncertainty, people are not sure how to position ahead of the SEP and ahead of Powell,” said Jason Ware, chief investment officer at Albion Financial Group in Salt Lake City, Utah.NYC seafood bastion Lure Fishbar faces boot for pushy Prada: sources “Everyone knows we’re getting 25 bps … what Powell is going to say at the press conference, what the SEP is going to tell us, those things people are not quite sure of so you have a little bit of jitters ahead of that.” On Tuesday, the blue-chip Dow fell 267.58 points, to 43,449.90 extending the longest losing streak since 1978. The S&P 500 lost 0.39% and closed at 6,050.61, while the Nasdaq Composite, which hit a record high on Monday, dipped.32% to end at 20,109.06. Some of the drop in the Dow can be attributed to profit-taking immediately after the 30-stock index hit a record high of 45,00

FEDERAL RESERVE INTEREST RATES DOW JONES MARKET VOLATILITY ECONOMIC OUTLOOK

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Dow Jones Slumps: UnitedHealth Leads Decline Amid Cyclical Sell-OffThe Dow Jones Industrial Average is experiencing a historic losing streak, with UnitedHealth being the primary driver. Investors are shifting away from cyclical stocks, and concerns about a weaker economy are adding to the pressure.

Dow Jones Slumps: UnitedHealth Leads Decline Amid Cyclical Sell-OffThe Dow Jones Industrial Average is experiencing a historic losing streak, with UnitedHealth being the primary driver. Investors are shifting away from cyclical stocks, and concerns about a weaker economy are adding to the pressure.

Read more »

Dow Jones Slumps Amidst Investor Rotation and Economic ConcernsThe Dow Jones Industrial Average has experienced a significant decline in recent weeks, largely driven by investor rotation away from cyclical stocks and concerns about a potential slowdown in the economy.

Dow Jones Slumps Amidst Investor Rotation and Economic ConcernsThe Dow Jones Industrial Average has experienced a significant decline in recent weeks, largely driven by investor rotation away from cyclical stocks and concerns about a potential slowdown in the economy.

Read more »

AUD/USD Price Forecast: Slumps to near 0.6500 as Fed dovish bets easeThe AUD/USD pair drops sharply to near the psychological support of 0.6500 in the North American trading session on Wednesday.

AUD/USD Price Forecast: Slumps to near 0.6500 as Fed dovish bets easeThe AUD/USD pair drops sharply to near the psychological support of 0.6500 in the North American trading session on Wednesday.

Read more »

Nvidia Correction, Dow Streak, and Fed Rate ExpectationsNvidia's stock price fell into correction territory after a recent surge, marking a shift in investor sentiment towards AI-related trades. The Dow Jones Industrial Average experienced its longest losing streak since 2018, declining for the eighth consecutive day. Meanwhile, the Federal Reserve is expected to cut interest rates further, with economists predicting two more quarter-point reductions by the end of 2026.

Nvidia Correction, Dow Streak, and Fed Rate ExpectationsNvidia's stock price fell into correction territory after a recent surge, marking a shift in investor sentiment towards AI-related trades. The Dow Jones Industrial Average experienced its longest losing streak since 2018, declining for the eighth consecutive day. Meanwhile, the Federal Reserve is expected to cut interest rates further, with economists predicting two more quarter-point reductions by the end of 2026.

Read more »

Dow Jones tepid as investors await FedThe Dow Jones Industrial Average (DJIA) continues to churn on the low end of recent chart action, with the major equity index bogged down near 43,800.

Dow Jones tepid as investors await FedThe Dow Jones Industrial Average (DJIA) continues to churn on the low end of recent chart action, with the major equity index bogged down near 43,800.

Read more »

Stock market today: Dow in longest losing streak since 1978; Fed decision loomsStock market today: Dow in longest losing streak since 1978; Fed decision looms

Stock market today: Dow in longest losing streak since 1978; Fed decision loomsStock market today: Dow in longest losing streak since 1978; Fed decision looms

Read more »