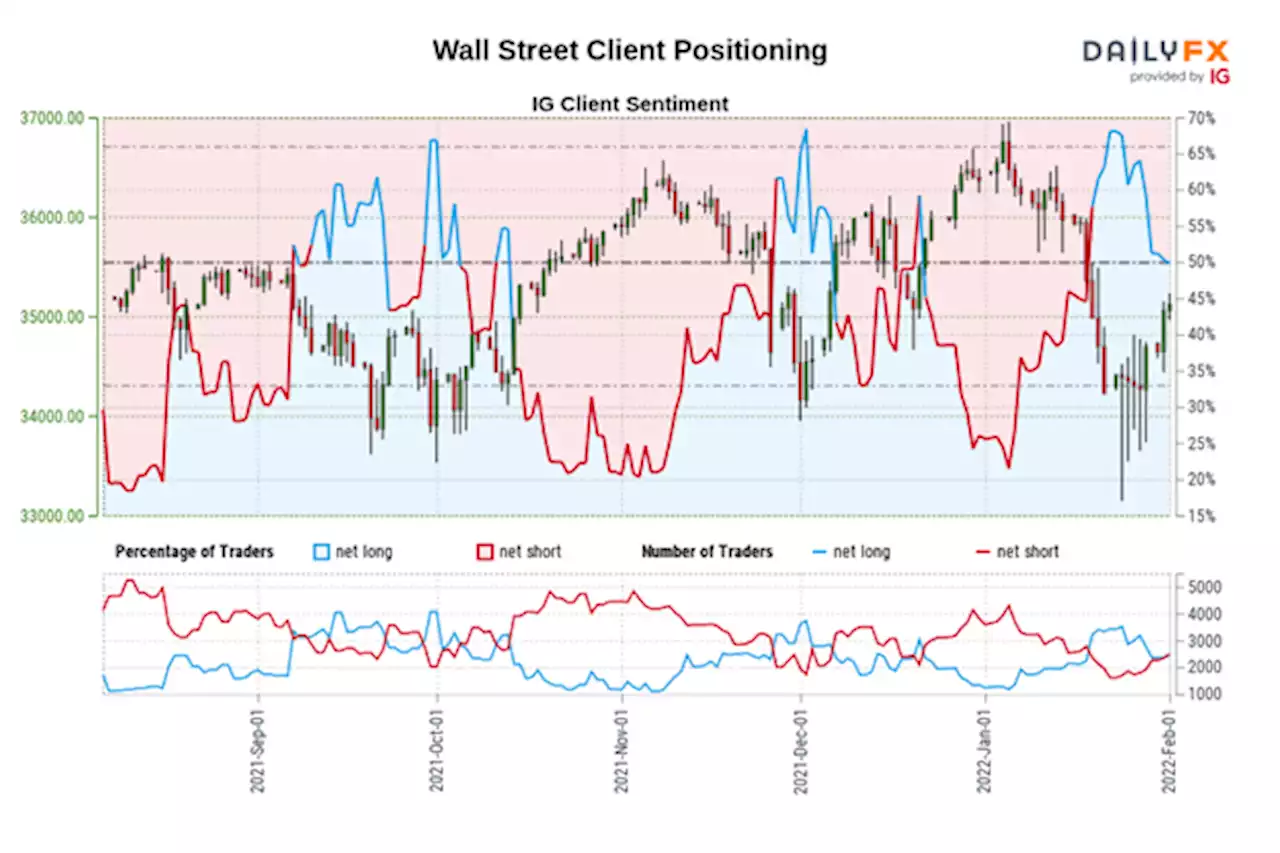

The Dow Jones and S&P 500 may rise as retail traders flip to selling these equities once more. What are key technical levels to watch for from here? Get your market update from ddubrovskyFX here:

According to IG Client Sentiment , retail investors are increasingly betting that equities may weaken in the near term. Downside exposure is on the rise in the Dow Jones and S&P 500. At times, IGCS can be a contrarian indicator. If this trend in positioning extends, then volatility on Wall Street could continue cooling ahead. Fur a further breakdown of this tool, which includes fundamental analysis, check out the recording of this week’s webinar above!shows that 49.

Upside exposure increased by 7.8% and 49.86% compared to yesterday and last week respectively. The combination of overall and recent changes in positioning are offering a bullish contrarian trading bias.On the 4-hour chart, Dow Jones futures are facing a combination of a near-term falling trendline from the beginning of January and the 61.8% Fibonacci retracement at 35380. This follows a bullish crossover between the 20- and 50-period Simple Moving Averages .