Despite a mixed performance within the Dow Jones, the major equity index remains near record highs. The Federal Reserve's decision to hold interest rates steady and its cautious approach to future adjustments have influenced market expectations.

The Dow Jones Industrial Average (DJIA) remained relatively stable on Wednesday, fluctuating near the 44,800 mark. This performance comes as the Fed eral Reserve ( Fed ) adopts a cautious wait-and-see approach to future interest rate adjustments, signaling that any changes are unlikely before June at the earliest.

Despite the expectation of continued stable rates, market participants are closely monitoring the Federal Open Market Committee (FOMC) for any hints or signals regarding their future monetary policy decisions.\The Fed, as anticipated, held interest rates steady at its latest meeting. Fed Chair Jerome Powell emphasized the central bank's commitment to a data-driven approach when making decisions about future rate changes. He clarified that while the FOMC is observing the economic impact of US President Donald Trump's policies, there has been no direct contact between the White House and the Fed. Powell stressed that the Fed operates as an independent federal institution, and the President's influence on its policy guidance is limited. Furthermore, Powell noted that while inflation is gradually moving towards the Fed's target levels, the current economic climate, coupled with uncertainties surrounding President Trump's trade policies, leads the Fed to proceed cautiously with any adjustments to current policy rates. As a result, market expectations for Fed rate cuts in 2025 have diminished.\The CME's FedWatch Tool indicates that rate futures markets anticipate no changes to the Fed funds rate until at least June. Meanwhile, the Dow Jones is experiencing mixed performance, with some sectors showing gains while others, particularly Nvidia (NVDA), are encountering losses. Nvidia shares continued their downward trend, falling another 4.6% on Wednesday, dropping below $123 per share. This decline coincides with concerns over the impact of China's open-source AI model, DeepSeek, which threatens the dominance of US venture-capital-backed AI infrastructure. The Dow Jones Industrial Average is currently trading near record highs above 45,000, with intraday price action testing the waters near 44,800. A successful break above this level could lead to new all-time highs for the Dow Jones, while a bearish reversal would signify the first 'lower high' pattern for the major equity index since mid-2024

FED DOW JONES INTEREST RATES MONETARY POLICY Nvidia AI CHINA

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Euro Holds Steady Against US Dollar Amidst Mixed SignalsThe Euro (EUR) traded flat against the US Dollar (USD) on Friday, oscillating around the middle of its Wednesday range. While short-term charts suggest continued range trading, longer-term patterns remain bullish. ECB Governor Nagel's comments about avoiding hasty rate cuts add to the uncertainty surrounding the EUR's future direction.

Euro Holds Steady Against US Dollar Amidst Mixed SignalsThe Euro (EUR) traded flat against the US Dollar (USD) on Friday, oscillating around the middle of its Wednesday range. While short-term charts suggest continued range trading, longer-term patterns remain bullish. ECB Governor Nagel's comments about avoiding hasty rate cuts add to the uncertainty surrounding the EUR's future direction.

Read more »

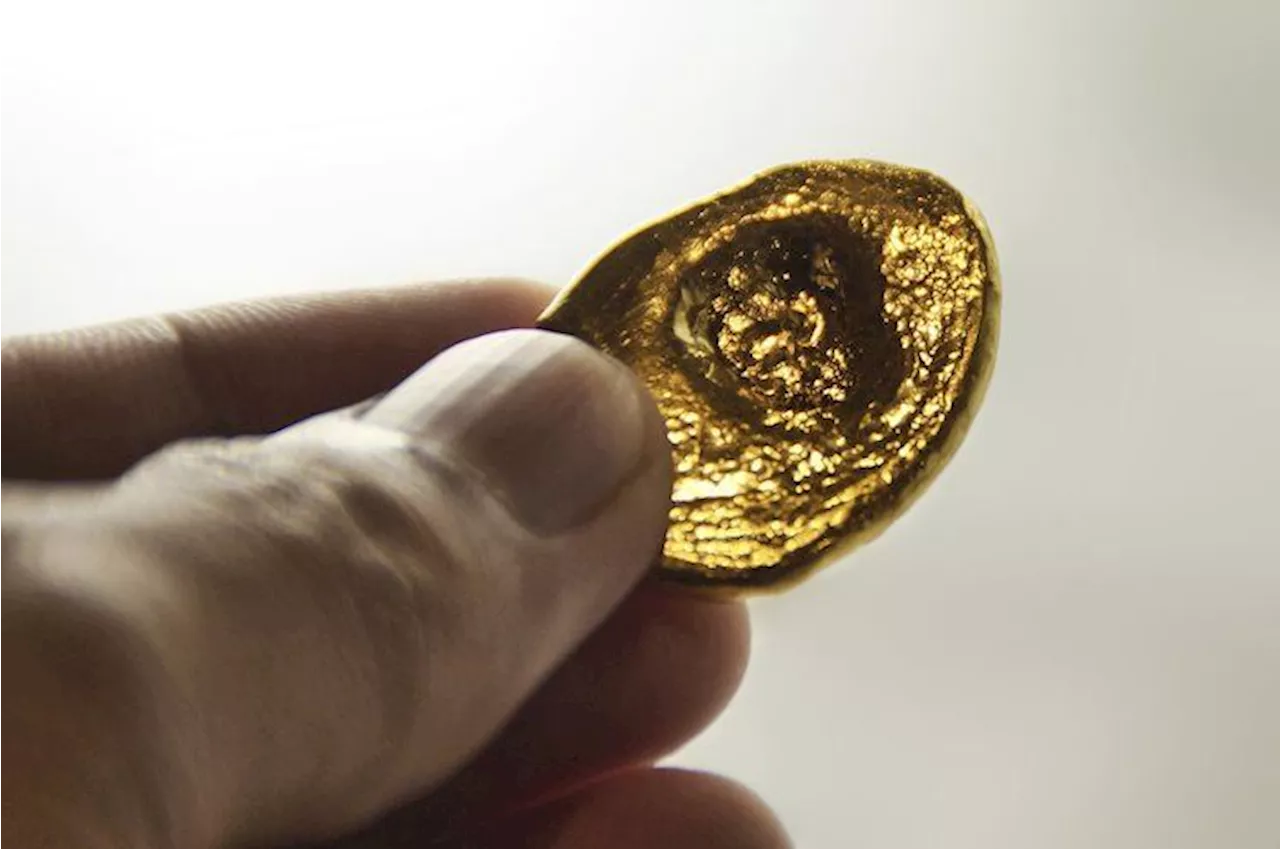

Gold Price Holds Steady Near $2,625 as Geopolitical Risks and Central Bank Buying Drive DemandGold prices remain positive near $2,625 in early Thursday trading, supported by geopolitical risks, central bank buying, and safe-haven flows. However, expectations of a slower pace of Fed rate cuts may limit further gains.

Gold Price Holds Steady Near $2,625 as Geopolitical Risks and Central Bank Buying Drive DemandGold prices remain positive near $2,625 in early Thursday trading, supported by geopolitical risks, central bank buying, and safe-haven flows. However, expectations of a slower pace of Fed rate cuts may limit further gains.

Read more »

EUR/JPY Holds Steady Ahead of Inflation Data, ECB Rate Cut ExpectedThe EUR/JPY currency pair remains range-bound as investors await key inflation figures from Germany and the Eurozone. Market expectations are for a 25 basis point rate cut by the ECB this month, with potential for a larger reduction if inflation slows significantly. Japanese markets are closed for New Year holidays.

EUR/JPY Holds Steady Ahead of Inflation Data, ECB Rate Cut ExpectedThe EUR/JPY currency pair remains range-bound as investors await key inflation figures from Germany and the Eurozone. Market expectations are for a 25 basis point rate cut by the ECB this month, with potential for a larger reduction if inflation slows significantly. Japanese markets are closed for New Year holidays.

Read more »

AUD/USD Holds Steady Ahead of US Manufacturing PMI and Australian CPI DataThe AUD/USD pair fluctuates near 0.6200 as market participants await key economic indicators, including the US ISM Manufacturing PMI and Australia's monthly CPI.

AUD/USD Holds Steady Ahead of US Manufacturing PMI and Australian CPI DataThe AUD/USD pair fluctuates near 0.6200 as market participants await key economic indicators, including the US ISM Manufacturing PMI and Australia's monthly CPI.

Read more »

Gold Price Holds Steady Amidst US Economic Data and Geopolitical TensionsThe gold price remains stable near $2,640 despite the US Manufacturing PMI exceeding expectations and a stronger US dollar. While economic data boosts the dollar, geopolitical uncertainties and potential central bank purchases could drive gold prices upward.

Gold Price Holds Steady Amidst US Economic Data and Geopolitical TensionsThe gold price remains stable near $2,640 despite the US Manufacturing PMI exceeding expectations and a stronger US dollar. While economic data boosts the dollar, geopolitical uncertainties and potential central bank purchases could drive gold prices upward.

Read more »

Indian Rupee Holds Steady Amid Global UncertaintyThe Indian Rupee (INR) maintains its position despite record lows and external pressures. Analysts predict slight depreciation in 2025 due to volatile investments and a potential strengthening US Dollar.

Indian Rupee Holds Steady Amid Global UncertaintyThe Indian Rupee (INR) maintains its position despite record lows and external pressures. Analysts predict slight depreciation in 2025 due to volatile investments and a potential strengthening US Dollar.

Read more »