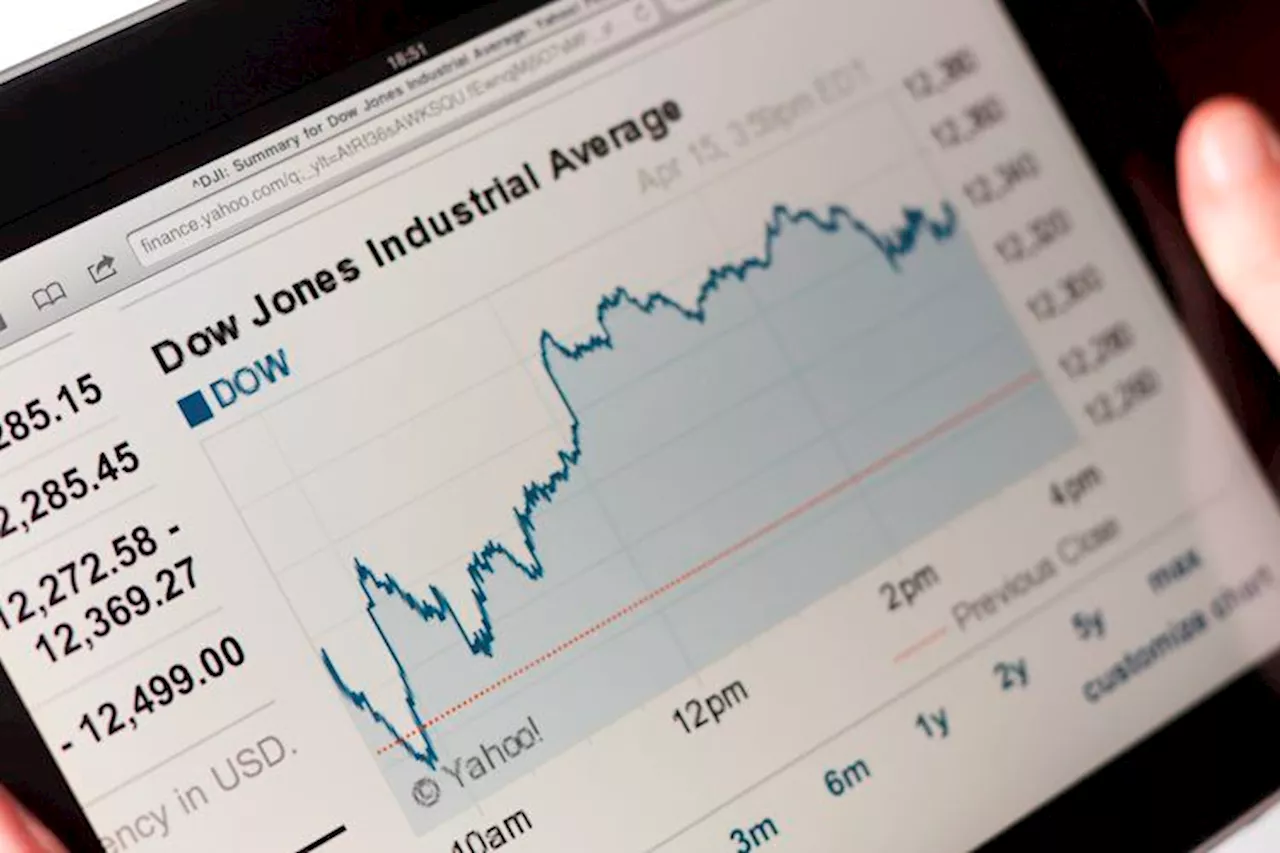

The Dow Jones Industrial Average continued its upward trend, gaining 0.8% on Thursday, fueled by a risk-on sentiment among investors despite a lack of substantial economic data. President Trump's appearance at the World Economic Forum in Davos dominated market attention, with his comments on crude oil prices and trade policies generating some volatility. US PMI figures are expected on Friday, but their impact remains uncertain.

The Dow Jones climbed another 350 points on Thursday, gaining 0.8%. Markets are dealing with a lack of meaningful data by hitting the buy button. US PMI figures loom ahead on Friday, but Trump headlines dominate. The Dow Jones Industrial Average continued its steady drift into the high end on Thursday, gaining 0.8% and adding around 350 points to the tally as investors broadly tilt into a risk on stance.

as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions. What is Dow Theory? Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average and the Dow Jones Transportation Average and only follow trends where both are moving in the same direction.

. One is to use ETFs which allow investors to trade the

DOW JONES MARKET TRENDS DONALD TRUMP ECONOMIC DATA US PMI

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Dow Jones Soars as Trump Takes Office, Markets React to New Administration's ActionsThe Dow Jones Industrial Average surged on the first day of the second Trump Administration, driven by strong earnings reports and investor sentiment. However, President Trump's initial actions, including potential tariffs and policy reversals, are expected to have a significant impact on markets in the coming months.

Dow Jones Soars as Trump Takes Office, Markets React to New Administration's ActionsThe Dow Jones Industrial Average surged on the first day of the second Trump Administration, driven by strong earnings reports and investor sentiment. However, President Trump's initial actions, including potential tariffs and policy reversals, are expected to have a significant impact on markets in the coming months.

Read more »

Dow Jones Drops 400 Points as Holiday Markets CoolThe Dow Jones Industrial Average shed 400 points on Friday, mirroring a broader pullback in holiday-affected markets. Investors are taking profits ahead of the new year, and thin trading volumes contribute to the subdued performance. The Federal Reserve's recent pivot on interest rate expectations also weighs on market sentiment.

Dow Jones Drops 400 Points as Holiday Markets CoolThe Dow Jones Industrial Average shed 400 points on Friday, mirroring a broader pullback in holiday-affected markets. Investors are taking profits ahead of the new year, and thin trading volumes contribute to the subdued performance. The Federal Reserve's recent pivot on interest rate expectations also weighs on market sentiment.

Read more »

Dow Jones Dips as Year-End Looms and Tech Rally FadesThe Dow Jones Industrial Average closed down over 300 points on Monday, marking a significant drop as investors brace for the year-end. The tech-driven rally that propelled the market to record highs in 2024 appears to be losing momentum.

Dow Jones Dips as Year-End Looms and Tech Rally FadesThe Dow Jones Industrial Average closed down over 300 points on Monday, marking a significant drop as investors brace for the year-end. The tech-driven rally that propelled the market to record highs in 2024 appears to be losing momentum.

Read more »

Dow Jones Starts 2025 Flat Despite Early Gains, Tech Rally FaltersThe Dow Jones Industrial Average ended the first trading day of 2025 with a flat performance near 42,500, despite initial gains that reversed throughout the day. Tepid trading volumes and concentrated losses in major stocks like Boeing and Apple hampered the index's performance. While Nvidia rebounded, the broader market remained subdued.

Dow Jones Starts 2025 Flat Despite Early Gains, Tech Rally FaltersThe Dow Jones Industrial Average ended the first trading day of 2025 with a flat performance near 42,500, despite initial gains that reversed throughout the day. Tepid trading volumes and concentrated losses in major stocks like Boeing and Apple hampered the index's performance. While Nvidia rebounded, the broader market remained subdued.

Read more »

Dow Jones Surges Past 43,000 on Tariff HopesThe Dow Jones Industrial Average rallied over 300 points on Monday, exceeding 43,000, fuelled by optimism over potential revisions to the incoming Trump administration's tariff plans. Despite reports suggesting a more nuanced approach, former President Trump refuted these claims, reaffirming his stance on imposing broad tariffs.

Dow Jones Surges Past 43,000 on Tariff HopesThe Dow Jones Industrial Average rallied over 300 points on Monday, exceeding 43,000, fuelled by optimism over potential revisions to the incoming Trump administration's tariff plans. Despite reports suggesting a more nuanced approach, former President Trump refuted these claims, reaffirming his stance on imposing broad tariffs.

Read more »

Dow Jones Stalls as Strong ISM PMI Fuels Rate Cut ConcernsThe Dow Jones Industrial Average struggled to advance on Tuesday, held back by a hotter-than-expected ISM PMI report for December. The strong business survey results raise fears that the Federal Reserve will hold off on planned rate cuts, impacting investor sentiment.

Dow Jones Stalls as Strong ISM PMI Fuels Rate Cut ConcernsThe Dow Jones Industrial Average struggled to advance on Tuesday, held back by a hotter-than-expected ISM PMI report for December. The strong business survey results raise fears that the Federal Reserve will hold off on planned rate cuts, impacting investor sentiment.

Read more »