Focusing solely on the lowest insurance premiums can lead to hidden costs and inadequate coverage. This article highlights the importance of choosing an insurance partner strategically, considering factors like coverage adequacy, policy terms, and agent qualifications.

Many business owners unknowingly fall into the commercial insurance trap of focusing only on securing the lowest premiums. It’s understandable for businesses to prioritize saving money, but it could lead to unintended consequences affecting their stability. Choosing an insurance partner demands a more strategic approach – considering coverage adequacy, policy terms, and agent qualifications.

With this, Scott Mayor, founder of Endurance Risk and Management Services, advocates for a shift in perspective. He believes businesses should invest time qualifying their agents and managing the quoting process to secure optimal coverage and value. Businesses feel inclined to prioritize price because of a misunderstanding of how insurance operates. A lower premium might seem like the obvious choice at face value, but deeper issues lie behind it. Hidden costs, coverage gaps, and inadequate risk management services only surface when it’s too late to mitigate them. Years of experience have allowed Mayor to witness how choosing an insurance agent based solely on price usually results in unforeseen expenses. How insurance agents are compensated is a significant factor. Most agents earn commissions of 10% to 15% of the premium, which can subtly influence their priorities. They might steer decisions that align with their financial incentives instead of prioritizing what’s best for the client. It is okay to ask how they are compensated and what services they perform in order to earn their commissions. Mayor states that there are also instances when a small percentage of agents manipulate information during the quoting process to secure business. “For example, they might underreport payroll to achieve a lower premium. Yes, it can create short-term savings, but this will backfire during end-of-policy audits,” he remarks. Businesses may then face hefty, unexpected adjustments to their premiums, negating any perceived initial savings

INSURANCE BUSINESSOWNERS RISKMANAGEMENT COMMISSION PREMIUM

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

US Investor Seller Pressure Drags Bitcoin Coinbase Premium Index to 12-Month Low: CryptoQuantCrypto Blog

US Investor Seller Pressure Drags Bitcoin Coinbase Premium Index to 12-Month Low: CryptoQuantCrypto Blog

Read more »

Gas Prices Fall to Holiday Low Since PandemicThe national average gas price has dropped to $3.04 per gallon, marking one of the lowest levels during the holiday season since the COVID-19 pandemic. Experts say this dip is due to several factors, including lower demand and stabilized oil costs.

Gas Prices Fall to Holiday Low Since PandemicThe national average gas price has dropped to $3.04 per gallon, marking one of the lowest levels during the holiday season since the COVID-19 pandemic. Experts say this dip is due to several factors, including lower demand and stabilized oil costs.

Read more »

US Unemployment Claims Fall to 8-Month LowNew unemployment claims in the US decreased to their lowest point in eight months, signaling a strong labor market and potential for fewer interest rate cuts by the Federal Reserve.

US Unemployment Claims Fall to 8-Month LowNew unemployment claims in the US decreased to their lowest point in eight months, signaling a strong labor market and potential for fewer interest rate cuts by the Federal Reserve.

Read more »

US Unemployment Claims Fall to 8-Month LowNew applications for unemployment benefits in the US reached an eight-month low, indicating a strong labor market and potentially influencing the Federal Reserve's interest rate decisions.

US Unemployment Claims Fall to 8-Month LowNew applications for unemployment benefits in the US reached an eight-month low, indicating a strong labor market and potentially influencing the Federal Reserve's interest rate decisions.

Read more »

'Low-hire, low-fire': The U.S. job market is stagnant right now, economists sayThe labor market is not nearly as dynamic as it was in 2021 and 2022. That provides both good and bad news for workers.

'Low-hire, low-fire': The U.S. job market is stagnant right now, economists sayThe labor market is not nearly as dynamic as it was in 2021 and 2022. That provides both good and bad news for workers.

Read more »

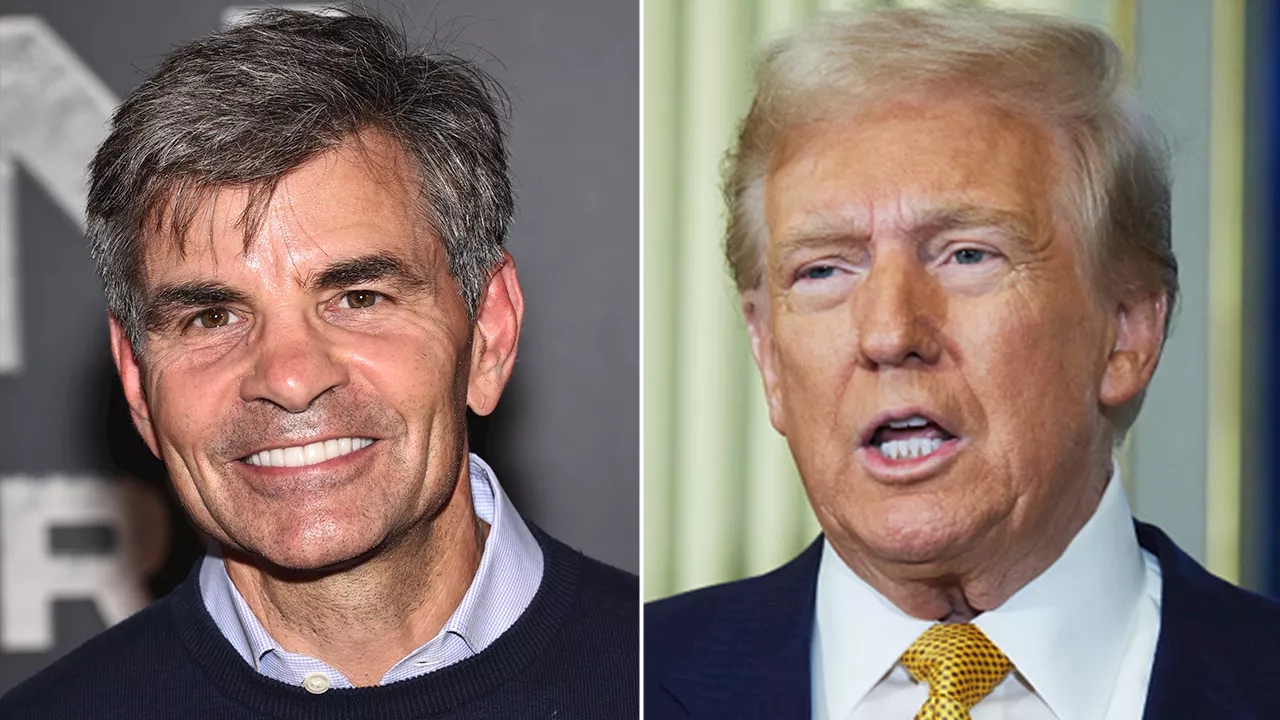

Disney, ABC News continue to take heat for massive Trump settlement: 'Low, low point'ABC News continues to take heat for its massive settlement with President-elect Donald Trump and the high salary commanded by anchor George Stephanopoulos.

Disney, ABC News continue to take heat for massive Trump settlement: 'Low, low point'ABC News continues to take heat for its massive settlement with President-elect Donald Trump and the high salary commanded by anchor George Stephanopoulos.

Read more »