Investors pulled money out of cryptocurrency funds for a fifth straight week, reflecting the bearish mood in the cryptocurrency market. LedesmaLyllah reports.

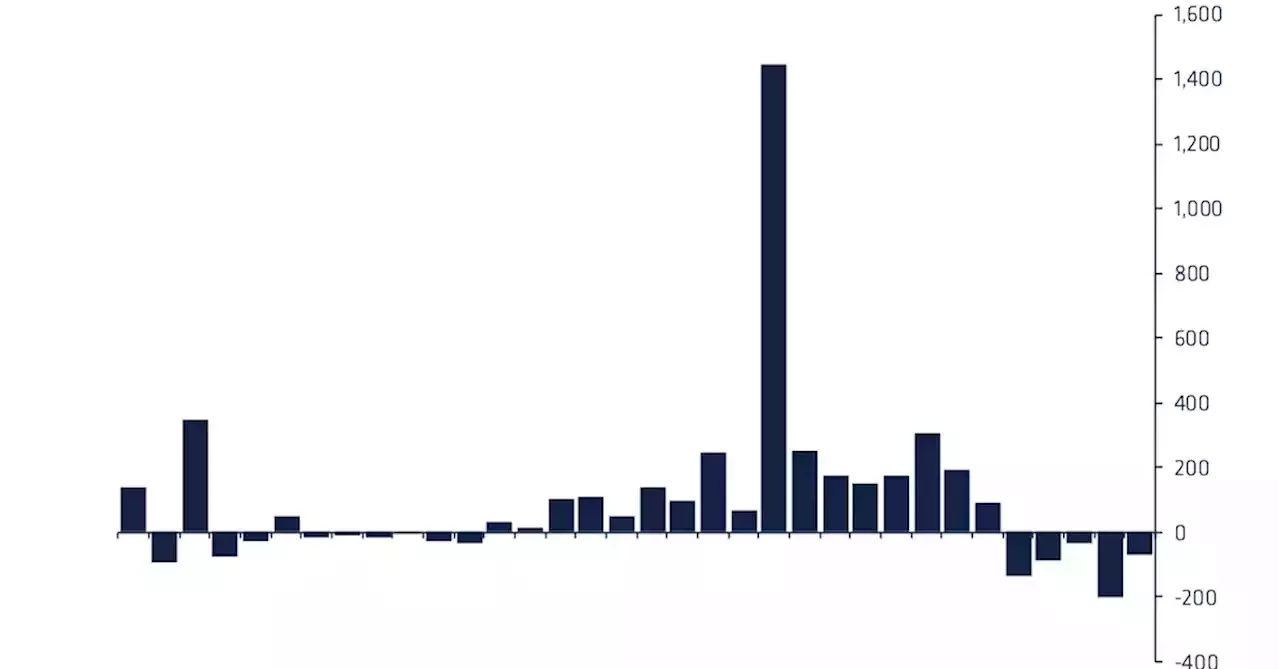

Digital asset investment products saw outflows totalling a weekly record of $73 million, the fifth week of outflows.

Digital-asset investment products saw $73 million of outflows during the seven days through Jan. 14, according to a report published Monday by the crypto firm CoinShares. The redemptions accumulate to $532 million over the five weeks, cutting industrywide assets under management across all funds to $56.1 billion.

However, the report noted that on a daily basis, for the first time this year, there were inflows on Wednesday and Friday of last week.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Singapore curbs crypto marketing in digital asset crackdownSingapore advised that service providers should only market their wares on their own websites, apps or social media.

Singapore curbs crypto marketing in digital asset crackdownSingapore advised that service providers should only market their wares on their own websites, apps or social media.

Read more »

Sotheby's to Accept Crypto for a 555-Carat Black Diamond (Report)Sotheby’s continues with its pro-cryptocurrency approach after announcing the sale of a rare diamond with several digital assets.

Sotheby's to Accept Crypto for a 555-Carat Black Diamond (Report)Sotheby’s continues with its pro-cryptocurrency approach after announcing the sale of a rare diamond with several digital assets.

Read more »

Australian football league secures $25M deal with Crypto.comThe AFL's women's league AFLW has secured a sponsorship deal with digital assets exchange Crypto.com in what will be the first major crypto sports sponsorship in Australia.

Australian football league secures $25M deal with Crypto.comThe AFL's women's league AFLW has secured a sponsorship deal with digital assets exchange Crypto.com in what will be the first major crypto sports sponsorship in Australia.

Read more »

CryptoCom Becomes Financial Backer of the Australian Football League and the AFLWCryptoCom became the digital asset partner of the Toyota AFL Premiership Season and the NAB AFLW after signing a deal with the local football federation.

CryptoCom Becomes Financial Backer of the Australian Football League and the AFLWCryptoCom became the digital asset partner of the Toyota AFL Premiership Season and the NAB AFLW after signing a deal with the local football federation.

Read more »

BitMEX CEO, CFO to Buy One of Germany's Oldest BanksBXM Operations, a firm founded by BitMEX's CEO and CFO has agreed to buy 268-year old German private bank Bankhaus von der Heydt. By JamieCrawleyCD

BitMEX CEO, CFO to Buy One of Germany's Oldest BanksBXM Operations, a firm founded by BitMEX's CEO and CFO has agreed to buy 268-year old German private bank Bankhaus von der Heydt. By JamieCrawleyCD

Read more »

Bitcoin Is Here to Stay: JPMorgan ExecDigital assets are 'here to stay,' and they look like Napster in the 90s, claimed Onyx's CEO Umar Farooq.

Bitcoin Is Here to Stay: JPMorgan ExecDigital assets are 'here to stay,' and they look like Napster in the 90s, claimed Onyx's CEO Umar Farooq.

Read more »