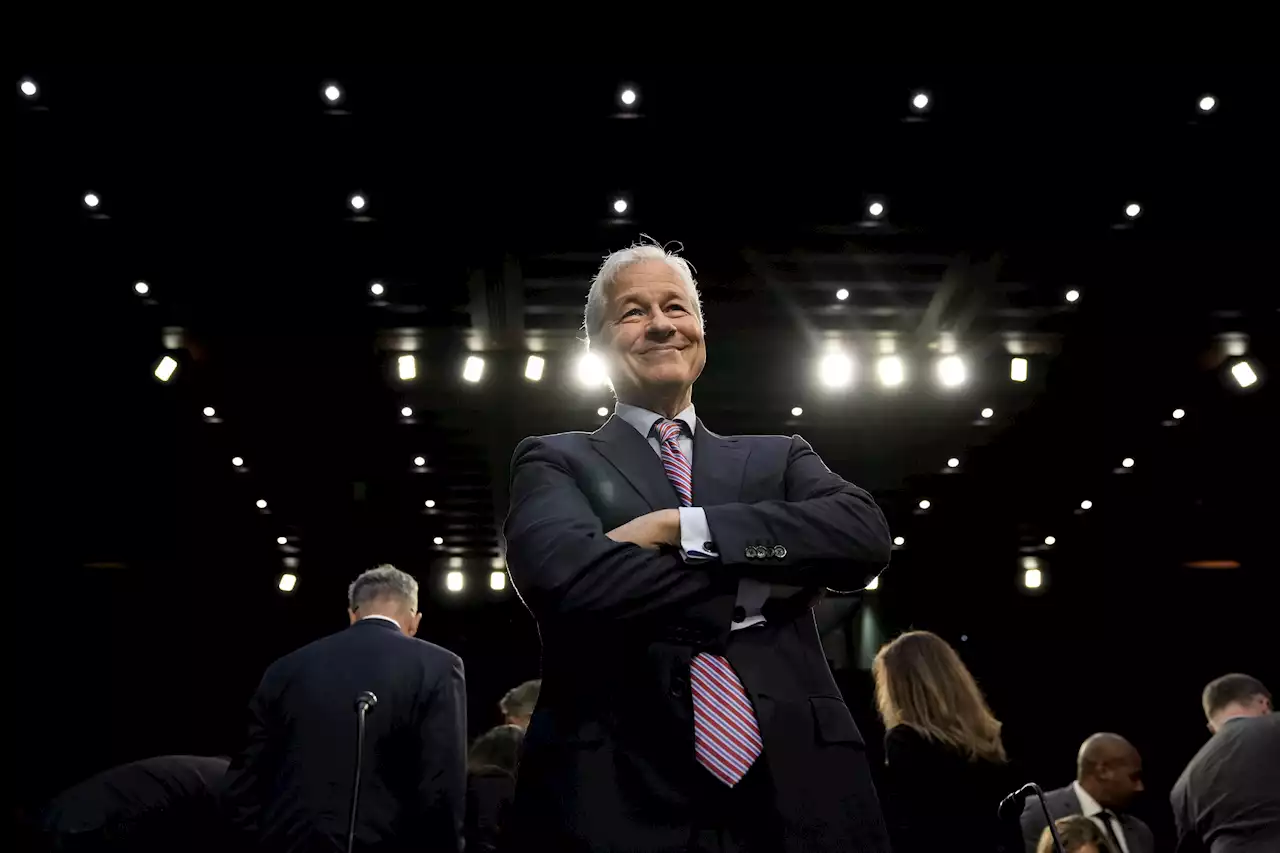

JPMorgan CEO Jamie Dimon will be deposed in late May for a lawsuit accusing the bank of benefitting from sex trafficking by the late money manager Jeffrey Epstein, sources tell EamonJavers.

JPMorgan Chase CEO Jamie Dimon will be deposed in late May over two days for a lawsuit accusing the giant bank of benefitting from sex trafficking by the late money manager Jeffrey Epstein, a source told CNBC's Eamon Javers.

Dimon's deposition will occur in New York, on May 26 and 27, a Friday and Saturday, the sources said. The government of the U.S. Virgin Islands and one of Epstein's accusers are suing JPMorgan, which has denied any wrongdoing.Jamie Dimon, chairman and chief executive officer of JPMorgan Chase & Co., during a Senate Banking, Housing, and Urban Affairs Committee hearing in Washington, D.C., US, on Thursday, Sept. 22, 2022.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Jamie Dimon says 'this part of the crisis is over' after JPMorgan Chase buys First RepublicThe crisis that led to the downfall of three regional U.S. banks in recent weeks is largely over after the resolution of First Republic, according to JPMorgan CEO Jamie Dimon. Full story:

Jamie Dimon says 'this part of the crisis is over' after JPMorgan Chase buys First RepublicThe crisis that led to the downfall of three regional U.S. banks in recent weeks is largely over after the resolution of First Republic, according to JPMorgan CEO Jamie Dimon. Full story:

Read more »

JPMorgan's Dimon sparks new clash over `too-big-to-fail' banks'The failure of First Republic Bank shows how deregulation has made the too big to fail problem even worse,' Sen. Elizabeth Warren said.

JPMorgan's Dimon sparks new clash over `too-big-to-fail' banks'The failure of First Republic Bank shows how deregulation has made the too big to fail problem even worse,' Sen. Elizabeth Warren said.

Read more »

America's Biggest Bank Just Got Bigger - The Journal. - WSJ PodcastsJPMorgan Chase CEO Jamie Dimon stepped in on Monday to acquire the failing First Republic Bank after it was seized by government regulators. While the deal will put an end to the recent series of bank failures, it also makes the banking industry's leader even more powerful. WSJ's Charles Forelle explains how Dimon's bid came together. Further Reading: -Why First Republic Bank Collapsed -Jamie Dimon Wins Again in First Republic Bank Deal Further Listening: -Banking Troubles Are Not Over -Two Executives On What It's Like to Stop a Bank Run

America's Biggest Bank Just Got Bigger - The Journal. - WSJ PodcastsJPMorgan Chase CEO Jamie Dimon stepped in on Monday to acquire the failing First Republic Bank after it was seized by government regulators. While the deal will put an end to the recent series of bank failures, it also makes the banking industry's leader even more powerful. WSJ's Charles Forelle explains how Dimon's bid came together. Further Reading: -Why First Republic Bank Collapsed -Jamie Dimon Wins Again in First Republic Bank Deal Further Listening: -Banking Troubles Are Not Over -Two Executives On What It's Like to Stop a Bank Run

Read more »

First Republic Bank seized, sold in fire sale to JPMorganRegulators seized troubled First Republic Bank early Monday, making it the second-largest bank failure in U.S. history, and promptly sold all of its deposits and most of its assets to JPMorgan Chase in a bid to end the turmoil that has raised questions about the health of the U.S. banking system. The only larger bank failure in U.S. history was Washington Mutual, which collapsed at the height of the 2008 financial crisis and was also taken over by JPMorgan in a similar government-orchestrated deal. “Our government invited us and others to step up, and we did,” said Jamie Dimon, chairman and CEO of JPMorgan Chase.

First Republic Bank seized, sold in fire sale to JPMorganRegulators seized troubled First Republic Bank early Monday, making it the second-largest bank failure in U.S. history, and promptly sold all of its deposits and most of its assets to JPMorgan Chase in a bid to end the turmoil that has raised questions about the health of the U.S. banking system. The only larger bank failure in U.S. history was Washington Mutual, which collapsed at the height of the 2008 financial crisis and was also taken over by JPMorgan in a similar government-orchestrated deal. “Our government invited us and others to step up, and we did,” said Jamie Dimon, chairman and CEO of JPMorgan Chase.

Read more »

Gibson President/CEO James Curleigh Out, Cesar Gueikian Named Interim CEO“We are transitioning to new leadership at a time of strength to ensure the company continues its momentum,” said Gibson board chairman Nat Zilkha.

Gibson President/CEO James Curleigh Out, Cesar Gueikian Named Interim CEO“We are transitioning to new leadership at a time of strength to ensure the company continues its momentum,” said Gibson board chairman Nat Zilkha.

Read more »