DeepSeek, a Chinese open-source AI model, has surprised investors with its capabilities, prompting analysts to predict a growing interest in Chinese stocks. Despite economic worries, DeepSeek's success highlights China's strength in AI, offering a compelling investment opportunity.

DeepSeek's emergence as a powerful open-source AI model has sent ripples through the global investment community, prompting analysts to predict a shift in investor sentiment towards Chinese stocks. Despite lingering economic concerns, many believe DeepSeek's capabilities demonstrate China 's growing prowess in the AI sector, offering a compelling investment opportunity in a market previously viewed as risky. 'Before the overarching talk was, China is uninvestible.

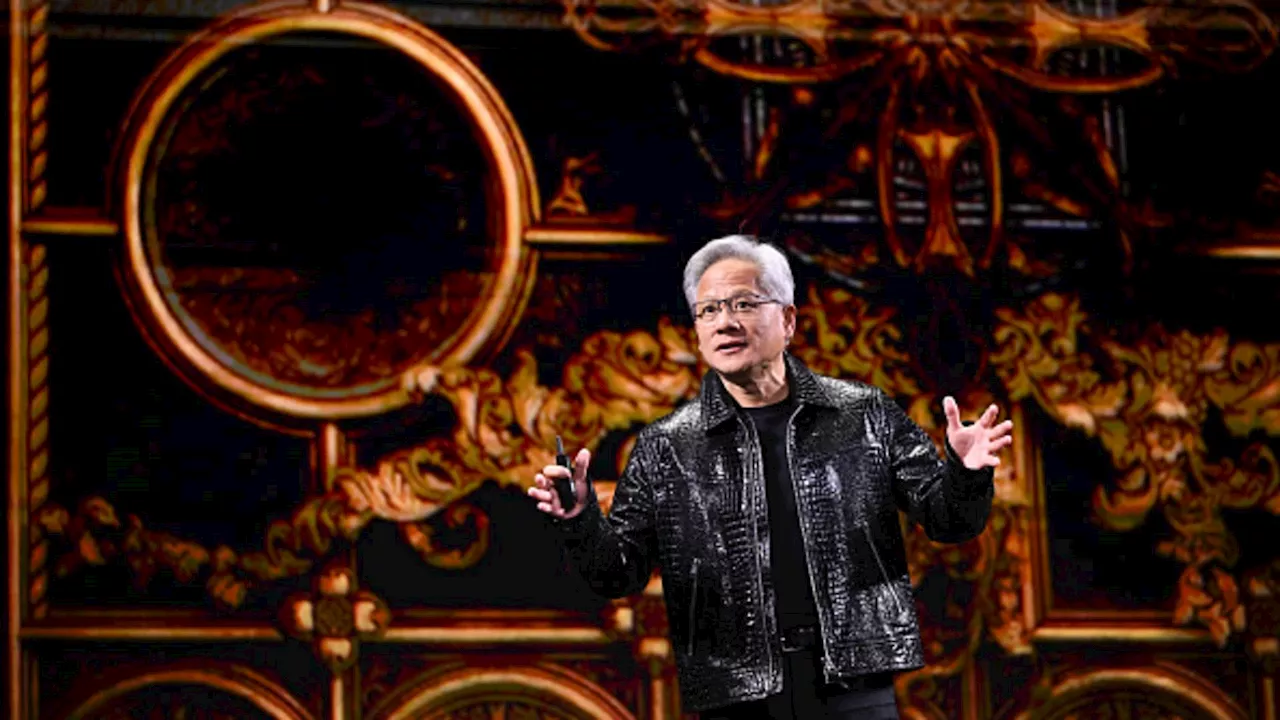

… Now you definitely see people start thinking it probably helps to have China,' said Liqian Ren, leader of quantitative investment at WisdomTree. It's a realization that 'the macro environment can be still cool in China and you still see innovation,' Ren said, adding she expects progress in the next few years in Chinese drug development and other areas. 'DeepSeek is the tip of what's likely to come.' Released in January, DeepSeek surprised many U.S. tech investors with its ability to share its thought process and claims to undercut OpenAI drastically on costs — despite U.S. export controls on advanced semiconductors. The news sent shockwaves through the tech world, prompting a 17% plunge in Nvidia's stock on January 27, its worst day since 2020, as global tech stocks dropped. This development has raised questions about the vast sums being invested in AI and whether it will prove to be a worthwhile investment. 'I expect the current high concentration in the US stock market to be a temporary phenomenon,' said David Chao, global market strategist, Asia Pacific, ex-Japan, at Invesco. 'I would just add that it favors an equally weighted approach to the US market, US small-mid caps over mega caps and Chinese equities vs US equities,' he said. 'Chinese equities, and especially Chinese technology companies are priced at a steep discount compared to their American counterparts, and similar to the AI development gap narrowing, so too is the valuation gap.' DeepSeek showcases the potential of Chinese tech giants to develop AI models comparable to their U.S. counterparts, making it a bullish indicator for the MSCI China index, which includes Hong Kong and mainland-traded stocks. The index's subdued valuation, light positioning, and recovering earnings cycle are further reasons for optimism. Several Chinese stocks are expected to benefit from the surge in local AI development. 'Kingdee and Kingsoft Office remain our top names to gain exposure to the AI themes,' Boris Van and Ting Ming Neo, Bernstein analysts, said in a February 5 report. They expect Hong Kong-listed software company Kingdee to benefit due to its large base of small and medium-sized businesses, strong product positioning, and subscription model. 'The stock is well positioned for a macro recovery should private enterprise budgets resume later in the year, presenting upside to current estimates, with the AI story largely not yet priced in today,' the Bernstein analysts said. They are more cautious in the near term about Shanghai-listed Kingsoft Office, operator of the word-processing app WPS, due to uncertainty about its enterprise AI business's success. 'Long term AI winner but find the right entry point in 1H,' the analysts said. They rate both stocks outperform. Within China stocks likely to benefit from rising AI adoption, J.P. Morgan China equity strategists also favor Kingdee over Kingsoft Office. 'DeepSeek's low cost and quality AI data infrastructure should help raise the installation and revenue base for AI enabled software applications,' they said in a February 3 note. The firm highlighted Kingdee as a preferred pick. They pointed out that while businesses have not spent much on software due to slow growth, government offices in China have been digitizing data and processes to improve efficiency. The J.P. Morgan China strategists also expect increased availability of AI applications to encourage consumers to buy new smartphones more frequently. Among the publicly-traded Chinese players, they like Hong Kong-listed Xiaomi the best as they expect Lenovo to be more affected by tariffs. The team rates Xiaomi overweight. HSBC analysts on February 6 raised their revenue estimates for Xiaomi partly on expectations of better smartphone and connected home appliance sales. They pointed out that Xiaomi has an in-house AI large model team and strategic cooperation with Kingsoft Cloud and AI startup MiniMax. 'With the rise of low-cost models such as DeepSeek-R1 and the gradual maturity of AI computing infrastructures, we believe Xiaomi will benefit as one of the top global edge AI players,' the HSBC analysts said, referring to on-device AI. While the rise of Chinese AI presents exciting opportunities, Chinese stocks still face U.S. tariff uncertainty, and questions remain about how quickly the world's second-largest economy can grow this year without sufficient support. WisdomTree's Ren cautioned that China investors might face 'very painful' periods due to the barrage of headline-driven volatility. She added that new buyers are likely increasing their allocation from emerging markets rather than U.S. stocks

AI China Deepseek Investment Technology Stocks MSCI China Kingdee Kingsoft Office Xiaomi Nvidia Openai

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

China: AI’s Sputnik moment? A short Q and A on DeepSeekOn 20 January the Chinese start-up DeepSeek released its AI model DeepSeek-R1.

China: AI’s Sputnik moment? A short Q and A on DeepSeekOn 20 January the Chinese start-up DeepSeek released its AI model DeepSeek-R1.

Read more »

European Chip Stocks Could Benefit From Rise of Chinese AI Model DeepSeekAnalysts predict European semiconductor companies like ASML, ASMI, and VAT Group could see increased demand due to the widespread adoption of DeepSeek, a cost-effective AI model developed in China. While investors worry about DeepSeek's impact on Western tech giants like Nvidia, Microsoft, Amazon, and Google, JPMorgan analysts argue that European chip suppliers profit from manufacturing volume growth, which DeepSeek's potential deployment on consumer devices could drive.

European Chip Stocks Could Benefit From Rise of Chinese AI Model DeepSeekAnalysts predict European semiconductor companies like ASML, ASMI, and VAT Group could see increased demand due to the widespread adoption of DeepSeek, a cost-effective AI model developed in China. While investors worry about DeepSeek's impact on Western tech giants like Nvidia, Microsoft, Amazon, and Google, JPMorgan analysts argue that European chip suppliers profit from manufacturing volume growth, which DeepSeek's potential deployment on consumer devices could drive.

Read more »

![]() Chinese AI Startup DeepSeek Stuns Silicon Valley with Rapid RiseDeepSeek, a Chinese AI company specializing in open-source large language models, has made a significant impact on the AI landscape with its latest model, R1. Despite utilizing fewer and less powerful chips compared to U.S.-based rivals, DeepSeek's R1 achieved impressive performance rankings, challenging the dominance of established AI companies.

Chinese AI Startup DeepSeek Stuns Silicon Valley with Rapid RiseDeepSeek, a Chinese AI company specializing in open-source large language models, has made a significant impact on the AI landscape with its latest model, R1. Despite utilizing fewer and less powerful chips compared to U.S.-based rivals, DeepSeek's R1 achieved impressive performance rankings, challenging the dominance of established AI companies.

Read more »

DeepSeek's Rise: A Chinese AI Challenge Triggered by U.S. PolicyDeepSeek, a Chinese AI company, has emerged as a major competitor in the global AI market, fueled by U.S. trade restrictions. The U.S. export controls aimed at limiting China's access to advanced semiconductors have inadvertently spurred China's development of its own, cheaper chips. DeepSeek's capabilities have raised concerns about its potential to disrupt the existing AI market, particularly its reliance on companies like Nvidia. The situation has prompted a reassessment of AI valuations and the future of U.S. AI policy.

DeepSeek's Rise: A Chinese AI Challenge Triggered by U.S. PolicyDeepSeek, a Chinese AI company, has emerged as a major competitor in the global AI market, fueled by U.S. trade restrictions. The U.S. export controls aimed at limiting China's access to advanced semiconductors have inadvertently spurred China's development of its own, cheaper chips. DeepSeek's capabilities have raised concerns about its potential to disrupt the existing AI market, particularly its reliance on companies like Nvidia. The situation has prompted a reassessment of AI valuations and the future of U.S. AI policy.

Read more »

DeepSeek's Rise Sparks Concerns as Chinese AI Challenges US DominanceDeepSeek, a year-old Chinese AI company, has taken the top spot in Apple's App Store, pushing OpenAI's ChatGPT to second place. This success raises concerns about China's growing influence in AI and its potential impact on US national security.

DeepSeek's Rise Sparks Concerns as Chinese AI Challenges US DominanceDeepSeek, a year-old Chinese AI company, has taken the top spot in Apple's App Store, pushing OpenAI's ChatGPT to second place. This success raises concerns about China's growing influence in AI and its potential impact on US national security.

Read more »

DeepSeek's Rise: US Tech Industry Reacts to Chinese AI RivalChinese AI startup DeepSeek challenges the US tech landscape with a cost-effective reasoning model comparable to ChatGPT. This sparks debate about the future of AI hardware spending as Meta CEO reaffirms commitment to billions in investment while exploring DeepSeek's potential applications.

DeepSeek's Rise: US Tech Industry Reacts to Chinese AI RivalChinese AI startup DeepSeek challenges the US tech landscape with a cost-effective reasoning model comparable to ChatGPT. This sparks debate about the future of AI hardware spending as Meta CEO reaffirms commitment to billions in investment while exploring DeepSeek's potential applications.

Read more »