The emergence of DeepSeek, a Chinese startup that claims to have developed a highly efficient AI reasoning model, has shaken the tech industry. Investors are closely watching earnings reports from major tech companies to understand the implications of DeepSeek's claims for their AI spending plans.

Tech earnings season kicks off on Wednesday, with reports coming from Meta , Microsoft , and Tesla, followed by Apple on Thursday. Shares of Nvidia and other providers of artificial intelligence infrastructure plummeted on Monday after reports about China's DeepSeek and its efficiency in training AI models. The biggest tech companies are all spending heavily on AI chips, so investors will want to hear what the DeepSeek development means for their plans.

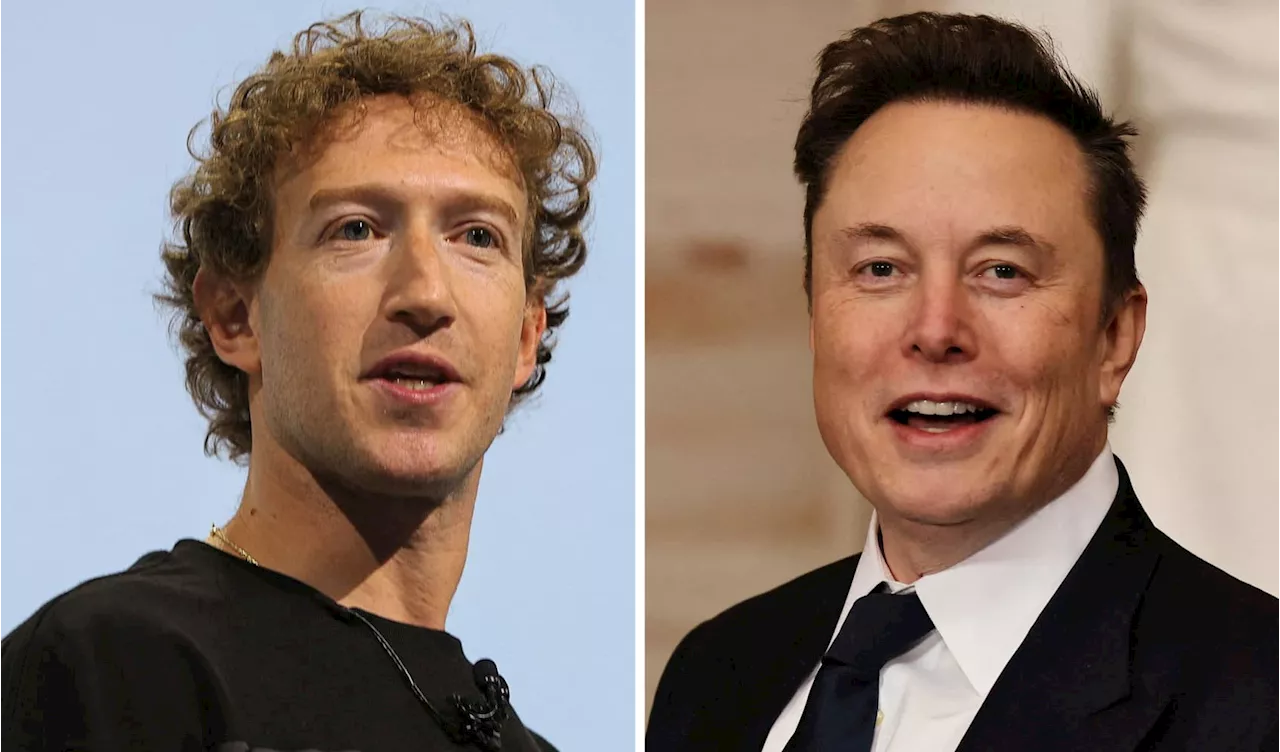

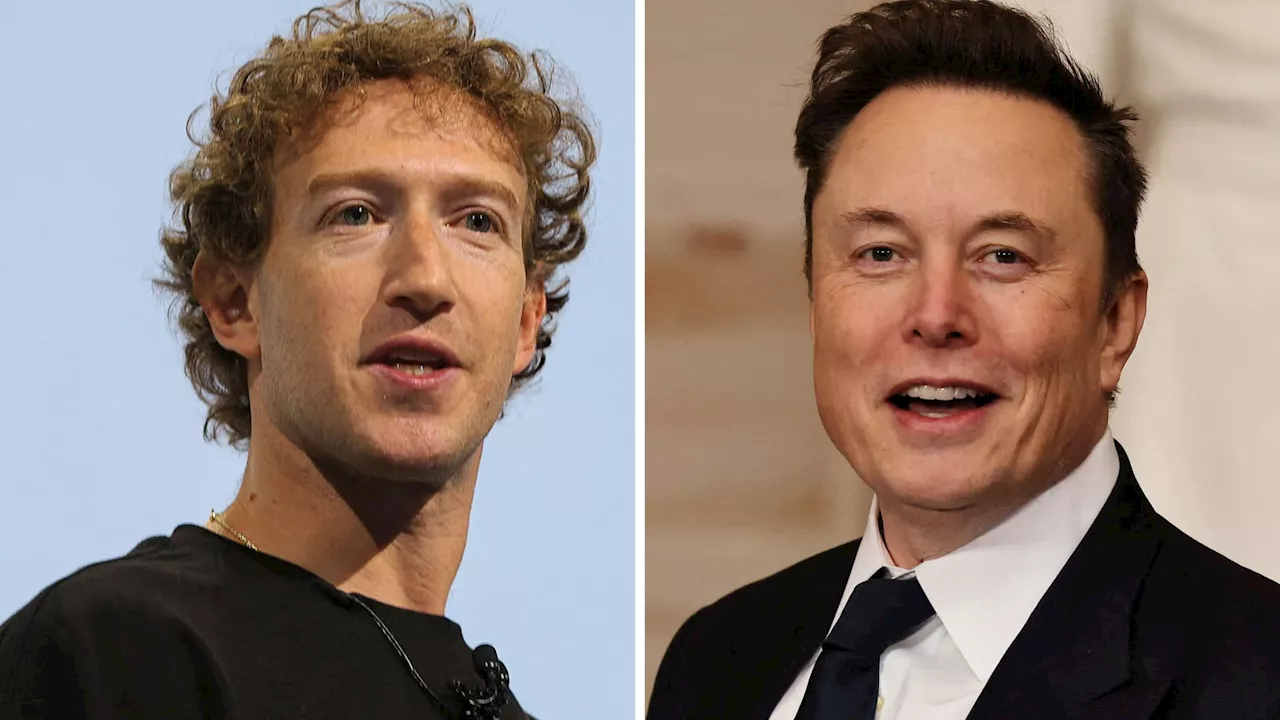

\The emergence of DeepSeek, a Chinese startup that claims to have developed a highly efficient AI reasoning model called R1, has sent shockwaves through the tech market on Monday, landing just in time to give U.S. tech investors a reason to pay particularly close attention to earnings season, which kicks off after the bell on Wednesday. DeepSeek launched a free, open-source large language model in late December that it said took only two months and less than $6 million to build. While there's plenty of skepticism surrounding DeepSeek's claims, the latest pronouncements caused a panic on Wall Street due to the potential implications of significantly cheaper AI models coming sooner rather than later. \Nvidia, a key player in the AI infrastructure market, saw its shares drop 17% on Monday, its steepest drop since the early days of the Covid pandemic in March 2020. The selloff wiped out almost $600 billion in market cap, the biggest one-day loss ever for a U.S. company. The big immediate issues for those companies with respect to DeepSeek are less about revenue and more about costs. It's a topic they tend to spend a lot of time talking about on earnings calls. 'The sheer efficiency of DeepSeek's pre and post training framework (if true) raises the question as to whether or not global hyperscalers and governments, that have and continue to invest significant capex dollars into AI infrastructure, may pause to consider the innovative methodologies that have come to light with DeepSeek's research,' wrote analysts at Stifel in a report on Monday. Investors hope to get some initial answers in earnings reports this week and next. Nvidia doesn't report until late February, and Broadcom is expected to announce results in March. \Mark Zuckerberg, chief executive officer of Meta Platforms Inc., wears Orion augmented reality glasses during the Meta Connect event in Menlo Park, California, Sept. 25, 2024. Meta, which is planning to increase its capital expenditures in 2025 as it bulks up its AI infrastructure, has been vocal about its AI ambitions. Zuckerberg talks extensively about AI on his company's quarterly updates, and likes to tout advancements in its open-source AI development. Given how much Meta spends on Nvidia GPUs, any change in the market dynamics is of deep interest to shareholders. Some tech investors have expressed concern about the hefty amount of spending on AI relative to the immediate returns companies are seeing. Satya Nadella, chief executive officer of Microsoft Corp., speaks during the company event on AI technologies in Jakarta, Indonesia, on Tuesday, April 30, 2024. Among the large software and internet companies, Microsoft is closest to the AI boom due to its intimate relationship with ChatGPT creator OpenAI. The roughly $10 billion Microsoft has pumped into OpenAI has been critical for the startup, which needs boatloads of GPUs to build and run its models. Late Monday, OpenAI CEO Sam Altman called R1 'an impressive model, particularly around what they're able to deliver for the price.' He added that OpenAI will deliver better models, but that it's 'legit invigorating to have a new competitor!' In addition to funneling money to OpenAI, Microsoft is a big spender on its own when it comes to GPUs for its AI products and its Azure cloud-computing service. Oppenheimer analyst Timothy Horan sees DeepSeek as a negative sign for Microsoft, which 'has bet more on proprietary models (OpenAI) and higher-cost hardware,' he wrote in a report. Elon Musk, who also runs SpaceX, expressed doubt that DeepSeek's models were created on the reportedly low budget of under $10 million. But Musk showed appreciation for DeepSeek's technical achievements. Musk has a history in the space technology sector and is currently focused on developing his own AI systems at SpaceX.

AI Deepseek Nvidia Microsoft Meta Tech Earnings Openai Chatgpt

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

![]() DeepSeek App Sends Shockwaves Through Silicon Valley, Triggering AI Sell-OffChinese AI app DeepSeek's impressive capabilities and low development costs have caused a market sell-off in the US tech sector. Nvidia, a key player in AI hardware, experienced its worst single-day percentage drop since 2020. Other AI companies, including Google, Microsoft, and Palantir, also saw losses, while Meta rose after announcing increased capital spending plans. DeepSeek's emergence raises questions about the future of AI dominance and the impact on companies that supply computing power for AI training.

DeepSeek App Sends Shockwaves Through Silicon Valley, Triggering AI Sell-OffChinese AI app DeepSeek's impressive capabilities and low development costs have caused a market sell-off in the US tech sector. Nvidia, a key player in AI hardware, experienced its worst single-day percentage drop since 2020. Other AI companies, including Google, Microsoft, and Palantir, also saw losses, while Meta rose after announcing increased capital spending plans. DeepSeek's emergence raises questions about the future of AI dominance and the impact on companies that supply computing power for AI training.

Read more »

DeepSeek vs. ChatGPT: Hands On With DeepSeek’s R1 ChatbotDeekSeek’s chatbot with the R1 model is a stunning release from the Chinese startup. While it’s an innovation in training efficiency, hallucinations still run rampant.

DeepSeek vs. ChatGPT: Hands On With DeepSeek’s R1 ChatbotDeekSeek’s chatbot with the R1 model is a stunning release from the Chinese startup. While it’s an innovation in training efficiency, hallucinations still run rampant.

Read more »

Explaining DeepSeek: The Chinese model's efficiency is scaring marketsBusiness Insider tells the global tech, finance, stock market, media, economy, lifestyle, real estate, AI and innovative stories you want to know.

Explaining DeepSeek: The Chinese model's efficiency is scaring marketsBusiness Insider tells the global tech, finance, stock market, media, economy, lifestyle, real estate, AI and innovative stories you want to know.

Read more »

DeepSeek's AI Efficiency Shakes Up Tech Earnings SeasonChina's DeepSeek startup has made waves with claims of a highly efficient AI model, raising questions about the future of AI infrastructure spending for tech giants. Investors are eager to hear how companies like Meta, Microsoft, and Tesla plan to navigate this development during the upcoming earnings season.

DeepSeek's AI Efficiency Shakes Up Tech Earnings SeasonChina's DeepSeek startup has made waves with claims of a highly efficient AI model, raising questions about the future of AI infrastructure spending for tech giants. Investors are eager to hear how companies like Meta, Microsoft, and Tesla plan to navigate this development during the upcoming earnings season.

Read more »

Tech Sell-Off Sends Shockwaves Through Global MarketsWall Street's tech rout triggers declines in Japan and fuels concerns about a broader market slowdown. Investors await the Federal Reserve's next move and monitor developments in emerging markets like India.

Tech Sell-Off Sends Shockwaves Through Global MarketsWall Street's tech rout triggers declines in Japan and fuels concerns about a broader market slowdown. Investors await the Federal Reserve's next move and monitor developments in emerging markets like India.

Read more »

Trump's Tariff Threat Sends Shockwaves Through North American Auto IndustryPresident Trump's inauguration marks a new era for the U.S. auto industry, with looming tariffs on Canada and Mexico threatening to disrupt decades of progress in the North American supply chain. GM Canada's President warns of potential price hikes for consumers, while Scout Motors stands firm against Volkswagen dealers who oppose its direct-to-consumer sales model. This article explores the potential impact of tariffs on the automotive landscape and the changing dynamics of dealership relationships in the age of electric vehicles.

Trump's Tariff Threat Sends Shockwaves Through North American Auto IndustryPresident Trump's inauguration marks a new era for the U.S. auto industry, with looming tariffs on Canada and Mexico threatening to disrupt decades of progress in the North American supply chain. GM Canada's President warns of potential price hikes for consumers, while Scout Motors stands firm against Volkswagen dealers who oppose its direct-to-consumer sales model. This article explores the potential impact of tariffs on the automotive landscape and the changing dynamics of dealership relationships in the age of electric vehicles.

Read more »