Exeter, which specializes in subprime lending, makes more money on loans that default than on ones paid on time.

Jessica Patterson tensed as she tore open the letter from Exeter Finance. “This notice is being sent to you concerning your default,” the company wrote.It was January 2018. Seven months earlier, she’d borrowed $14,786.07 to purchase a silver Kia Rio. The interest rate was sky high — 25.17% — and the $402 monthly payment was more than a quarter of her take-home pay. But she needed the car to keep her job and support her three young children.

Exeter is one of the largest auto lenders in the nation, specializing in high-interest loans to people with histories of not paying bills or defaulting on debt, a practice known as subprime lending. The company, which has more than 500,000 active loans and a partnership agreement with CarMax, the country’s largest used car retailer, casts itself as a provider of second chances. “We’re here to help,” it says on its website. In reality, Exeter’s practices often do the opposite.

“Exeter’s mission is to enable Americans who otherwise may not be able to access financing the opportunity to own their own vehicle so they can go to work and take care of their families,” the company said. “We take that mission seriously as well as our commitment to our customers.” Extensions that hide the consequences from borrowers “are taking a loan that is not working and ensuring that it’s just not going to work for a little longer,” said Pamela Foohey, a University of Georgia law professor who has written extensively about subprime lending.

“You guys have gotten double what this vehicle is worth, and you still want to take another $6,000 from me?” Smith said of Exeter. “I was appalled. I couldn’t believe it.” The company attributed part of a more recent uptick in extensions to the COVID-19 relief bill that Congress passed during the pandemic in 2020, saying the legislation “encouraged compassion from lenders.”

The company said it updated those disclosures in late 2021 but declined to provide copies or details about the changes., said that an extension would increase the borrowers’ interest charges as well as the amount of their final payment. However, the notices did not include the actual dollar amount. If borrowers wanted to know more, the letter directed them to call a toll-free number.

As a receptionist at a hearing aid sales center, she made $12 an hour, below the federal poverty line. She’d just moved her family out of a domestic violence shelter and into a basement apartment of their own. Their life felt fragile. Patterson agreed to the terms. To get to work and get her kids to school, she needed a car. Turning down the loan felt like giving up.

To save on food, she drove her family to free church dinners every Wednesday and Thursday night. Donations from a nearby food bank allowed them to keep grocery bills at a bare minimum. “If you can manipulate the payment schedule in such a way that makes the original disclosures meaningless, that’s a huge problem,” said Erin Witte, consumer protection director at the Consumer Federation of America.

For people who take extensions and make it to the end of their loan, a large final payment typically awaits. “I couldn’t get heads or tails about how much of that was actual payments and how much of that was fees,” Weaver said.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Surprise costs at major auto lender drive struggling borrowers deeper into debtSurprise costs at a major auto lender are driving borrowers deeper into debt. Read more in this Scripps News, ProPublica partnership story.

Surprise costs at major auto lender drive struggling borrowers deeper into debtSurprise costs at a major auto lender are driving borrowers deeper into debt. Read more in this Scripps News, ProPublica partnership story.

Read more »

ProPublica: Irving-based auto lender Exeter deferred loans and drove up borrowing costsExeter is one of the largest auto lenders in the nation, specializing in high-interest loans to people with histories of not paying bills or defaulting on...

ProPublica: Irving-based auto lender Exeter deferred loans and drove up borrowing costsExeter is one of the largest auto lenders in the nation, specializing in high-interest loans to people with histories of not paying bills or defaulting on...

Read more »

Sonoma auto shop owner gets 9 years prison after stealing $350K from customersA former car restoration shop owner in Santa Rosa was sentenced to nearly 10 years in prison for stealing more than $350,000 from his customers, according to prosecutors.

Sonoma auto shop owner gets 9 years prison after stealing $350K from customersA former car restoration shop owner in Santa Rosa was sentenced to nearly 10 years in prison for stealing more than $350,000 from his customers, according to prosecutors.

Read more »

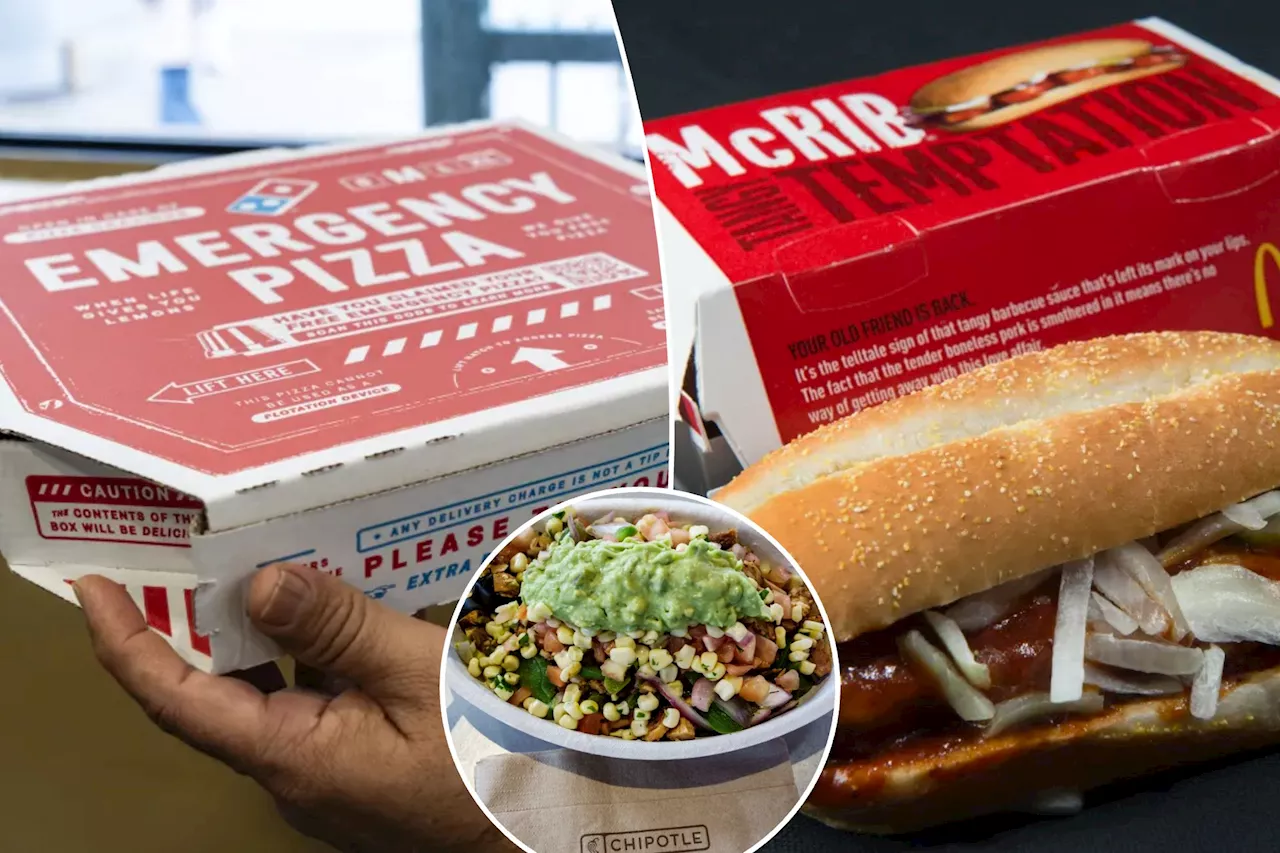

Top 10 most-missed fast-food items revealed — here's what customers wish would come backTop 5 discontinued fast food items

Top 10 most-missed fast-food items revealed — here's what customers wish would come backTop 5 discontinued fast food items

Read more »

Speedy Auto Service: A Legacy Driven by Passion | Car NewsSpeedy Auto Service: Seven Decades of Expertise and Trust in Auto Repair

Speedy Auto Service: A Legacy Driven by Passion | Car NewsSpeedy Auto Service: Seven Decades of Expertise and Trust in Auto Repair

Read more »

Top 25 Jacksonville Jaguars Countdown: Key Veteran Defender Kicks Off Top 5The top-5 starts with one of the best tacklers in the NFL: Jacksonville Jaguars linebacker Foyesade Oluokun.

Top 25 Jacksonville Jaguars Countdown: Key Veteran Defender Kicks Off Top 5The top-5 starts with one of the best tacklers in the NFL: Jacksonville Jaguars linebacker Foyesade Oluokun.

Read more »