Treating cryptocurrency platforms as banks could prevent a future crisis like the FTX one, Yanase argued.

Mamoru Yanase – Deputy Director-General of Japan’s Financial Services Agency – urged global watchdogs to impose tougher regulations on the cryptocurrency industry.It’s All Because of FTXto Yanase, one way to prevent another collapse of a cryptocurrency platform is if regulators treat such entities as traditional financial institutions. The Japanese referred to the demise of FTX, saying its bankruptcy and alleged fraud committed by Sam Bankman-Fried have wrecked the entire blockchain sector.

Yanase further argued that global regulators should protect consumers by enforcing more stringent anti-money laundering rules, applying enhanced governance on the crypto industry, and running internal auditing and control.“What’s brought about the latest scandal isn’t crypto technology itself. It is loose governance, lax internal controls, and the absence of regulation and supervision,” he said.

a permit in September 2022 to operate in “the Land of the Rising Sun.” Its renewed interest comes as a result of the relaxed crypto laws which Prime Minister Fumio Kishida promised to enforce: “Japanese Prime Minister Fumio Kishida’s agenda for reinvigorating the economy under the rubric of “New Capitalism” includes supporting the growth of so-called Web3 firms. The term “Web3″ refers to a vision of a decentralized internet built around blockchains, crypto’s underlying technology.”the Sakura Exchange BitCoin . The latter operates as a cryptocurrency exchange and is registered with the FSA.intentions to leave the Japanese market, citing unstable economic conditions.

“Current market conditions in Japan, in combination with a weak crypto market globally mean the resources needed to further grow our business in Japan aren’t justified at this time. As a result, Kraken will no longer service clients in Japan through Payward Asia.”

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Scaramucci to invest in crypto firm founded by former FTX US bossAnthony Scaramucci, the founder SkyBridge Capital, has confirmed that he’s personally investing in FTX US President Brett Harrison’s new crypto software start-up.

Scaramucci to invest in crypto firm founded by former FTX US bossAnthony Scaramucci, the founder SkyBridge Capital, has confirmed that he’s personally investing in FTX US President Brett Harrison’s new crypto software start-up.

Read more »

Binance Finds Solution to Stop Investors Scared by FTX Crash From Leaving: Details.binance eases investors’ concerns caused by the FTX collapse, here’s the solution. cz_binance

Binance Finds Solution to Stop Investors Scared by FTX Crash From Leaving: Details.binance eases investors’ concerns caused by the FTX collapse, here’s the solution. cz_binance

Read more »

FTX debtors identify $5.5 billion of liquid assets in ’Herculean effort’FTX identified $5.5 billion in cash, liquid crypto and liquid securities.

FTX debtors identify $5.5 billion of liquid assets in ’Herculean effort’FTX identified $5.5 billion in cash, liquid crypto and liquid securities.

Read more »

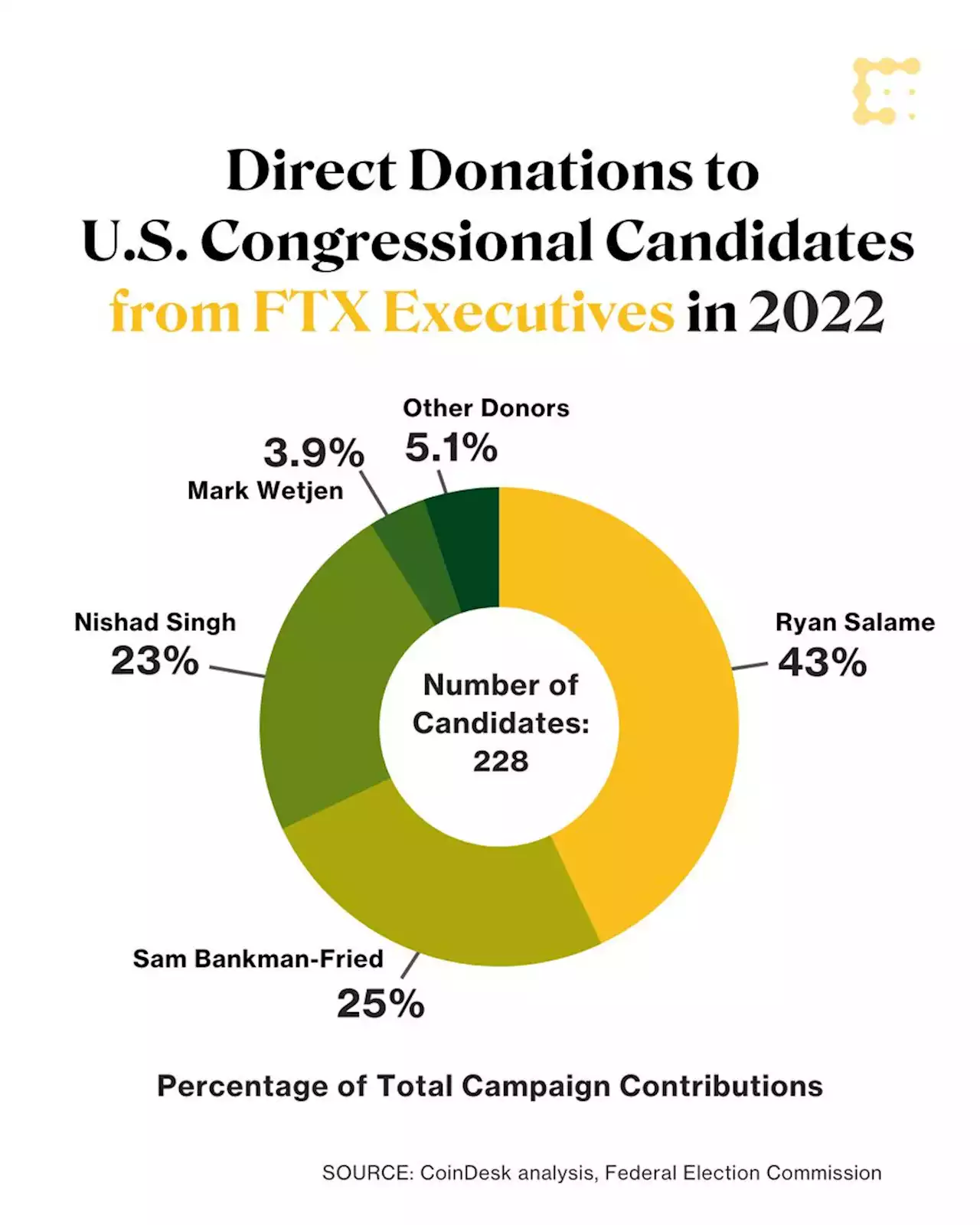

Congress' FTX Problem: 1 in 3 Members Got Cash From Crypto Exchange's BossesThe session began with 196 U.S. lawmakers who took direct contributions from Sam Bankman-Fried and other former FTX executives, and many of them are still trying to get rid of it.

Congress' FTX Problem: 1 in 3 Members Got Cash From Crypto Exchange's BossesThe session began with 196 U.S. lawmakers who took direct contributions from Sam Bankman-Fried and other former FTX executives, and many of them are still trying to get rid of it.

Read more »

Anthony Scaramucci Backs Ex-President of FTX US In New Crypto Venture | CoinMarketCapHarrison has not been accused of any wrongdoing in the $10 billion fraud that brought down Bankman-Fried's empire.

Anthony Scaramucci Backs Ex-President of FTX US In New Crypto Venture | CoinMarketCapHarrison has not been accused of any wrongdoing in the $10 billion fraud that brought down Bankman-Fried's empire.

Read more »

FTX says $415 million of crypto was hackedFTX management updated its estimated asset recoveries to $5.5 billion, and offered a new breakdown of over $400 million worth of missing assets.

FTX says $415 million of crypto was hackedFTX management updated its estimated asset recoveries to $5.5 billion, and offered a new breakdown of over $400 million worth of missing assets.

Read more »