Commodities Analysis by Naeem Aslam covering: Brent Oil Futures, Crude Oil WTI Futures. Read Naeem Aslam's latest article on Investing.com

prices continue to deflate while war tensions are very much anchored in place between Iran and Iraq. There is no doubt that we two groups of traders are currently moving the prices.

The question for traders is when Israel will attack Iran and if the attack will involve any oil fields as that would impact the oil equations.Oil prices have been experiencing volatile moves in the past few months as the initial attacks began. Traders have been on the edge as they continue to be that the recent retaliatory attacks by Iran on Israeli soil changed the dynamics of things significantly as this was the first time that we saw Iranian missiles landing in Israel.

Traders are concerned that if Israel does attack Iranian energy resources, it could lead to a significant spike in oil prices worldwide. This uncertainty in the market has caused oil prices to fluctuate as investors weigh the potential consequences of such an attack. With tensions escalating in the Middle East, traders are keeping a close eye on the situation and preparing for any potential market volatility that may arise.

Speaking from the technical perspective, the crude oil price continues to trade below the 200-day SMA on the daily time frame, which is a concern for bulls as they strongly believe that if the price was going to move higher, we should see the price moving above this SMA. The bears have their strong belief, which is that prices are likely to move to remain under their control as long as the price doesn’t move above the $80 price mark.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Crude Oil softens as traders remain split over big Fed rate cutCrude Oil edges down slightly on Monday after more weak Chinese economic data released over the weekend weighs on prices. Price action this week will largely depend on the US Federal Reserve (Fed), which is set to cut interest rates with markets

Crude Oil softens as traders remain split over big Fed rate cutCrude Oil edges down slightly on Monday after more weak Chinese economic data released over the weekend weighs on prices. Price action this week will largely depend on the US Federal Reserve (Fed), which is set to cut interest rates with markets

Read more »

Crude Oil Edges Down, Partially Reversing Monday’s GainsCrude oil prices fell on Tuesday, hovering around $68 and partially reversing Monday's rally. Despite bullish drivers such as the impact of Tropical Storm Francine on Gulf production and expectations for a large Fed rate cut, oil failed to rebound sharply.

Crude Oil Edges Down, Partially Reversing Monday’s GainsCrude oil prices fell on Tuesday, hovering around $68 and partially reversing Monday's rally. Despite bullish drivers such as the impact of Tropical Storm Francine on Gulf production and expectations for a large Fed rate cut, oil failed to rebound sharply.

Read more »

U.S. crude oil trades above $70 per barrel as Gulf of Mexico production recoversU.S. crude oil is down more than 13% this quarter, while Brent has fallen nearly 16% as demand slows in China.

U.S. crude oil trades above $70 per barrel as Gulf of Mexico production recoversU.S. crude oil is down more than 13% this quarter, while Brent has fallen nearly 16% as demand slows in China.

Read more »

U.S. Crude Oil Prices Rise Above $70 Per Barrel Amid Gulf of Mexico RecoveryU.S. crude oil prices surged above $70 per barrel on Tuesday, driven by ongoing recovery efforts in the Gulf of Mexico following Hurricane Francine. While global benchmark Brent has experienced a decline this year, traders are anticipating a potential impact from the Federal Reserve's interest rate decision later this week.

U.S. Crude Oil Prices Rise Above $70 Per Barrel Amid Gulf of Mexico RecoveryU.S. crude oil prices surged above $70 per barrel on Tuesday, driven by ongoing recovery efforts in the Gulf of Mexico following Hurricane Francine. While global benchmark Brent has experienced a decline this year, traders are anticipating a potential impact from the Federal Reserve's interest rate decision later this week.

Read more »

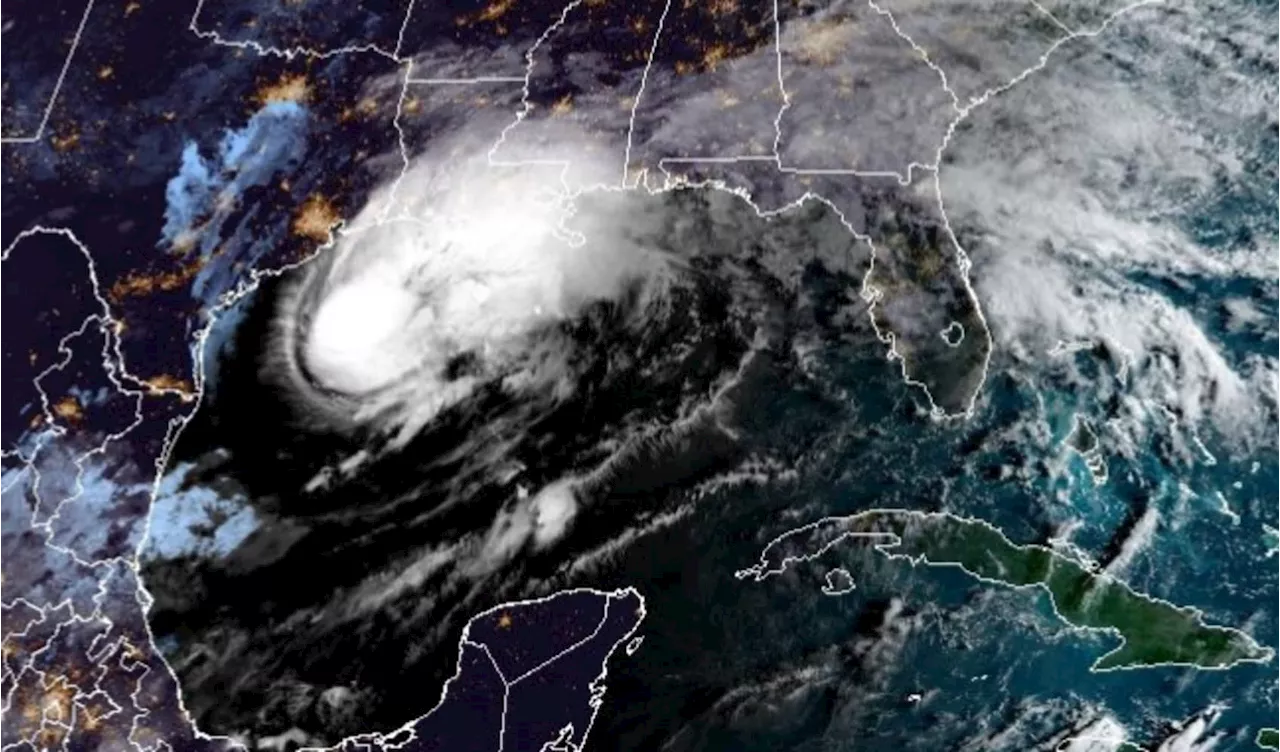

Crude Oil extends rebound as tropical storm Francine hits LouisianaCrude Oil pops over 1.50% for a second day in a row after booking over 1.50% gains on Wednesday, which was the biggest daily gain for Crude Oil in two weeks.

Crude Oil extends rebound as tropical storm Francine hits LouisianaCrude Oil pops over 1.50% for a second day in a row after booking over 1.50% gains on Wednesday, which was the biggest daily gain for Crude Oil in two weeks.

Read more »

U.S. crude oil rises more than 1% as Francine disrupts production in Gulf of MexicoUBS expects oil prices will continue to rise, at least the short term.

U.S. crude oil rises more than 1% as Francine disrupts production in Gulf of MexicoUBS expects oil prices will continue to rise, at least the short term.

Read more »