Credit Suisse, the 167-year-old bank and the second-largest lender in Switzerland, is in deep trouble. Its struggles set off anxiety in Europe and across global markets, and what happens at Credit Suisse could impact the broader financial system.

The bank said it would borrow up to 50 billion Swiss francs from the Swiss National Bank, taking advantage of a lifeline late Wednesday after its stock crashed as much as 30%. It also said it would buy back some of its own debt. Its struggles set off anxiety in Europe and across global markets, and what happens at Credit Suisse could impact the broader financial system. Why does Credit Suisse matter? Credit Suisse is one of the biggest financial institutions in the world.

And over the past decade, the Swiss bank has been hit with fines and penalties related to tax evasion, misplaced bets and other issues. In 2014, Credit Suisse pleaded guilty to federal charges that it illegally allowed some U.S. clients to evade their taxes. The bank paid a total of $2.6 billion to the federal government and New York financial regulators as part of the settlement. The bank’s reputation was damaged by an accounting scandal at Luckin Coffee.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Credit Suisse to borrow up to $54 billion from Switzerland's central bankCredit Suisse is borrowing from the Swiss National Bank under a covered loan facility.

Credit Suisse to borrow up to $54 billion from Switzerland's central bankCredit Suisse is borrowing from the Swiss National Bank under a covered loan facility.

Read more »

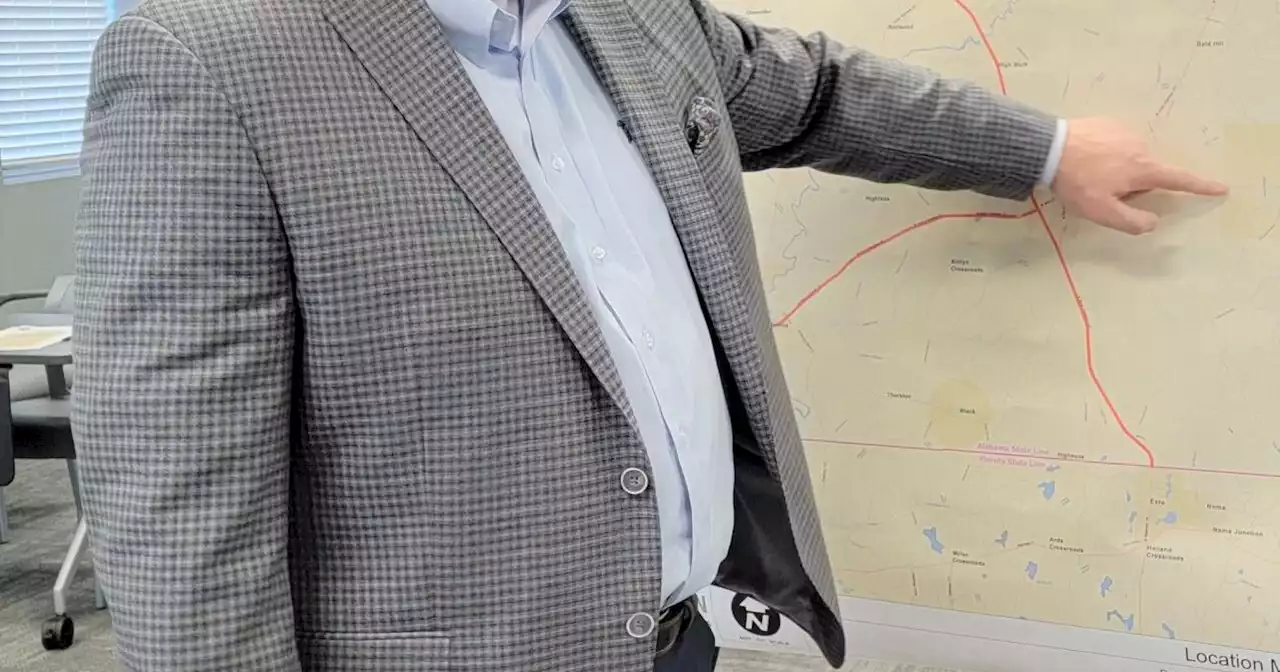

Four-laning SR-167 topic at SEARP&DC public meetingHARTFORD-The second of two public involvement meetings in as many weeks as part of a Southeast Alabama Regional Planning and Development Commission feasibility study was held Tuesday at the Wiregrass

Four-laning SR-167 topic at SEARP&DC public meetingHARTFORD-The second of two public involvement meetings in as many weeks as part of a Southeast Alabama Regional Planning and Development Commission feasibility study was held Tuesday at the Wiregrass

Read more »

Sources: Large US banks view Credit Suisse exposure as manageable – ReutersSources: Large US banks view Credit Suisse exposure as manageable – Reuters – by anilpanchal7 RiskAversion Banks UnitedStates Europe NewsTrading

Sources: Large US banks view Credit Suisse exposure as manageable – ReutersSources: Large US banks view Credit Suisse exposure as manageable – Reuters – by anilpanchal7 RiskAversion Banks UnitedStates Europe NewsTrading

Read more »

Large U.S. banks view Credit Suisse exposure as manageable -sourcesLarge U.S. banks have managed their exposure to Credit Suisse in recent months and view risks from the lender as contained so far, according to three industry sources on Wednesday who declined to be identified because of the sensitivity of the situation.

Large U.S. banks view Credit Suisse exposure as manageable -sourcesLarge U.S. banks have managed their exposure to Credit Suisse in recent months and view risks from the lender as contained so far, according to three industry sources on Wednesday who declined to be identified because of the sensitivity of the situation.

Read more »

Credit Suisse shares hit record lowCredit Suisse saw its stock sink to a record-low price level Tuesday in the morning, with shares for the bank subsequently being priced around $2.50 by afternoon.

Credit Suisse shares hit record lowCredit Suisse saw its stock sink to a record-low price level Tuesday in the morning, with shares for the bank subsequently being priced around $2.50 by afternoon.

Read more »

Credit Suisse chairman took a pass on $1.6 million award, had his pay cutCredit Suisse's chairman took a pass on a $1.6 million award and had his pay cut

Read more »