Jim Cramer's Charitable Trust is selling 250 shares of Nvidia (NVDA) and downgrading its rating to 2, advising investors to wait for a pullback before buying shares. Despite this, Cramer maintains his bullish outlook on Nvidia for the long term.

Shortly after the opening, we will be selling 250 shares of Nvidia at roughly $136.02. Following the trade, Jim Cramer 's Charitable Trust will own 1,050 shares of NVDA , decreasing its weighting to about 4% from about 5%. We're kicking off the new year by rightsizing our position in Nvidia , locking in a huge gain of about 975% on stock purchased in March 2021.

As with our Apple trim last week , this sale doesn't reflect any change in our longstanding view about Nvidia and the artificial intelligence giant's status as an 'own it, don't trade it' stock. However, discipline always trumps conviction. Just because we want to own a stock for the long term doesn't mean we can forgo discipline. We still must take profits from time to time after a big run. We let the stock run for essentially all of 2024, a year in which it delivered a 171% return. Ironically, the last time we sold Nvidia shares was on Jan. 2, 2024, on the heels of its monster 2023 performance. In addition to Thursday's sale, we are downgrading our rating to 2, meaning wait for a pullback before buying shares . Previously, we had upgraded Nvidia to our buy-equivalent 1 rating on Aug. 2 when the stock fell to roughly $109 a share. The stock is up about 23% since the upgrade, exceeding the S & P 500's return of about 10%. Nvidia is still in strong position for a 2025 , but we must acknowledge there could be some speed bumps along the way. Some of those bumps could be from increased competition from custom AI chips, a rationalization in capital expenditures from the megacap tech companies, and a dependence on Taiwan Semiconductor Manufacturing in an era where we have to be a little more careful about China with President-elect Donald Trump soon returning to the White House. (Jim Cramer's Charitable Trust is long NVDA. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trad

TECHNOLOGY Nvidia NVDA Jim Cramer Charitable Trust Stock Sale Downgrade Artificial Intelligence Investment Advice

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Here are Jim Cramer's thoughts on risks of Broadcom's strength to Nvidia and AMDThe Investing Club holds its 'Morning Meeting' every weekday at 10:20 a.m. ET.

Here are Jim Cramer's thoughts on risks of Broadcom's strength to Nvidia and AMDThe Investing Club holds its 'Morning Meeting' every weekday at 10:20 a.m. ET.

Read more »

Cramer Sells Morgan Stanley, Buys Goldman Sachs After Market OversoldJim Cramer's Charitable Trust is shifting its financial positions, selling half its Morgan Stanley shares to invest in Goldman Sachs. The move comes after a Fed-driven selloff pushed the market into oversold territory, prompting Cramer to look for buying opportunities.

Cramer Sells Morgan Stanley, Buys Goldman Sachs After Market OversoldJim Cramer's Charitable Trust is shifting its financial positions, selling half its Morgan Stanley shares to invest in Goldman Sachs. The move comes after a Fed-driven selloff pushed the market into oversold territory, prompting Cramer to look for buying opportunities.

Read more »

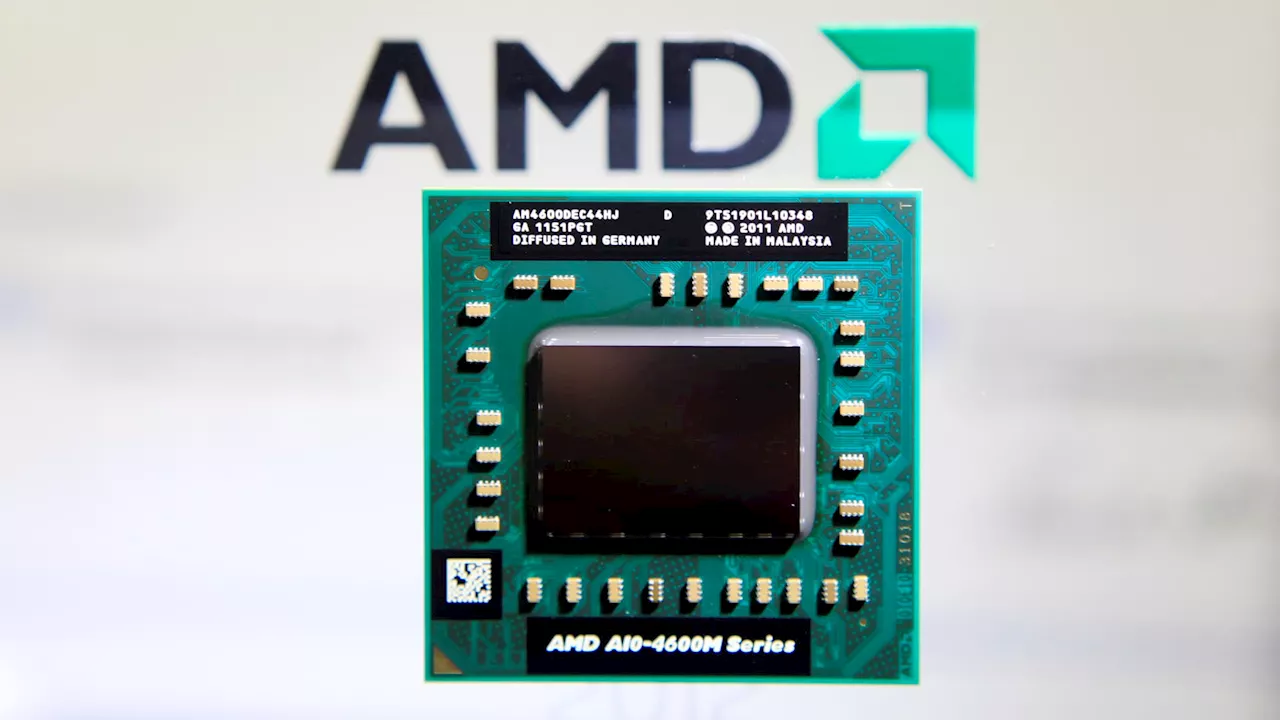

Jim Cramer Sells Broadcom, Cuts AMD PositionCramer's Charitable Trust trims Broadcom stake after parabolic rally, citing disciplined profit-taking and portfolio rebalancing. Simultaneously, AMD position is reduced and downgraded to a 'sell' rating due to evolving insights into the AI chip market.

Jim Cramer Sells Broadcom, Cuts AMD PositionCramer's Charitable Trust trims Broadcom stake after parabolic rally, citing disciplined profit-taking and portfolio rebalancing. Simultaneously, AMD position is reduced and downgraded to a 'sell' rating due to evolving insights into the AI chip market.

Read more »

Bank of America downgrades AMD due to potential market share lossesAdvanced Micro Devices could lose market share as cloud customers increasingly prefer custom chips, Bank of America said.

Bank of America downgrades AMD due to potential market share lossesAdvanced Micro Devices could lose market share as cloud customers increasingly prefer custom chips, Bank of America said.

Read more »

S&P Global downgrades Intel's credit rating on slow recovery, management changesS&P Global downgrades Intel's credit rating on slow recovery, management changes

Read more »

BofA upgrades UK equities, downgrades German stocksBofA upgrades UK equities, downgrades German stocks

BofA upgrades UK equities, downgrades German stocksBofA upgrades UK equities, downgrades German stocks

Read more »