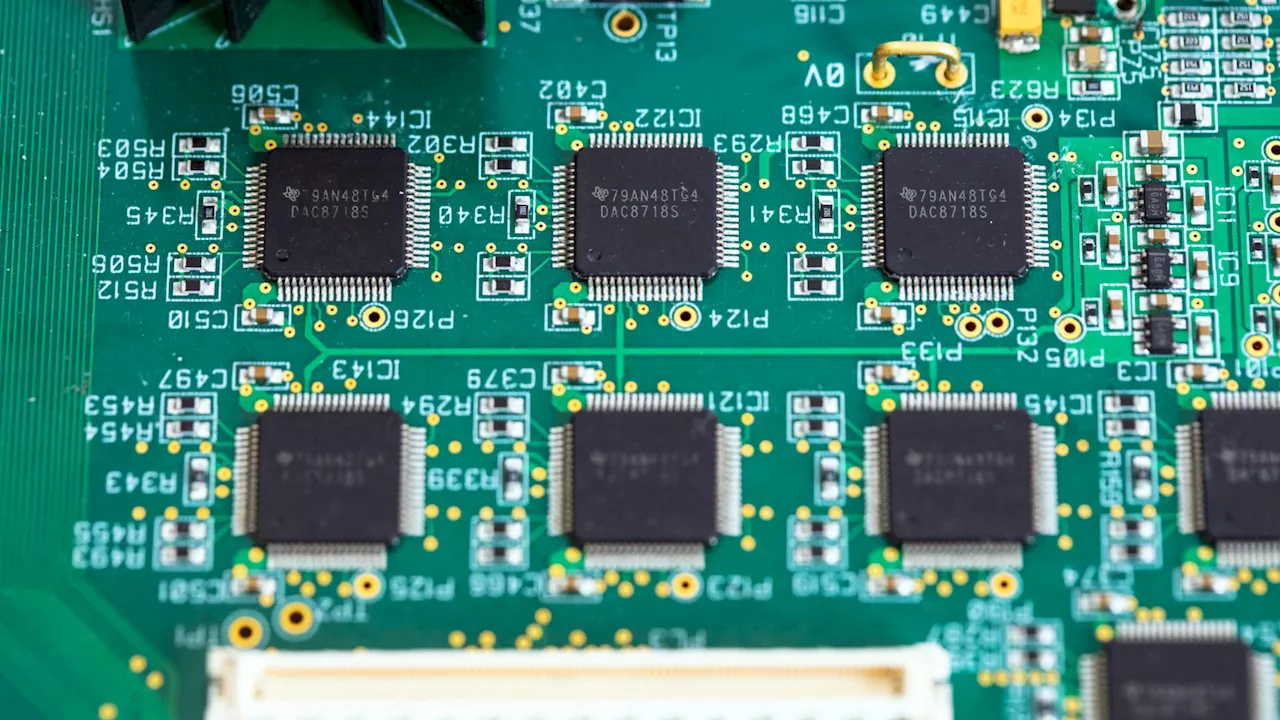

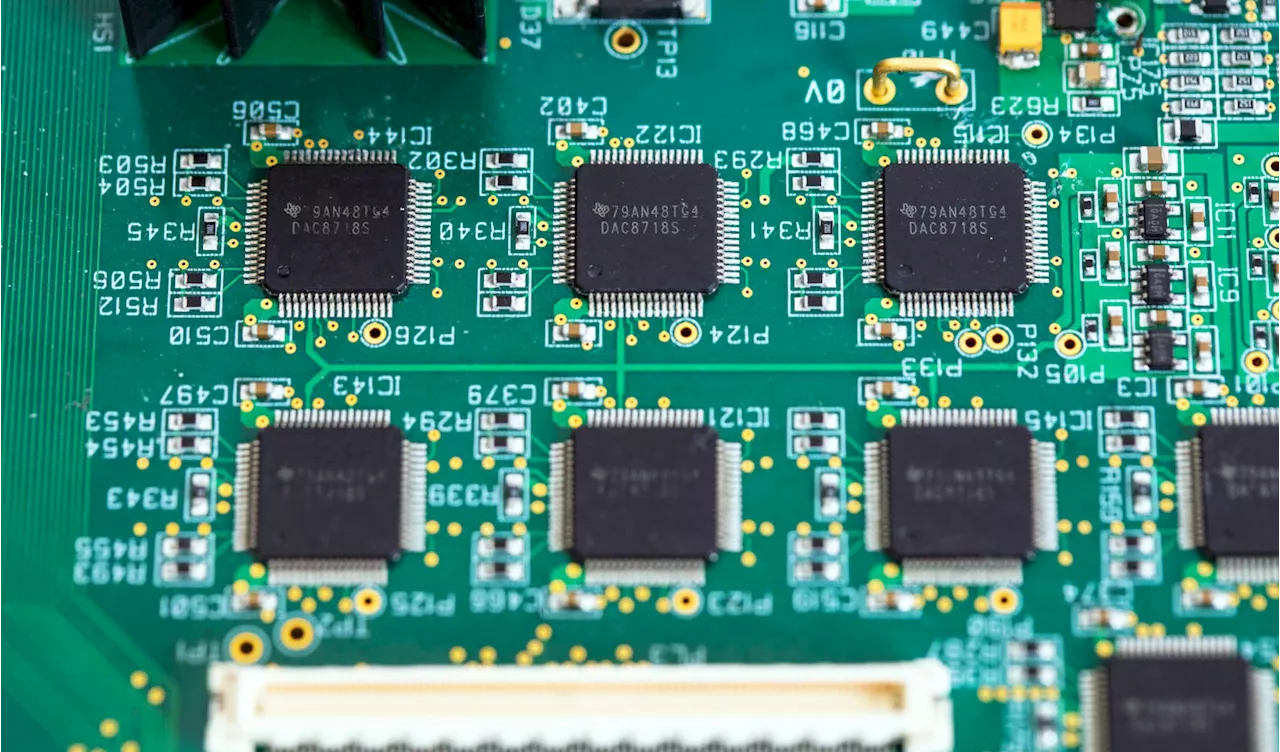

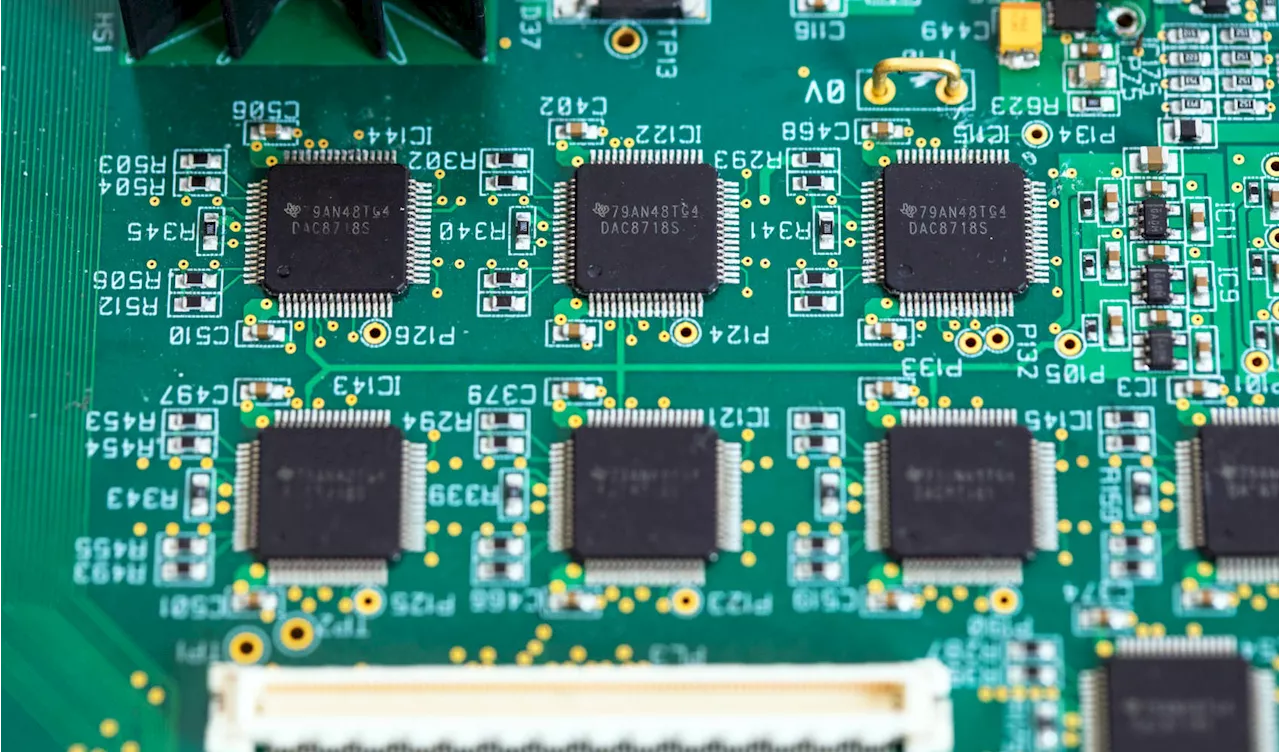

CNBC's Jim Cramer criticizes Texas Instruments for its failure to meet investor expectations and expand into less cyclical markets. He argues that the company, despite making high-quality industrial and auto chips, is content with its current position and lacks ambition. Cramer compares TI unfavorably to its peer, which successfully diversified into high-bandwidth memory chips.

CNBC's Jim Cramer on Friday critiqued Texas Instruments , saying the semiconductor company is not living up to investors' expectations or trying to expand into less cyclical markets.

"I'm absolutely convinced that if Texas Instruments wanted to, it could go beyond its cyclical nature. But it won't," he said. "It's content to remain as it is. It's just not content with the critics.", saying the semiconductor company is not living up to investors' expectations or trying to expand into less cyclical markets.

"I'm absolutely convinced that if Texas Instruments wanted to, it could go beyond its cyclical nature. But it won't," he said. "It's content to remain as it is. It's just not content with the critics."Thursday, with Wall Street disappointed by its earnings forecast for the current quarter. The chip maker predicted 94 cents to $1.

If Texas Instruments were a private company, this focus on autos and industrials might not be an issue, Cramer continued. But right now, the company isn't serving shareholders as they expect it to do, he said. He compared Texas Instruments to peer, saying that company was able to successfully expand its focus from commodity chips to high bandwidth memory chips for the data center.

"Texas Instruments … doesn't' seem to care if you don't like them," Cramer said. "So, there's no reason to own the stock, unless you think that the company's really going to take itself private or put itself up for sale, and I don't think they're going to do that."

SEMICONDUCTORS INVESTMENT TEXAS INSTRUMENTS GROWTH EARNINGS

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Jim Cramer Criticizes Texas Instruments for Lack of GrowthCNBC's Jim Cramer argues that Texas Instruments is failing to meet investor expectations by not diversifying beyond its cyclical industrial and automotive markets. While acknowledging the quality of their chips, Cramer believes the company's narrow focus is detrimental to long-term growth and shareholder value. He contrasts TI with competitor which has successfully expanded into higher-growth areas.

Jim Cramer Criticizes Texas Instruments for Lack of GrowthCNBC's Jim Cramer argues that Texas Instruments is failing to meet investor expectations by not diversifying beyond its cyclical industrial and automotive markets. While acknowledging the quality of their chips, Cramer believes the company's narrow focus is detrimental to long-term growth and shareholder value. He contrasts TI with competitor which has successfully expanded into higher-growth areas.

Read more »

Jim Cramer Criticizes Texas Instruments for Failing to Evolve and Meet Investor ExpectationsCNBC's Jim Cramer criticizes Texas Instruments for its lack of innovation and its persistent focus on cyclical markets, arguing that the company is not serving shareholder interests effectively. Cramer believes TI has the potential to diversify but chooses to remain stagnant despite investor pressure.

Jim Cramer Criticizes Texas Instruments for Failing to Evolve and Meet Investor ExpectationsCNBC's Jim Cramer criticizes Texas Instruments for its lack of innovation and its persistent focus on cyclical markets, arguing that the company is not serving shareholder interests effectively. Cramer believes TI has the potential to diversify but chooses to remain stagnant despite investor pressure.

Read more »

Jim Cramer critiques Texas Instruments as it deals with auto and industrial market slumpCNBC’s Jim Cramer on Friday critiqued Texas Instruments.

Jim Cramer critiques Texas Instruments as it deals with auto and industrial market slumpCNBC’s Jim Cramer on Friday critiqued Texas Instruments.

Read more »

The Futility of Texas' Border EnforcementAn editorial criticizes the Texas border enforcement operation, highlighting its ineffectiveness and the human cost.

The Futility of Texas' Border EnforcementAn editorial criticizes the Texas border enforcement operation, highlighting its ineffectiveness and the human cost.

Read more »

Texas Instruments Forecasts Continued Weakness in Industrial DemandTexas Instruments, a major semiconductor maker, lowered its revenue forecast for the current quarter, citing persistent weakness in industrial demand. Despite beating fourth-quarter earnings estimates, the company anticipates sales and profit declines for the coming period. CEO Haviv Ilan highlighted the continued challenges in industrial automation and energy infrastructure, while automotive growth in China failed to offset expected weakness elsewhere.

Texas Instruments Forecasts Continued Weakness in Industrial DemandTexas Instruments, a major semiconductor maker, lowered its revenue forecast for the current quarter, citing persistent weakness in industrial demand. Despite beating fourth-quarter earnings estimates, the company anticipates sales and profit declines for the coming period. CEO Haviv Ilan highlighted the continued challenges in industrial automation and energy infrastructure, while automotive growth in China failed to offset expected weakness elsewhere.

Read more »

Landsberg Advises Investors to Avoid Texas Instruments and VerizonMichael Landsberg, chief investment officer of Landsberg Bennett Private Wealth Management, recommends avoiding Texas Instruments and Verizon, citing concerns about their lack of exposure to AI and limited growth potential. He expresses a neutral stance on Twilio, acknowledging its strong revenue growth but emphasizing the need to evaluate its profitability improvements.

Landsberg Advises Investors to Avoid Texas Instruments and VerizonMichael Landsberg, chief investment officer of Landsberg Bennett Private Wealth Management, recommends avoiding Texas Instruments and Verizon, citing concerns about their lack of exposure to AI and limited growth potential. He expresses a neutral stance on Twilio, acknowledging its strong revenue growth but emphasizing the need to evaluate its profitability improvements.

Read more »