Market Overview Analysis by Michael Pento covering: S&P 500, United States 10-Year. Read Michael Pento's latest article on Investing.com

So, the Fed has pivoted once again. Jerome Powell has done so many twists that Chubby Checker would be envious. Or better said, the Fed has panicked and now realized it is again offside on its inflation target.

They have been well taught by Greenspan, Bernanke, Yellen, and now Powell that the Fed stands ready to take the bottom out of rates with alacrity. Therefore, Wall Street has already front-run all of the rate cuts in the pipeline. This means further interest rate cuts on the short end of the yield curve, which the Fed controls, will only serve to push rates on the long end of the yield curve higher.

Even if we have a soft landing and inflation gracefully retreats to the Fed's target, nominal GDP growth should be around 4%, which is historically where long-term rates tend to trade. Long-term interest rates are most concerned about inflation and insolvency. With $2 trillion deficits, $1 trillion of interest rate payments, and a $35 trillion National debt , there are significant solvency concerns as never before realized.

So, the only scenario for interest rates to fall from this point would be a significant drop in the earnings and economic growth outlook. But is that what Wall Street really wants? To the contrary, investors are pricing in a 21 multiple onWe also have Quantitative Tightening ongoing, along with the reverse repo facility, which is now drained. And, even after this 50bp rate cut, the real level of the FFR remains firmly in positive territory.

As it turns out, our current Fed Head is not data-dependent at all. He isn’t cutting rates because inflation has been vanquished. It isn’t even due to faltering GDP, or a higher-than-normal unemployment rate. And it is certainly not because asset bubbles are crumbling—at least not yet. It isn’t at all because of his omniscient belief that the stock market or the economy is about to fall apart.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

The Fed’s Rate Cut Won't Be Enough for a Soft LandingMarket Overview Analysis by Michael Pento covering: . Read Michael Pento's latest article on Investing.com

The Fed’s Rate Cut Won't Be Enough for a Soft LandingMarket Overview Analysis by Michael Pento covering: . Read Michael Pento's latest article on Investing.com

Read more »

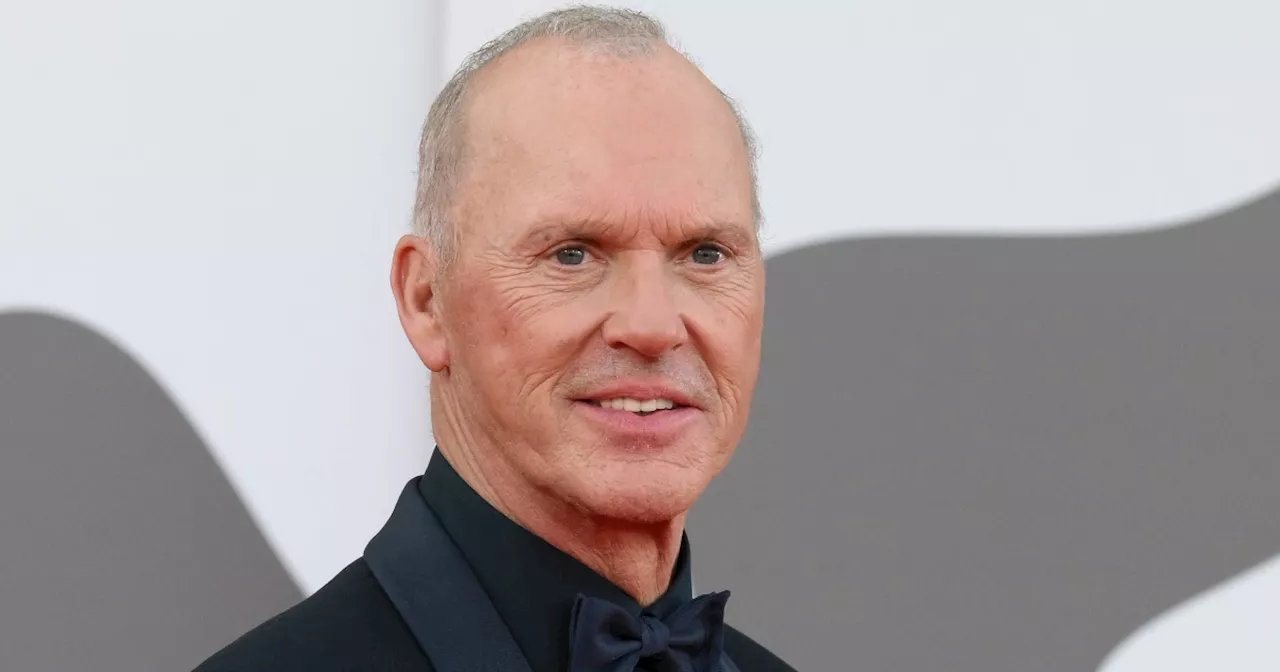

Michael Keaton To Change Name To Michael Keaton DouglasAlex Portée is a senior trending reporter at TODAY Digital and is based in Los Angeles.

Michael Keaton To Change Name To Michael Keaton DouglasAlex Portée is a senior trending reporter at TODAY Digital and is based in Los Angeles.

Read more »

10 Controversial '80s Movies Where The Audience Missed The PointRoboCop-Scarface-Al-Pacino-Wall-Street-Michael-Douglas

10 Controversial '80s Movies Where The Audience Missed The PointRoboCop-Scarface-Al-Pacino-Wall-Street-Michael-Douglas

Read more »

Michael Keaton wants to start going by his real name, Michael Douglas… sort ofMichael Douglas' days are numbered as the only Michael Douglas in town. Michael Keaton, whose shares his birth name with the 'Wall Street' star, plans on changing his professional credit to Michael Keaton Douglas from here on out.

Michael Keaton wants to start going by his real name, Michael Douglas… sort ofMichael Douglas' days are numbered as the only Michael Douglas in town. Michael Keaton, whose shares his birth name with the 'Wall Street' star, plans on changing his professional credit to Michael Keaton Douglas from here on out.

Read more »

After heavy rain collapses basement wall, retired couple learns insurance won’t cover the damageDon and Donna Bechtel, both 72, live on a fixed-income in their Dillsburg-area home. Now friends and family are rallying to help them.

After heavy rain collapses basement wall, retired couple learns insurance won’t cover the damageDon and Donna Bechtel, both 72, live on a fixed-income in their Dillsburg-area home. Now friends and family are rallying to help them.

Read more »

Watch reporter seek cover from Hurricane Helene eye wall in Perry, FloridaThis is additional taxonomy that helps us with analytics

Watch reporter seek cover from Hurricane Helene eye wall in Perry, FloridaThis is additional taxonomy that helps us with analytics

Read more »