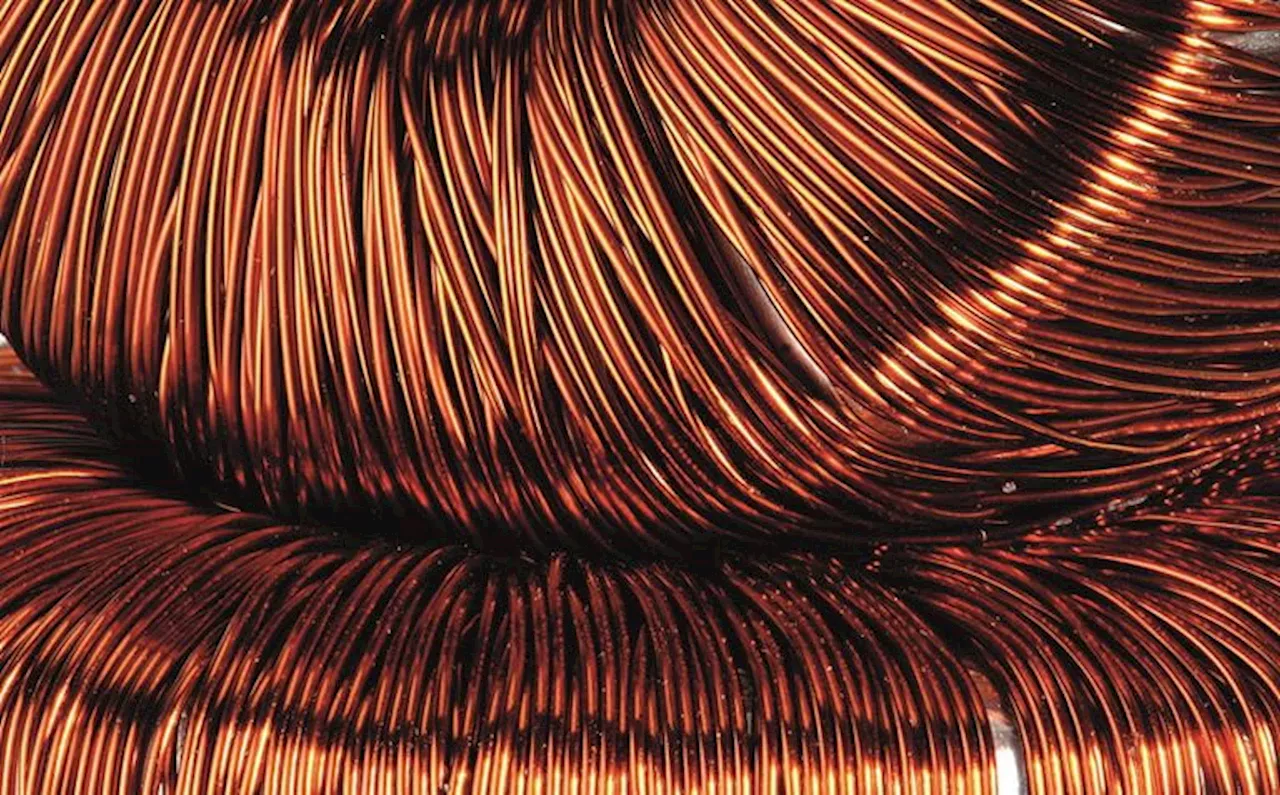

Prices are more likely to overshoot to the downside, notwithstanding the likely overly pessimistic sentiment surrounding demand, TDS senior commodity strategist Daniel Ghali notes.

Demand sentiment may be nearing a local bottom Our gauge of demand sentiment embedded within the cross-section of commodities prices is now nearing its lowest levels of the year. These levels are now quantitatively inconsistent with recent history, and considering macro vol has been fairly muted, commodity demand sentiment now appears oversold.

Today, we now estimate that 80% of discretionary length in the red metal has already been liquidated, and we now see signs that the top traders in Shanghai are notably covering their shorts. That being said, CTA trend followers still hold a substantial amount of dry-powder to sell and now have only a narrow margin of safety against selling programs. In fact, our simulations of future prices also suggest that a flat tape can now spark large-scale CTA selling activity over the next week.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Traders prefer Aluminum over CopperChinese traders are growing more bearish on Copper, TDS senior commodity strategist Daniel Ghali notes.

Traders prefer Aluminum over CopperChinese traders are growing more bearish on Copper, TDS senior commodity strategist Daniel Ghali notes.

Read more »

Copper holds losses as traders eye soft demand in ChinaNo 1 source of global mining news and opinion

Copper holds losses as traders eye soft demand in ChinaNo 1 source of global mining news and opinion

Read more »

Freeport Indonesia launches $3.7bn Gresik copper smelter to meet renewables demandNo 1 source of global mining news and opinion

Freeport Indonesia launches $3.7bn Gresik copper smelter to meet renewables demandNo 1 source of global mining news and opinion

Read more »

China’s copper stockpiles shrink again in hint at demand upturnNo 1 source of global mining news and opinion

China’s copper stockpiles shrink again in hint at demand upturnNo 1 source of global mining news and opinion

Read more »

Ukraine war sparks surge in copper demandNo 1 source of global mining news and opinion

Ukraine war sparks surge in copper demandNo 1 source of global mining news and opinion

Read more »

Nearby copper price hit by weak China demand, warehouse surplusNo 1 source of global mining news and opinion

Nearby copper price hit by weak China demand, warehouse surplusNo 1 source of global mining news and opinion

Read more »