Payday lenders argue that the CFPB's funding structure is unconstitutional because it's not funded by money appropriated by Congress. The argument threatens the existence of other agencies, too.

The fate of the CFPB, and other agencies that are similarly funded, is in the hands of the U.S. Supreme Court.

After the financial crisis, Congress created the CFPB to protect consumers from what were seen as predatory and dishonest practices by financial institutions. Since then, the CFPB has established consumer protections for financial transactions ranging from mortgages to credit cards. It has won $17.5 billion in restitution and taken steps to cancel debts for some 200 million eligible Americans, according to the agency.

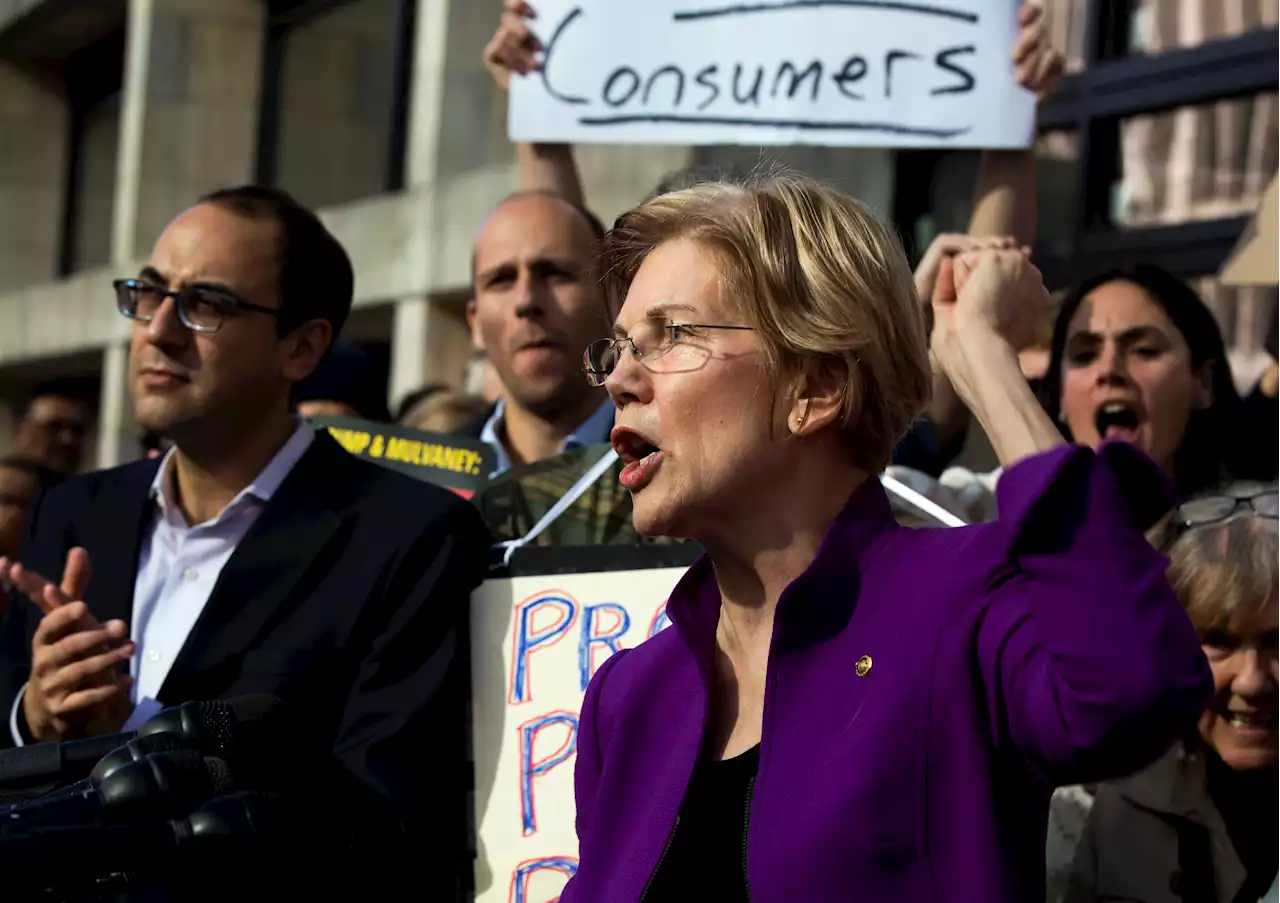

"A bad decision in the Supreme Court could wreck the financial security of millions of families and turn our economy upside down," says Sen. Elizabeth Warren, D-Mass., who first proposed the creation of the CFPB when she served in the Obama administration. Representing them, lawyer Robert Loeb notes that the regulations established by the CFPB for residential mortgages provide a uniform set of rules that protect not just consumers, but also the people issuing and servicing loans. If they follow the rules, they are protected from liability.

Part of the reason the military is especially worried is that young servicemembers with a regular pay check and a job are particular targets for payday lending businesses. Indeed, most military bases are surrounded by payday lender signs, and online lenders can reach members of the military anywhere in the world.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Consumer bureau poised for the fight of its life before Supreme CourtMany Democrats see the case as part of a broad-based attack on the regulatory state by Republicans eager to bring challenges before the Supreme Court.

Consumer bureau poised for the fight of its life before Supreme CourtMany Democrats see the case as part of a broad-based attack on the regulatory state by Republicans eager to bring challenges before the Supreme Court.

Read more »

Consumer watchdog agency's fate at Supreme Court could nix other agencies tooPayday lenders argue that the CFPB's funding structure is unconstitutional because it's not funded by money appropriated by Congress. The argument threatens the existence of other agencies, too.

Consumer watchdog agency's fate at Supreme Court could nix other agencies tooPayday lenders argue that the CFPB's funding structure is unconstitutional because it's not funded by money appropriated by Congress. The argument threatens the existence of other agencies, too.

Read more »

Consumer watchdog is in the crosshairs as Supreme Court weighs legal challengeThe case involving the Consumer Financial Protection Bureau is one of several conservative-backed efforts before the justices aimed at weakening federal agencies.

Consumer watchdog is in the crosshairs as Supreme Court weighs legal challengeThe case involving the Consumer Financial Protection Bureau is one of several conservative-backed efforts before the justices aimed at weakening federal agencies.

Read more »

US Supreme Court to hear case targeting consumer financial watchdogThe U.S. Supreme Court is set on Tuesday to hear a challenge to the funding structure of the Consumer Financial Protection Bureau (CFPB), a consumer watchdog established after the 2008 global financial crisis, in the first of several cases during its new term that could curb the power of federal agencies.

US Supreme Court to hear case targeting consumer financial watchdogThe U.S. Supreme Court is set on Tuesday to hear a challenge to the funding structure of the Consumer Financial Protection Bureau (CFPB), a consumer watchdog established after the 2008 global financial crisis, in the first of several cases during its new term that could curb the power of federal agencies.

Read more »

Biggest Supreme Court cases to watch in new termThe Supreme Court returned for its new term on Monday with several potentially major cases ahead. Jimmy Hoover, Supreme Court reporter at the National Law Journal, joins CBS News to take a look at some of the most important and controversial cases on the docket.

Biggest Supreme Court cases to watch in new termThe Supreme Court returned for its new term on Monday with several potentially major cases ahead. Jimmy Hoover, Supreme Court reporter at the National Law Journal, joins CBS News to take a look at some of the most important and controversial cases on the docket.

Read more »