The nation’s inflation rate has steadily cooled since peaking at 9.1% last June but remains far above the Federal Reserve’s 2% target rate.

The Fed is paying particular attention to so-called core prices, which exclude volatile food and energy costs and are regarded as a better gauge of longer-term inflation trends. Core prices rose 0.4% from March to April, the same as from February to March. It was the fifth straight month that core prices have risen by 0.4% or more. Increases at that pace are far above the Fed’s 2% target.Economists say the overall slowdown in U.S.

Yet unlike goods prices, the costs of services — from restaurant meals to auto insurance, dental care to education — are still surging. A major reason is thatin those industries to find and retain workers. Federal Reserve officials say that fast-rising wages, while good for workers, have contributed to higher costs in services industries because labor makes up a significant portion of those industries’ expenses.

have affected the economy. The full economic impact of the hikes, though, might not become evident for months.For more than two years, high inflation has been a significant burden for America’s consumers, a threat to the economy and a frustrating challenge for the Fed. The central bank has raised its key interest rate by a substantial 5 percentage points since March 2022 to try to drive inflation back down to its 2% target.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Does the Federal Reserve expect an increase in the Consumer Price Index?The Consumer Price Index (CPI) data release for April, published by the US Bureau of Labor Statistics (BLS), is scheduled for May 10 at 12:30 GMT. The

Does the Federal Reserve expect an increase in the Consumer Price Index?The Consumer Price Index (CPI) data release for April, published by the US Bureau of Labor Statistics (BLS), is scheduled for May 10 at 12:30 GMT. The

Read more »

CNBC Daily Open: Bracing for April’s consumer price indexMarkets had a quiet Tuesday as investors braced for key inflation reports coming out later today and Thursday.

CNBC Daily Open: Bracing for April’s consumer price indexMarkets had a quiet Tuesday as investors braced for key inflation reports coming out later today and Thursday.

Read more »

U.S. consumer price inflation below 5% for first time in two yearsU.S. consumer prices rose at a 4.9% annual rate in April, the lowest in two years, the Labor Department said Wednesday.

U.S. consumer price inflation below 5% for first time in two yearsU.S. consumer prices rose at a 4.9% annual rate in April, the lowest in two years, the Labor Department said Wednesday.

Read more »

US Consumer Price Index increased 4.9% year over year in April 2023Insider tells the global tech, finance, markets, media, healthcare, and strategy stories you want to know.

Read more »

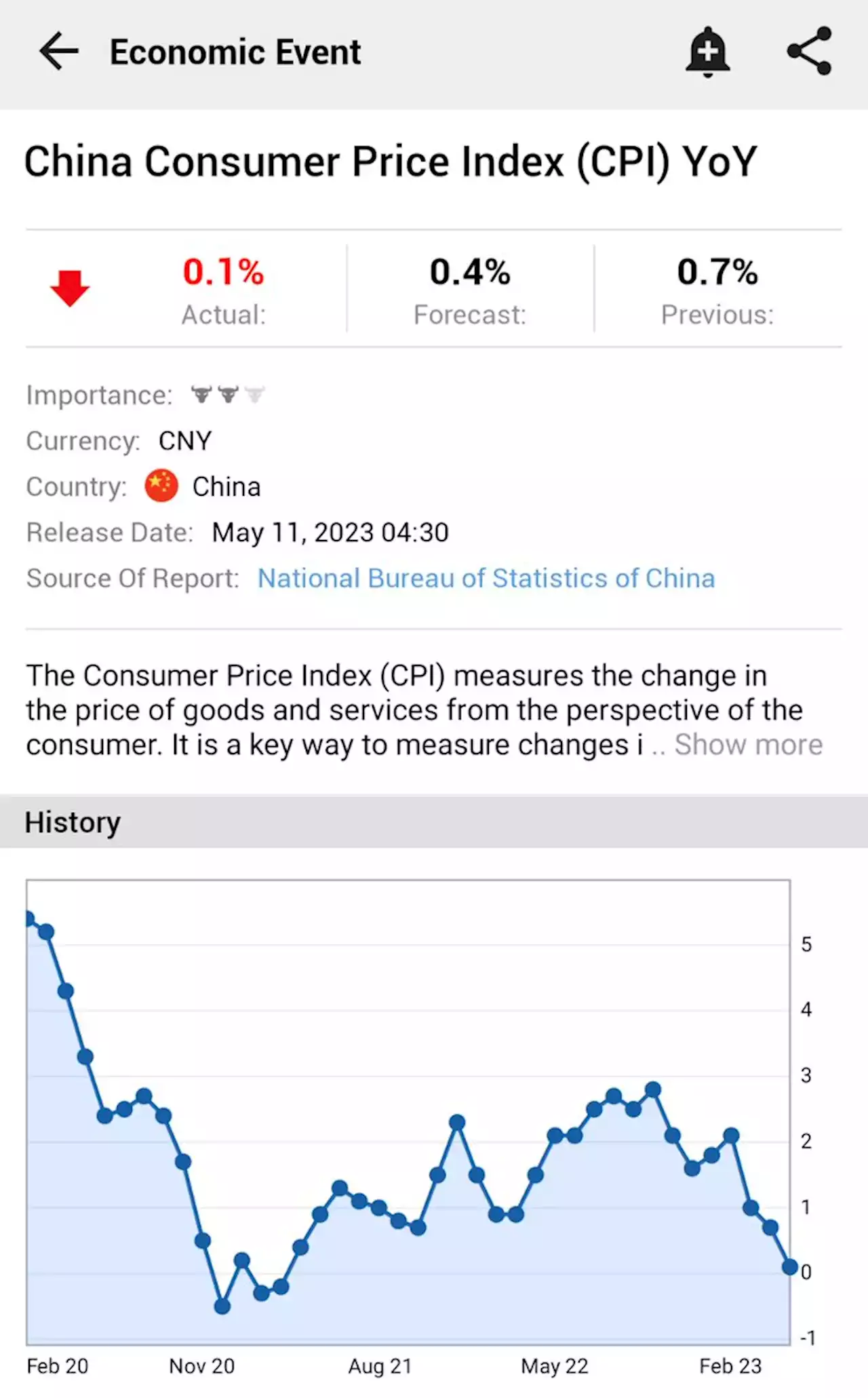

China Consumer Price Index (CPI) YoY⚠️BREAKING: *CHINA APRIL CPI INFLATION RISES 0.1% Y/Y; EST. 0.4%; PREV. 0.7% *LOWEST ANNUAL INCREASE SINCE FEBRUARY 2021 🇨🇳🇨🇳

China Consumer Price Index (CPI) YoY⚠️BREAKING: *CHINA APRIL CPI INFLATION RISES 0.1% Y/Y; EST. 0.4%; PREV. 0.7% *LOWEST ANNUAL INCREASE SINCE FEBRUARY 2021 🇨🇳🇨🇳

Read more »