The Conference Board's Consumer Confidence Index fell in January, driven by anxieties about the labor market. Despite strong current economic conditions, consumers are pessimistic about the future, particularly regarding job security and potential unemployment. While the index remains above pre-pandemic levels, the decline indicates a shift in sentiment. The Conference Board found that inflation expectations are also ticking up.

The Conference Board published itsThe index fell over five points from December, which itself fell several points from November.

The index, which got as high as 137.9 in the last decade, got as low as around 86 early in the pandemic.The Conference Board Senior Economist Stephanie Guichard said that’s mostly good.And Americans have proven they’re willing to spend at this level of consumer confidence.So, why did consumer optimism decline this month?

Small business owners have been feeling pretty good since Donald Trump and congressional Republicans won big on Election Day. And Wade said small business owners expect a “lessening the regulatory threat that they've endured.”

CONSUMERCONFIDENCE LABOR MARKET ECONOMY INFLATION SURVEY

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

British Retailers Face Grim Outlook as Taxes Bite and Consumer Confidence WanesChristmas sales disappointed British retailers, with the crucial 'golden quarter' failing to deliver the expected boost. The new year brings little cheer, as businesses brace for a surge in taxes and cautious consumers tighten their purse strings.

British Retailers Face Grim Outlook as Taxes Bite and Consumer Confidence WanesChristmas sales disappointed British retailers, with the crucial 'golden quarter' failing to deliver the expected boost. The new year brings little cheer, as businesses brace for a surge in taxes and cautious consumers tighten their purse strings.

Read more »

US Consumer Confidence Dips for Second MonthThe Conference Board reported that its consumer confidence index fell to 104.1 in January from 109.5 in December, signaling potential economic concerns. Although consumers remain confident about the future, their view of current economic conditions worsened due to higher borrowing costs.

US Consumer Confidence Dips for Second MonthThe Conference Board reported that its consumer confidence index fell to 104.1 in January from 109.5 in December, signaling potential economic concerns. Although consumers remain confident about the future, their view of current economic conditions worsened due to higher borrowing costs.

Read more »

Inflation Eases but Remains StickyConsumer confidence about inflation is shifting despite recent price increases

Inflation Eases but Remains StickyConsumer confidence about inflation is shifting despite recent price increases

Read more »

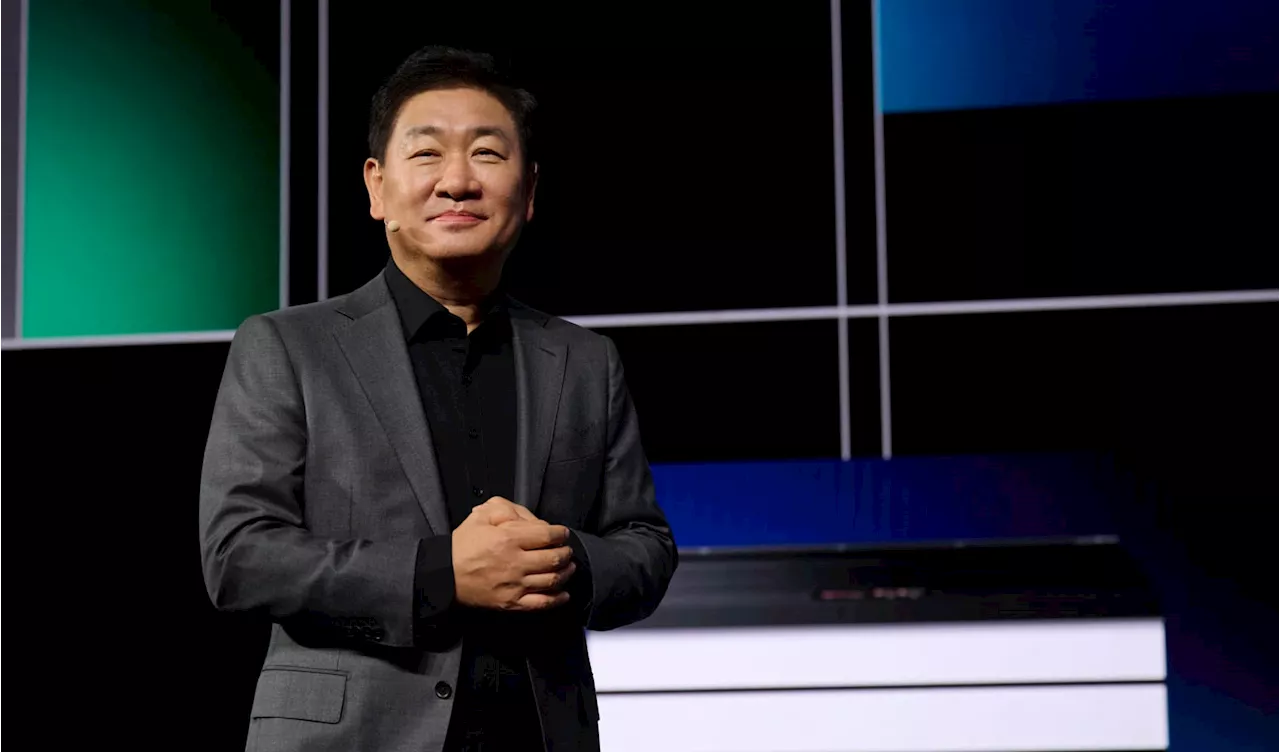

Samsung Bets on AI to Drive Consumer Electronics GrowthSamsung Electronics plans to prioritize on-device AI to fuel growth in its consumer electronics division, anticipating market expansion exceeding the global average. The company projects 4-5% growth for its mobile devices business this year, while TV and home appliance units are expected to accelerate.

Samsung Bets on AI to Drive Consumer Electronics GrowthSamsung Electronics plans to prioritize on-device AI to fuel growth in its consumer electronics division, anticipating market expansion exceeding the global average. The company projects 4-5% growth for its mobile devices business this year, while TV and home appliance units are expected to accelerate.

Read more »

New Federal Rule Could Eliminate Medical Debt from Credit ReportsA new federal rule announced by the Consumer Financial Protection Bureau (CFPB) aims to remove medical debt from credit reports, potentially boosting credit scores and increasing mortgage approval rates. The rule, which takes effect in 60 days, is welcomed by consumer advocates who argue that medical debt is not a reliable indicator of a consumer's ability to repay loans. However, the Consumer Data Industry Association (CDIA) representing credit reporting agencies, contends that the CFPB lacks legal authority to implement this change.

New Federal Rule Could Eliminate Medical Debt from Credit ReportsA new federal rule announced by the Consumer Financial Protection Bureau (CFPB) aims to remove medical debt from credit reports, potentially boosting credit scores and increasing mortgage approval rates. The rule, which takes effect in 60 days, is welcomed by consumer advocates who argue that medical debt is not a reliable indicator of a consumer's ability to repay loans. However, the Consumer Data Industry Association (CDIA) representing credit reporting agencies, contends that the CFPB lacks legal authority to implement this change.

Read more »

Equifax Settles CFPB Lawsuit Over Alleged Failure to Properly Investigate Consumer DisputesThe Consumer Financial Protection Bureau (CFPB) alleged that Equifax, one of the three major credit bureaus, failed to properly investigate consumer disputes, leading to inaccurate credit reports. The CFPB stated that Equifax ignored consumer documents and evidence, allowed previously deleted inaccuracies to be reinserted, provided confusing information, and used flawed software. Credit reports can significantly impact a consumer's ability to obtain loans, rent apartments, or secure employment. Equifax has settled the allegations and invested in technology and infrastructure improvements.

Equifax Settles CFPB Lawsuit Over Alleged Failure to Properly Investigate Consumer DisputesThe Consumer Financial Protection Bureau (CFPB) alleged that Equifax, one of the three major credit bureaus, failed to properly investigate consumer disputes, leading to inaccurate credit reports. The CFPB stated that Equifax ignored consumer documents and evidence, allowed previously deleted inaccuracies to be reinserted, provided confusing information, and used flawed software. Credit reports can significantly impact a consumer's ability to obtain loans, rent apartments, or secure employment. Equifax has settled the allegations and invested in technology and infrastructure improvements.

Read more »