Company director gets RM2.4 million penalty for failing to file tax returns

THE Johor Baru magistrates’ court today imposed a RM2.4 million penalty, in addition to a fine of RM18,000, on a recycling company director over her failure to file tax returns for the assessment years of 2021 and 2022 involving a taxable income of more than RM3.3 million.

Wong was charged under section 77A of the Income Tax Act 1967, which requires her to furnish a tax return in the prescribed form C for years of assessment 2021 to 2022 to the Inland Revenue Board director-general. Under section 112 of the Income Tax Act 1967, the offence was punishable by a fine not exceeding RM20,000 or imprisonment up to six months or both, in addition to a special penalty of triple the tax payable. She said her children were still in school, and her elderly mother and mother-in-law depended on her, adding that she had also paid taxes of RM120,000 for both 2021 and 2022.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Company owner fined RM200,000 for false claims | The Malaysian InsightMohd Azmi Mat Sah pleads guilty to alternative charge of using forged documents to claim Penjana Kerjaya incentives.

Company owner fined RM200,000 for false claims | The Malaysian InsightMohd Azmi Mat Sah pleads guilty to alternative charge of using forged documents to claim Penjana Kerjaya incentives.

Read more »

Didenda RM18,000, penalti lebih RM2.43 juta gagal kemuka borang cukaiDidenda RM18,000, penalti lebih RM2.43 juta gagal kemuka borang cukai BERITA Mahkamah NASIONAL

Didenda RM18,000, penalti lebih RM2.43 juta gagal kemuka borang cukaiDidenda RM18,000, penalti lebih RM2.43 juta gagal kemuka borang cukai BERITA Mahkamah NASIONAL

Read more »

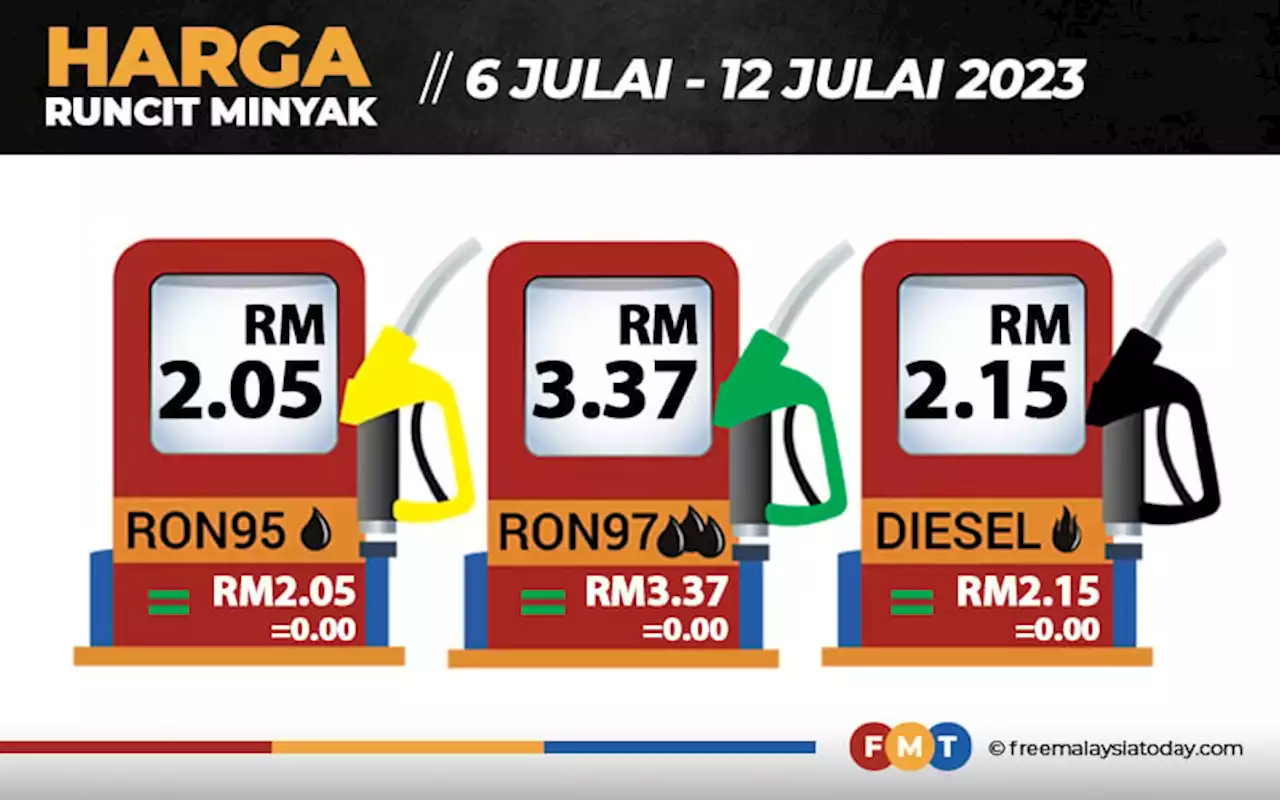

Harga petrol, diesel kekalHarga RON97 kekal pada RM3.37, manakala RON95 dan diesel pula masing-masing RM2.05 serta RM2.15 seliter.

Harga petrol, diesel kekalHarga RON97 kekal pada RM3.37, manakala RON95 dan diesel pula masing-masing RM2.05 serta RM2.15 seliter.

Read more »

Harga petrol, diesel kekal | The Malaysian InsightRON97 kekal pada RM3.37 seliter, manakala RON95 (RM2.05) dan diesel (RM2.15) sehingga 12 Julai, kata Kementerian Kewangan.

Harga petrol, diesel kekal | The Malaysian InsightRON97 kekal pada RM3.37 seliter, manakala RON95 (RM2.05) dan diesel (RM2.15) sehingga 12 Julai, kata Kementerian Kewangan.

Read more »

Penjana Kerjaya: Company owner fined RM200k for using forged documentsCourt orders accused to serve 12 months jail if he fails to pay fine.

Penjana Kerjaya: Company owner fined RM200k for using forged documentsCourt orders accused to serve 12 months jail if he fails to pay fine.

Read more »