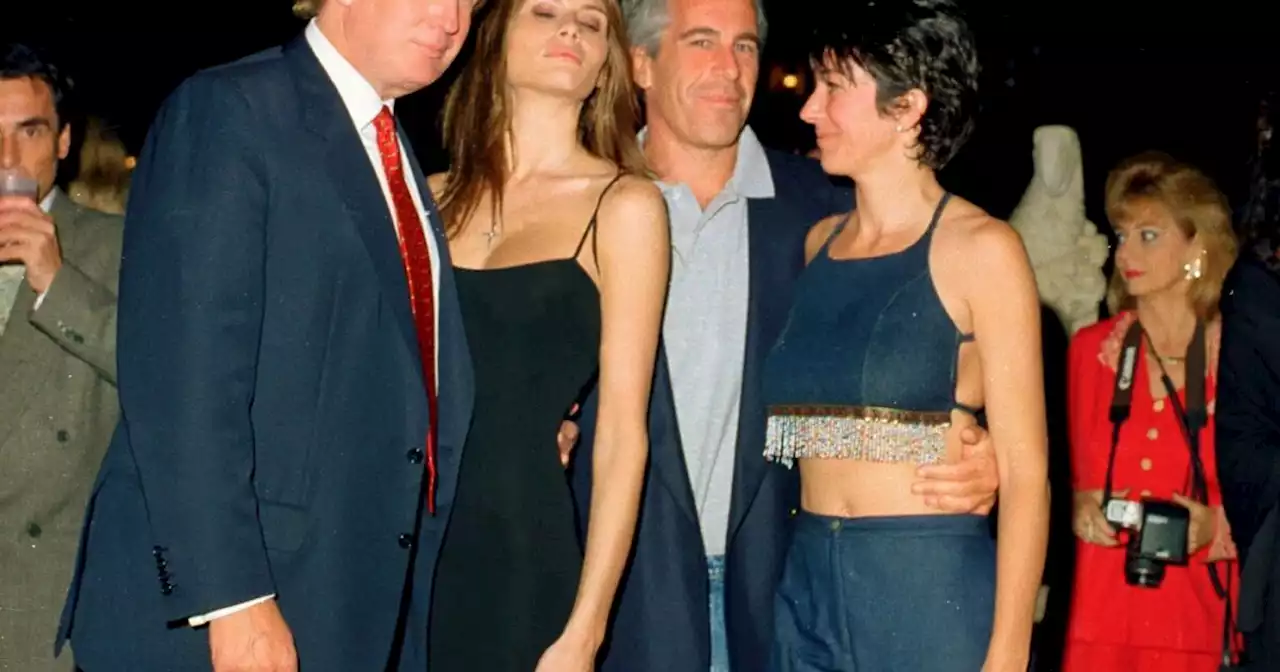

JPMorgan Chase made millions by keeping Jeffrey Epstein as a banking client. Now it faces a reckoning in federal court.

You might think that the chairman and CEO of a major bank that had just pleaded guilty to a federal felony charge and has paid out more than $20 billion in legal settlements in recent years would show a little humility.JPMorgan’s $290-million settlement and a separate $75-million agreement by Deutsche Bank will close the victims’ cases, assuming Rakoff approves them, leaving the Virgin Islands case to be litigated. That trial is currently scheduled to begin next month.

JPMorgan’s defense has been a distant cousin to a “guilty with an explanation” plea. It’s more like: “Here’s an explanation for why we’re not guilty.” The crux of its argument is that the wrongdoing was perpetrated by one individual. That’s James E. “Jes” Staley, who in a 33-year career with the bank rose to become CEO of its corporate and investment banking unit and an oft-mentioned successor to Chairman and CEO Jamie Dimon.

Their conclusion resembles JPMorgan’s argument. The bank says that Staley never told anyone there “that he had witnessed, was aware of, or participated in” Epstein’s sex trafficking. If there’s a better indication that corporate codes of conduct are designed more to shield corporations from legal liability than to hold their employees to the highest ethical standards, I can’t imagine it.Let’s get a few points straight regarding the federal government’s “big” $2-billion-plus settlement with JPMorgan Chase over the bank’s complicity in the Madoff case.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Column: Theo Epstein's baseball tree continues to growFormer Chicago Cubs President Theo Epstein's tree continues to grow with the hiring of Jeff Greenberg as Detroit Tigers general manager.

Column: Theo Epstein's baseball tree continues to growFormer Chicago Cubs President Theo Epstein's tree continues to grow with the hiring of Jeff Greenberg as Detroit Tigers general manager.

Read more »

No volatility jump in Indian bonds after JPMorgan inclusion, says BlackRockIndian bond markets won't see a jump in volatility in the near-term after JPMorgan announced India's inclusion in its widely tracked emerging market debt index, BlackRock's head of Asia Pacific fixed income said on Friday.

No volatility jump in Indian bonds after JPMorgan inclusion, says BlackRockIndian bond markets won't see a jump in volatility in the near-term after JPMorgan announced India's inclusion in its widely tracked emerging market debt index, BlackRock's head of Asia Pacific fixed income said on Friday.

Read more »

JPMorgan upgrades this sports betting stock that can rally 35%The bank upgraded the stock to overweight from neutral.

JPMorgan upgrades this sports betting stock that can rally 35%The bank upgraded the stock to overweight from neutral.

Read more »

World May Not Be Ready for U.S. Interest Rate at 7%, JPMorgan CEO SaysU.S. rates at 7% could push the U.S. economy into a recession, triggering risk aversion in financial markets.

World May Not Be Ready for U.S. Interest Rate at 7%, JPMorgan CEO SaysU.S. rates at 7% could push the U.S. economy into a recession, triggering risk aversion in financial markets.

Read more »

JPMorgan says buy the dip on this chemical giant trading at a 'reasonable valuation'The firm upgraded Dow to overweight from neutral and maintained its price target of $55.

JPMorgan says buy the dip on this chemical giant trading at a 'reasonable valuation'The firm upgraded Dow to overweight from neutral and maintained its price target of $55.

Read more »