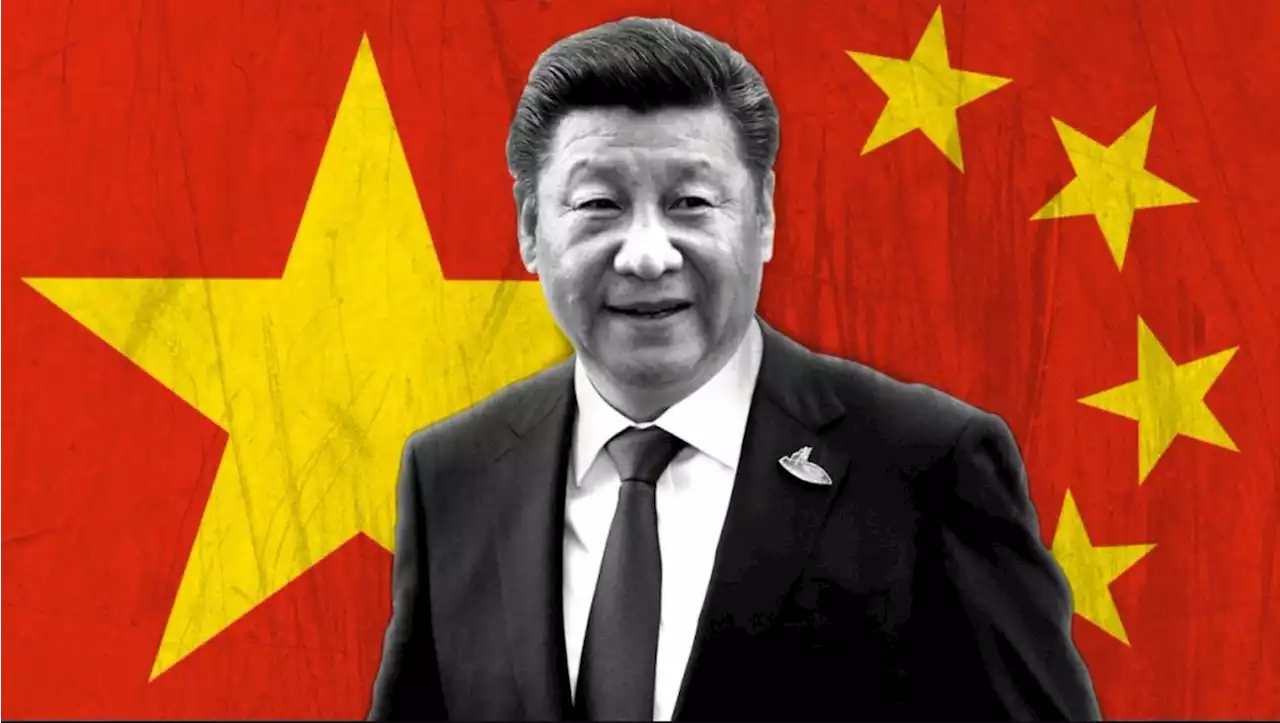

⚠️BREAKING: *CHINA DEFLATION FEARS MOUNT AFTER FIRST NEGATIVE CPI PRINT IN YEARS 🇨🇳🇨🇳

inflation fell 0.3% in the 12 months to July, slightly better than expectations for a drop of 0.4%, data from the National Bureau of Statistics showed on Wednesday. This came after a flat reading for June, and marks the first annual contraction in CPI since September 2021.

It also indicates that the world’s second-largest economy showed little signs of improvement after a dismal second quarter. A bulk of this weakness stems from a slowdown in China’s manufacturing sector, with a continued contraction inPPI inflation shrank 4.4% in July, more than expectations for a drop of 4.1%. While the reading did show some improvement from the 5.4% decline in June, it still remained close to its worst levels since the yuan crisis of 2016.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

China's CPI Inflation Falls to -0.3% YoY in JulyChina's annual Consumer Price Index (CPI) dropped by 0.3% in July, lower than the expected -0.4%. The data release had no significant impact on the market.

China's CPI Inflation Falls to -0.3% YoY in JulyChina's annual Consumer Price Index (CPI) dropped by 0.3% in July, lower than the expected -0.4%. The data release had no significant impact on the market.

Read more »

CPI Preview: Bitcoin Unlikely to Get Bullish Catalyst From July Inflation DataBitcoin bulls are not likely to find a positive catalyst from the July Consumer Price Index report, as economists expect a 0.2% increase on a monthly basis, the same as June. Year-over-year growth is forecast at 3.3%, up from 3% in June. Markets have already priced in rate cuts for 2024, and the Fed is not expected to make any more rate hikes this year.

CPI Preview: Bitcoin Unlikely to Get Bullish Catalyst From July Inflation DataBitcoin bulls are not likely to find a positive catalyst from the July Consumer Price Index report, as economists expect a 0.2% increase on a monthly basis, the same as June. Year-over-year growth is forecast at 3.3%, up from 3% in June. Markets have already priced in rate cuts for 2024, and the Fed is not expected to make any more rate hikes this year.

Read more »

Asian Stock Market: Trades mixed, investors await Chinese/ Indian CPI dataAsian stock markets trade mixed on Monday following mixed US employment data. That said, the Nonfarm Payrolls in the US rose 187,000 in July, worse th

Asian Stock Market: Trades mixed, investors await Chinese/ Indian CPI dataAsian stock markets trade mixed on Monday following mixed US employment data. That said, the Nonfarm Payrolls in the US rose 187,000 in July, worse th

Read more »

Chinese exports, imports shrink more than expected in JulyChinese exports and imports in July were lower than anticipated, indicating a slowdown in the country's economy. This decline in trade activity could be attributed to the ongoing trade tensions between China and the United States.

Chinese exports, imports shrink more than expected in JulyChinese exports and imports in July were lower than anticipated, indicating a slowdown in the country's economy. This decline in trade activity could be attributed to the ongoing trade tensions between China and the United States.

Read more »

AUD/USD fades corrective bounce near 0.6550 as China inflation flags mixed signalsAUD/USD remains sidelined near the intraday high surrounding 0.6550 as China inflation data flashes mixed signals during early Wednesday. In doing so, AUD/USD defends corrective bounce off two-month low after China data turns down deflation woes. China CPI slumps to -0.3% YoY, PPI improves to -4.4% YoY for July. Biden Administration’s relief to China AI companies, market’s consolidation after heavy risk aversion also favor Aussie buyers. Risk catalysts eyed ahead of Thursday’s Australia Consumer Inflation Expectations, US CPI.

AUD/USD fades corrective bounce near 0.6550 as China inflation flags mixed signalsAUD/USD remains sidelined near the intraday high surrounding 0.6550 as China inflation data flashes mixed signals during early Wednesday. In doing so, AUD/USD defends corrective bounce off two-month low after China data turns down deflation woes. China CPI slumps to -0.3% YoY, PPI improves to -4.4% YoY for July. Biden Administration’s relief to China AI companies, market’s consolidation after heavy risk aversion also favor Aussie buyers. Risk catalysts eyed ahead of Thursday’s Australia Consumer Inflation Expectations, US CPI.

Read more »

AUD/USD corrects to near two-month low around 0.6500 ahead of US/China CPI dataThe AUD/USD pair witnesses a sharp correction amid strength in the US Dollar Index (DXY) and a weakness in China’s business with other nations. The AUD/USD cracks swiftly to near a two-month low around 0.6500 amid strength in the US Dollar and China’s bleak economic growth. US annualized headline inflation is expected to bounce back to 3.3% vs. the former release of 3.0%. The Chinese economy struggles to push inflation higher due to weak domestic demand and vulnerable exports.

AUD/USD corrects to near two-month low around 0.6500 ahead of US/China CPI dataThe AUD/USD pair witnesses a sharp correction amid strength in the US Dollar Index (DXY) and a weakness in China’s business with other nations. The AUD/USD cracks swiftly to near a two-month low around 0.6500 amid strength in the US Dollar and China’s bleak economic growth. US annualized headline inflation is expected to bounce back to 3.3% vs. the former release of 3.0%. The Chinese economy struggles to push inflation higher due to weak domestic demand and vulnerable exports.

Read more »