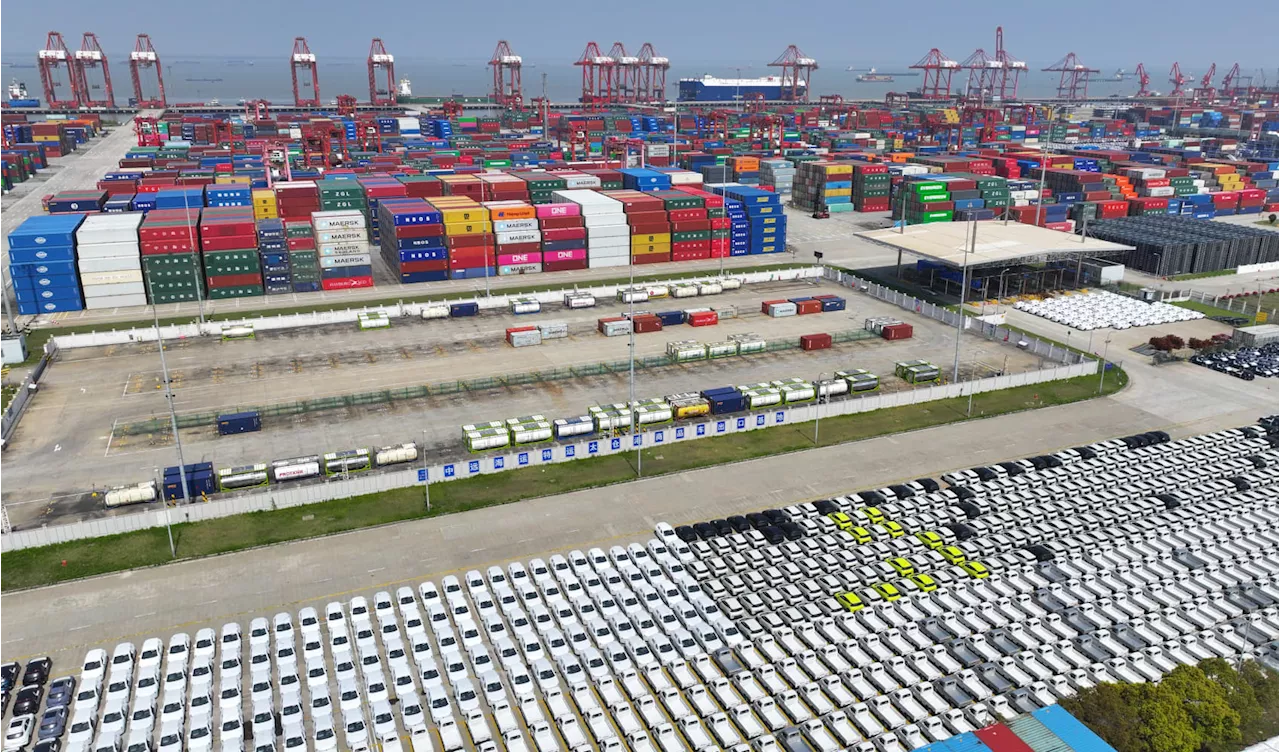

China's first-quarter gross domestic product numbers will be in focus, with the world's second-largest economy expected to grow 4.6% from a year ago. Nikkei 225 plunged 1.5% at the open, while the broad-based Topix was down 1.04%. Overnight the yen crossed 154 against the U.S. dollar, its weakest level since June 1990. Stocks retreated on Monday as rising yields and worries over the conflict in the Middle East overshadowed strong Goldman Sachs earnings. The yield on the 10-year Treasury rose above the key 4.6% level in the session, reaching its highest point since mid-November. The yen has been firmly beyond the 150 mark since the Bank of Japan raised interest rates on March 19, with Japanese officials repeatedly saying that "all options are on the table" to counter excessive yen moves.

On Tuesday, China 's first-quarter gross domestic product numbers will be in focus, with the world's second-largest economy expected to grow 4.6% from a year ago. Nikkei 225

Overnight in the U.S., stocks retreated on Monday as rising yields and worries over the conflict in the Middle East overshadowed strong Goldman Sachs earnings andalso poured cold water on the market bounce, with the yield on the 10-year Treasury rising above the key 4.6% level in the session and reaching its highest point since mid-November.

CNBC Pro: These 10 oil stocks are the most — and least — sensitive to price swings amid Iran-Israel tensionsCNBC Pro screened for stocks in the MSCI World Energy Index that are both highly correlated and inversely correlated with international benchmark Brent crude oil prices over the past week, month, and year.Asian markets have had a mixed start to the year — with investors looking keenly at India, Japan and increasingly China.

"What is not priced into the current market, in our view, is a potential continuation of a direct conflict between Iran and Israel," Maximilian Layton, head of commodities research at Citi, told clients in a note. Oil prices could spike above $100 a barrel depending on how Israel responds to the attack, the analyst wrote.Nasdaq Composite

China GDP Growth Nikkei 225 Topix Yen U.S. Dollar Stocks Yields Middle East Goldman Sachs Treasury Bank Of Japan

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

A strong quarter for Wall Street lifts Goldman's first-quarter resultsGoldman Sachs said Monday it saw a double-digit rise in its first-quarter profits, lifted broadly by the stock and bond markets’ performances in the first months of the year. The New York-based investment bank posted net income of $4.13 billion, up 28% from a year earlier. The company earned $11.

A strong quarter for Wall Street lifts Goldman's first-quarter resultsGoldman Sachs said Monday it saw a double-digit rise in its first-quarter profits, lifted broadly by the stock and bond markets’ performances in the first months of the year. The New York-based investment bank posted net income of $4.13 billion, up 28% from a year earlier. The company earned $11.

Read more »

Asia markets mixed ahead of China trade data; Singapore first-quarter GDP climbs 2.7%Investors will be keeping an eye on China’s trade figures, as well as Singapore’s GDP numbers, which could see the impact of…

Asia markets mixed ahead of China trade data; Singapore first-quarter GDP climbs 2.7%Investors will be keeping an eye on China’s trade figures, as well as Singapore’s GDP numbers, which could see the impact of…

Read more »

China natural disasters cost $3.3 billion in first quarter, government saysChina natural disasters cost $3.3 billion in first quarter, government says

China natural disasters cost $3.3 billion in first quarter, government saysChina natural disasters cost $3.3 billion in first quarter, government says

Read more »

China's first-quarter GDP expected to grow 4.6%China's first-quarter gross domestic product numbers will be in focus, with the world's second-largest economy expected to grow 4.6% from a year ago.

China's first-quarter GDP expected to grow 4.6%China's first-quarter gross domestic product numbers will be in focus, with the world's second-largest economy expected to grow 4.6% from a year ago.

Read more »

Investors Brace for Volatility After Strong First QuarterCFRA's Sam Stovall warns investors to prepare for a potentially tumultuous year following a strong first quarter. Despite the S & P 500's best first quarter performance since 2019, the second quarter began with a decline as fears of delayed Federal Reserve rate cuts caused market volatility. Stovall suggests that while historically a strong first quarter leads to a good second quarter, it could also make equities more susceptible to significant setbacks.

Investors Brace for Volatility After Strong First QuarterCFRA's Sam Stovall warns investors to prepare for a potentially tumultuous year following a strong first quarter. Despite the S & P 500's best first quarter performance since 2019, the second quarter began with a decline as fears of delayed Federal Reserve rate cuts caused market volatility. Stovall suggests that while historically a strong first quarter leads to a good second quarter, it could also make equities more susceptible to significant setbacks.

Read more »

Despite AI startup hype, U.S. venture deals slumped to lowest level since 2017 in first quarterPitchBook’s first-quarter report shows that venture activity got off to a slow start this year as investors remain cautious on early-stage tech.

Despite AI startup hype, U.S. venture deals slumped to lowest level since 2017 in first quarterPitchBook’s first-quarter report shows that venture activity got off to a slow start this year as investors remain cautious on early-stage tech.

Read more »