Chinese commercial banks are increasingly buying government bonds as Beijing's stimulus efforts haven't been successful in boosting consumer or business loan demand. New yuan loans have dropped over 20% in the first 11 months of 2024, leading to a rally in Chinese sovereign bonds with yields hitting all-time lows. This trend is driven by economic uncertainty, muted investment, and cautious spending by consumers and businesses.

Chinese commercial banks have flocked to buying government bonds as Beijing's stimulus push has failed to spur consumers loan demand.

"The lack of strong consumer and business loan demand has led the capital flows into the sovereign bonds market," said Edmund Goh, investment director of fixed income at abrdn in Singapore. For this year, authorities have vowed to make boosting consumption a top priority and to revive credit demand with lower corporate financing and household borrowing costs.

The widening yield differentials between Chinese and U.S. sovereign bonds could risk encouraging capital outflows and put further pressure on the yuan that has been weakening against the greenback.

CHINA ECONOMY LOANS GOVERNMENT BONDS STIMULUS INVESTMENT YIELD CONSUMER SPENDING

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Chinese Banks Flock to Government Bonds as Stimulus Fails to Spark Loan DemandDespite Beijing's economic stimulus efforts, consumer and business loan demand in China remains weak. This has led to a surge in Chinese banks buying government bonds, which have seen yields plunge to record lows. Economists attribute the lack of loan demand to pessimism about the Chinese economy and a shortage of investable assets. While the government is trying to stimulate credit demand and support economic growth, uncertainty about the effectiveness of its policies and external factors like rising tariffs are weighing on investor sentiment.

Chinese Banks Flock to Government Bonds as Stimulus Fails to Spark Loan DemandDespite Beijing's economic stimulus efforts, consumer and business loan demand in China remains weak. This has led to a surge in Chinese banks buying government bonds, which have seen yields plunge to record lows. Economists attribute the lack of loan demand to pessimism about the Chinese economy and a shortage of investable assets. While the government is trying to stimulate credit demand and support economic growth, uncertainty about the effectiveness of its policies and external factors like rising tariffs are weighing on investor sentiment.

Read more »

FLock.io Launches Mainnet on Base, Announces FLOCK Token Generation EventFLock.io, a private AI training platform, has officially launched its mainnet on Base. This launch coincides with the Token Generation Event (TGE) for its native token, FLOCK, which will incentivize and reward community participation in the FLock ecosystem. Users can earn FLOCK by engaging in decentralized AI training through the platform, accessible via FLock.io. These tokens will facilitate collaboration among data providers, training nodes, and compute providers within the ecosystem.

FLock.io Launches Mainnet on Base, Announces FLOCK Token Generation EventFLock.io, a private AI training platform, has officially launched its mainnet on Base. This launch coincides with the Token Generation Event (TGE) for its native token, FLOCK, which will incentivize and reward community participation in the FLock ecosystem. Users can earn FLOCK by engaging in decentralized AI training through the platform, accessible via FLock.io. These tokens will facilitate collaboration among data providers, training nodes, and compute providers within the ecosystem.

Read more »

Banks Sued Over Zelle Fraud, Agency Alleges Banks Ignored Customer ComplaintsThe Consumer Financial Protection Bureau (CFPB) filed a lawsuit against Wells Fargo, JPMorgan Chase, Bank of America, and Early Warning Services (EWS), alleging that the banks failed to adequately protect customers from fraud on the Zelle peer-to-peer payments platform.

Banks Sued Over Zelle Fraud, Agency Alleges Banks Ignored Customer ComplaintsThe Consumer Financial Protection Bureau (CFPB) filed a lawsuit against Wells Fargo, JPMorgan Chase, Bank of America, and Early Warning Services (EWS), alleging that the banks failed to adequately protect customers from fraud on the Zelle peer-to-peer payments platform.

Read more »

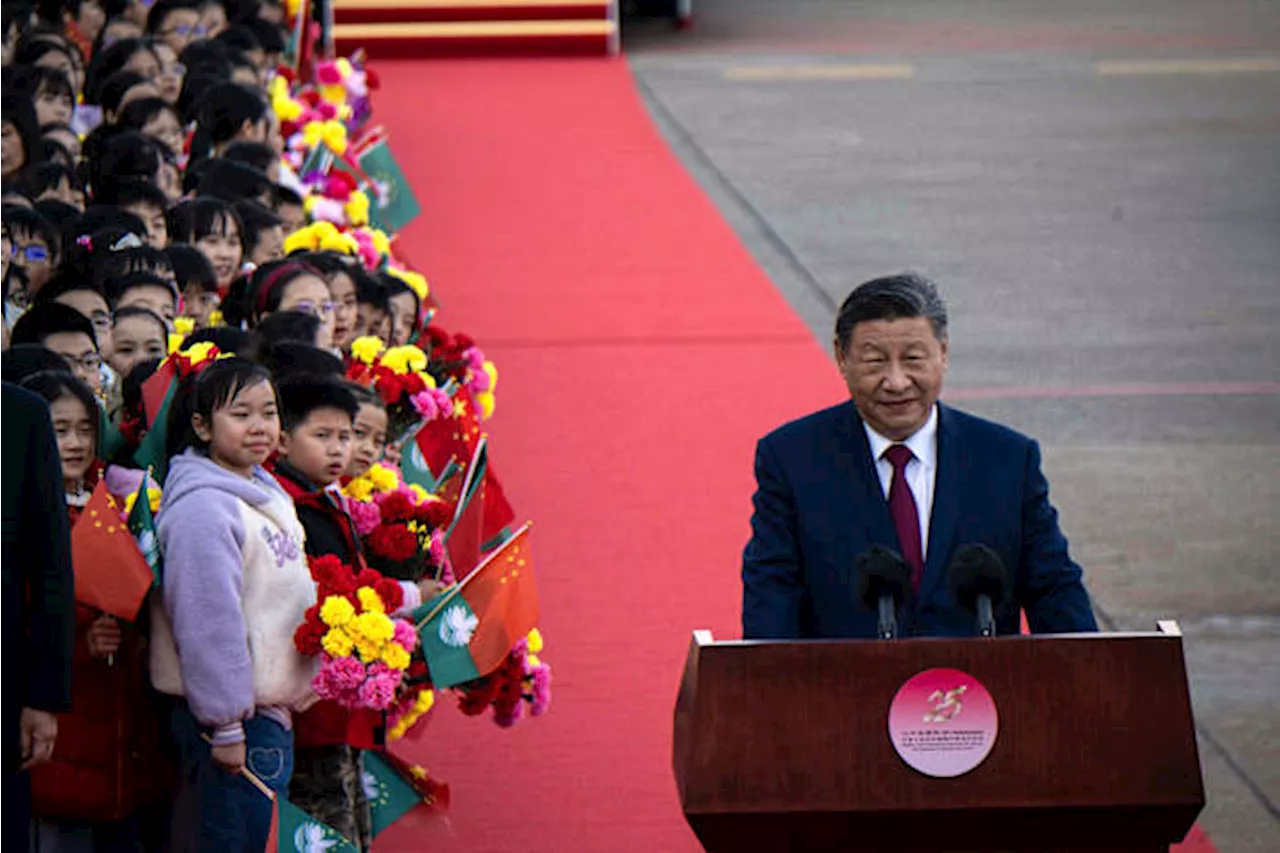

China's Xi Jinping Visits Macao for 25th Anniversary of Return to Chinese RuleChinese President Xi Jinping traveled to Macao to celebrate the 25th anniversary of its return to Chinese sovereignty. The city, known for its casinos, has undergone significant transformation since its handover.

China's Xi Jinping Visits Macao for 25th Anniversary of Return to Chinese RuleChinese President Xi Jinping traveled to Macao to celebrate the 25th anniversary of its return to Chinese sovereignty. The city, known for its casinos, has undergone significant transformation since its handover.

Read more »

Apple Offers Discounts on iPhones in China Ahead of Chinese New YearApple is offering discounts on its iPhone 16 series and other products in China for the upcoming Chinese New Year. This move comes as the tech giant faces increased competition from domestic brands like Huawei. While Apple previously resisted offering discounts through its own channels, it has become more willing to do so in recent times, particularly during seasonal events.

Apple Offers Discounts on iPhones in China Ahead of Chinese New YearApple is offering discounts on its iPhone 16 series and other products in China for the upcoming Chinese New Year. This move comes as the tech giant faces increased competition from domestic brands like Huawei. While Apple previously resisted offering discounts through its own channels, it has become more willing to do so in recent times, particularly during seasonal events.

Read more »

Air China Seen as Top Turnaround Pick for Chinese AirlinesAnalysts favor Air China as it recovers from pandemic struggles, driven by a strong global network and potential for domestic and international travel growth.

Air China Seen as Top Turnaround Pick for Chinese AirlinesAnalysts favor Air China as it recovers from pandemic struggles, driven by a strong global network and potential for domestic and international travel growth.

Read more »