The most popular apps covered by the rule collectively process more than 13 billion consumer payments a year, the CFPB said.

The Consumer Financial Protection Bureau on Thursday issued a finalized version of a rule saying it will soon supervise nonbank firms that offer financial services likes payments and wallet apps.

While the CFPB already had some authority over digital payment companies because of its oversight of electronic fund transfers, the new rule allows it to conduct"proactive examinations" to ensure legal compliance, enabling it to demand records and interview employees.it wanted to extend its oversight to tech and fintech companies that offer financial services but that have sidestepped more scrutiny by partnering with banks.

The most popular apps covered by the rule collectively process more than 13 billion consumer payments a year, and have gained"particularly strong adoption" among low- and middle-income users, the CFPB said on Thursday."What began as a convenient alternative to cash has evolved into a critical financial tool, processing over a trillion dollars in payments between consumers and their friends, families, and businesses," the regulator said.

The initial proposal would've subjected companies that process at least 5 million transactions annually to some of the same examinations that the CFPB conducts on banks and credit unions. That threshold got raised to 50 million transactions in the final rule, the agency said Thursday. The new CFPB rule is one of the rare instances where the U.S. banking industry publicly supported the regulator's actions; banks have long felt that tech firms making inroads in financial services ought to be more scrutinized.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

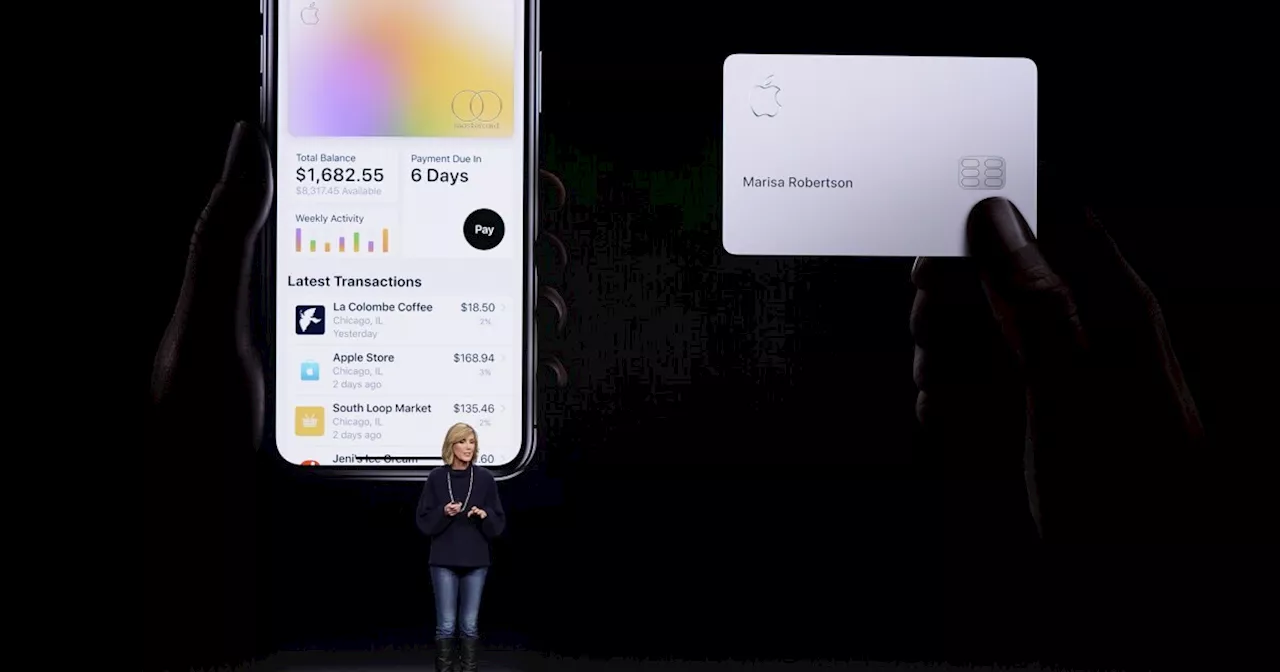

Apple and Goldman Sachs must pay $89 million for mishandling Apple Card transactions, CFPB ordersNEW YORK (AP) — A federal regulator on Wednesday ordered Apple and Goldman Sachs to pay a combined $89 million for deceiving consumers and mishandled

Apple and Goldman Sachs must pay $89 million for mishandling Apple Card transactions, CFPB ordersNEW YORK (AP) — A federal regulator on Wednesday ordered Apple and Goldman Sachs to pay a combined $89 million for deceiving consumers and mishandled

Read more »

Apple and Goldman Sachs must pay $89 million for mishandling Apple Card transactions, CFPB ordersA federal regulator has ordered Apple and Goldman Sachs to pay a combined $89 million for deceiving consumers and mishandled Apple Card customers' transaction.

Apple and Goldman Sachs must pay $89 million for mishandling Apple Card transactions, CFPB ordersA federal regulator has ordered Apple and Goldman Sachs to pay a combined $89 million for deceiving consumers and mishandled Apple Card customers' transaction.

Read more »

Apple and Goldman Sachs must pay $89 million for mishandling Apple Card transactions, CFPB ordersA federal regulator has ordered Apple and Goldman Sachs to pay a combined $89 million for deceiving consumers and mishandled Apple Card customers' transaction.

Apple and Goldman Sachs must pay $89 million for mishandling Apple Card transactions, CFPB ordersA federal regulator has ordered Apple and Goldman Sachs to pay a combined $89 million for deceiving consumers and mishandled Apple Card customers' transaction.

Read more »

Apple and Goldman Sachs must pay $89 million for mishandling Apple Card transactions, CFPB ordersA federal regulator has ordered Apple and Goldman Sachs to pay a combined $89 million for deceiving consumers and mishandled Apple Card customers' transaction.

Apple and Goldman Sachs must pay $89 million for mishandling Apple Card transactions, CFPB ordersA federal regulator has ordered Apple and Goldman Sachs to pay a combined $89 million for deceiving consumers and mishandled Apple Card customers' transaction.

Read more »

Apple and Goldman Sachs ordered to pay over $89 million for Apple card failuresApple and Goldman Sachs were fined more than $89 million for mishandling consumer disputes of Apple Card transactions, the CFPB said.

Apple and Goldman Sachs ordered to pay over $89 million for Apple card failuresApple and Goldman Sachs were fined more than $89 million for mishandling consumer disputes of Apple Card transactions, the CFPB said.

Read more »

Apple and Goldman Sachs ordered to pay $89M over Apple Card failuresApple and Goldman Sachs are being ordered by the CFPB to pay a combined $89 million in fines stemming from customer service issues with the Apple Card and regulatory violations.

Apple and Goldman Sachs ordered to pay $89M over Apple Card failuresApple and Goldman Sachs are being ordered by the CFPB to pay a combined $89 million in fines stemming from customer service issues with the Apple Card and regulatory violations.

Read more »