CalPERS should prioritize proven, effective strategies that cost less and consistently deliver better returns for taxpayers and public employees.

The suns peaks over the California Public Employees Retirement System’s building in Sacramento, Calif., Tuesday, Sept. 6, 2022. The California Public Employees’ Retirement System has $180 billion in unfunded liabilities as of its latest report. To try to reduce this debt, the nation’s largest pension system recently approved a plan to increase investment in private markets, doubling down on a strategy that has yet to deliver results and carries significant risks for taxpayers.

Private investments are often pitched as a way to generate returns higher than the public market and diversify portfolios. However, these promises frequently fall short when risks, fees, and market realities are accounted for. As is typical for pension investment portfolios, private equity on paper has been CalPERS’ highest-performing asset class, with a 20-year annualized return of 12.3%.

When CalPERS fails to meet its expected investment returns, California’s state and local governments—meaning taxpayers—are solely responsible for covering the resulting shortfall. Public pension liabilities are legally binding. There is no defaulting on them. Consequently, when public pension system investments underperform, government employers—again, taxpayers—must cover the gap.

But there could be a better way. Since 2000, CalPERS achieved a 23-year average return of 5.6%. Meanwhile, the Public Employees’ Retirement System of Nevada, a $58 billion fund, earned a 6.9% return during that time—while taking on less risk than CalPERS. Nevada PERS achieved such returns with just three employees managing the fund, limiting costs, and increasing long-term returns by investing almost exclusively in publicly traded index funds.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

CalPERS Doubles Down on Risky Private Investments Despite Years of UnderperformanceCalPERS, the nation’s largest pension system, faces $180 billion in unfunded liabilities and is increasing its investments in private markets, a strategy that has yet to deliver results and carries significant risks for taxpayers.

CalPERS Doubles Down on Risky Private Investments Despite Years of UnderperformanceCalPERS, the nation’s largest pension system, faces $180 billion in unfunded liabilities and is increasing its investments in private markets, a strategy that has yet to deliver results and carries significant risks for taxpayers.

Read more »

Tomley scores 21 as Weber State takes down Utah Tech 73-71Led by Miguel Tomley's 21 points, the Weber State Wildcats defeated the Utah Tech Trailblazers 73-71

Tomley scores 21 as Weber State takes down Utah Tech 73-71Led by Miguel Tomley's 21 points, the Weber State Wildcats defeated the Utah Tech Trailblazers 73-71

Read more »

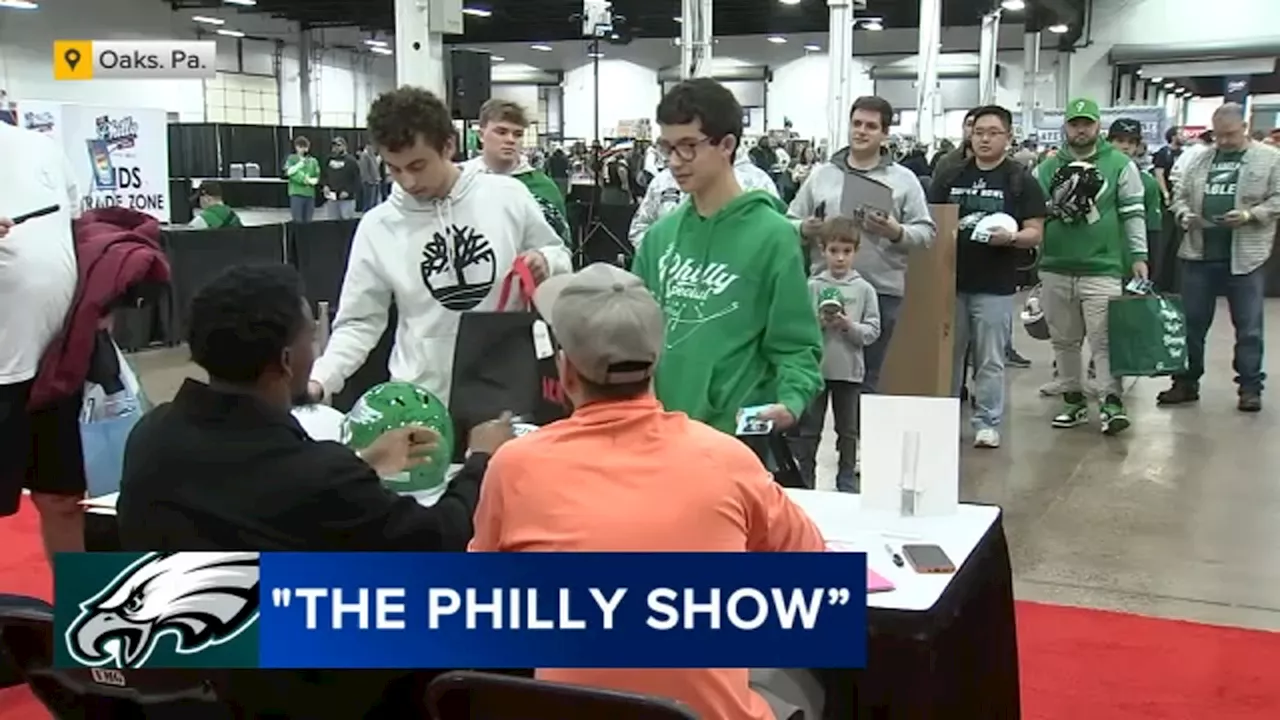

'Philly Show' takes over the Expo Center in Oaks; Eagles fans looking ahead to Steelers matchupFans came out to the 'Philly Show' on Friday to see some of their favorite Philadelphia icons. It was a night they'll never forget.

'Philly Show' takes over the Expo Center in Oaks; Eagles fans looking ahead to Steelers matchupFans came out to the 'Philly Show' on Friday to see some of their favorite Philadelphia icons. It was a night they'll never forget.

Read more »

Mystics co-owner takes exception with Caitlin Clark's Time magazine cover: 'Can foster resentment'Sheila Johnson has her own idea for Time magazine.

Mystics co-owner takes exception with Caitlin Clark's Time magazine cover: 'Can foster resentment'Sheila Johnson has her own idea for Time magazine.

Read more »

Orlando takes on New York, looks for 11th straight home winOrlando aims to continue its 10-game home win streak with a victory over New York. Sunday's matchup is the first this season between the two teams. Orlando is 13-6 against the Eastern Conference, and New York is 12-7 against conference opponents.

Orlando takes on New York, looks for 11th straight home winOrlando aims to continue its 10-game home win streak with a victory over New York. Sunday's matchup is the first this season between the two teams. Orlando is 13-6 against the Eastern Conference, and New York is 12-7 against conference opponents.

Read more »

Tomley scores 21 as Weber State takes down Utah Tech 73-71Led by Miguel Tomley's 21 points, the Weber State Wildcats defeated the Utah Tech Trailblazers 73-71

Tomley scores 21 as Weber State takes down Utah Tech 73-71Led by Miguel Tomley's 21 points, the Weber State Wildcats defeated the Utah Tech Trailblazers 73-71

Read more »