California’s unemployment insurance system is projected to have a $2 billion annual deficit over the next five years and an outstanding $20 billion federal loan balance, requiring a redesign according to a new report by the Legislative Analyst’s Office.

California ’s unemployment insurance financing system is facing big deficits, requiring a full "redesign," according to a new report from the state’s nonpartisan Legislative Analyst’s Office .The system, meant to be self-sufficient, has fallen short of covering annual benefit costs, resulting in a projected $2 billion annual deficit over the next five years and an outstanding $20 billion federal loan balance.

The report also recommends reworking how businesses are taxed for unemployment benefits to make the system simpler and encourage more hiring.To deal with the massive federal loan, the report suggests splitting the cost between employers and the state government, so that businesses aren’t stuck with all the debt."These are significant problems in isolation, let alone in combination," analysts wrote.

Unemployment Insurance California Deficit Redesign Legislative Analyst’S Office

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

California's Unemployment Insurance System Crashes Again During PandemicCalifornia's unemployment insurance system faced another collapse during the COVID-19 pandemic, similar to its failure during the Great Recession. The fund had no reserves to handle the surge in claims and borrowed $20 billion from the federal government, potentially facing increased payroll taxes as a result.

California's Unemployment Insurance System Crashes Again During PandemicCalifornia's unemployment insurance system faced another collapse during the COVID-19 pandemic, similar to its failure during the Great Recession. The fund had no reserves to handle the surge in claims and borrowed $20 billion from the federal government, potentially facing increased payroll taxes as a result.

Read more »

California insurance department accused of hiding information on life insurance complaintsThe Department of Insurance’s alleged stonewalling has gone on for months, the Bay Area-based group said

California insurance department accused of hiding information on life insurance complaintsThe Department of Insurance’s alleged stonewalling has gone on for months, the Bay Area-based group said

Read more »

California Insurance Commissioner takes step to increase insurance availability in wildfire-distressed areasThe new regulations aim to strengthen Proposition 103 by establishing unprecedented coverage commitments from insurance companies, aimed at stabilizing the insurance market and expanding options fo…

California Insurance Commissioner takes step to increase insurance availability in wildfire-distressed areasThe new regulations aim to strengthen Proposition 103 by establishing unprecedented coverage commitments from insurance companies, aimed at stabilizing the insurance market and expanding options fo…

Read more »

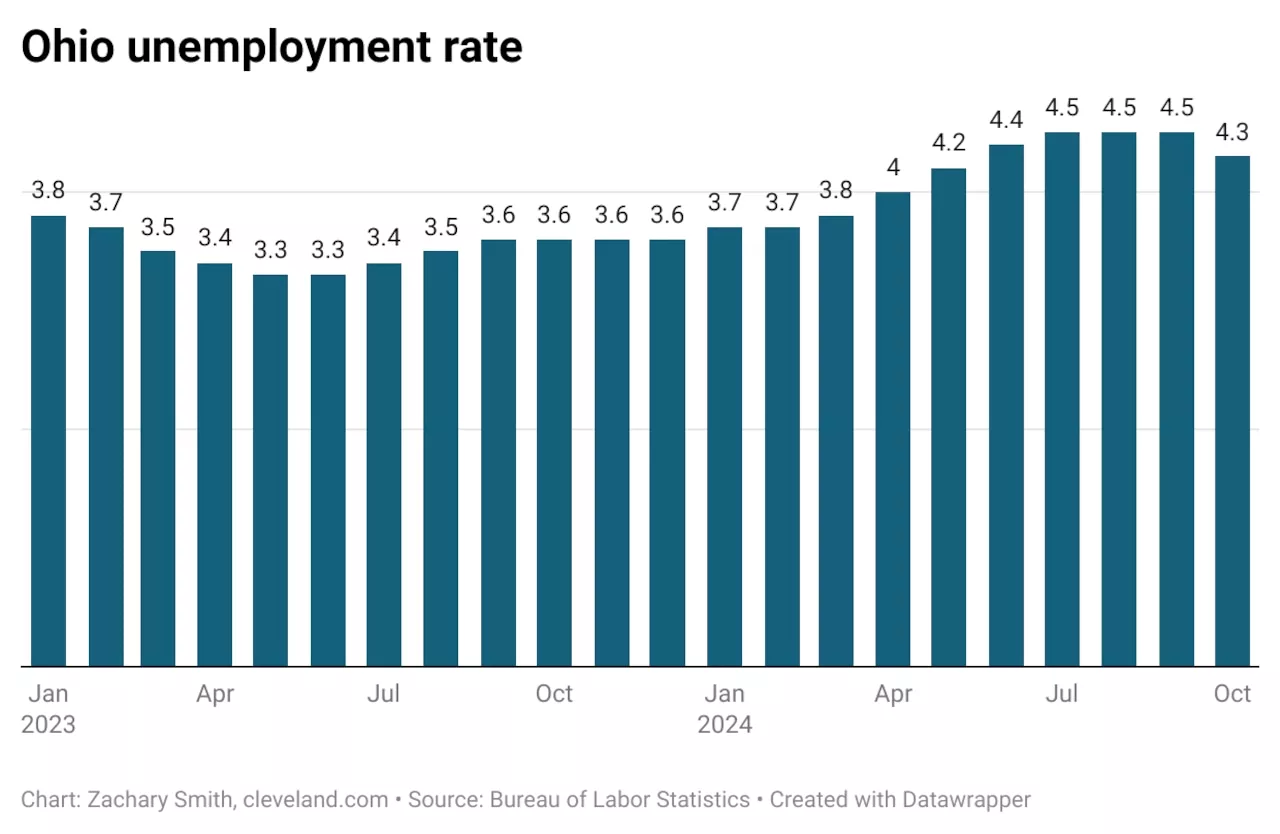

Ohio’s unemployment rate drops for first time in 18 months; remains above national levelOhio’s unemployment rate was 4.3% in October, remaining above the national unemployment rate of 4.1%

Ohio’s unemployment rate drops for first time in 18 months; remains above national levelOhio’s unemployment rate was 4.3% in October, remaining above the national unemployment rate of 4.1%

Read more »

California's unemployment benefits system 'broken' with $20B owed to feds in loan debt: reportThe system, meant to be self-sufficient, has fallen short of covering annual benefit costs, resulting in a projected $2 billion annual deficit over the next five years and an outstanding $20 billion federal loan balance.

California's unemployment benefits system 'broken' with $20B owed to feds in loan debt: reportThe system, meant to be self-sufficient, has fallen short of covering annual benefit costs, resulting in a projected $2 billion annual deficit over the next five years and an outstanding $20 billion federal loan balance.

Read more »

Mississippi Faces Steepest Health Insurance Coverage Loss if Subsidies ExpireA new report by The Urban Institute predicts a significant increase in uninsured rates in Mississippi if health insurance subsidies lapse without congressional extension. Over 100,000 residents could lose coverage, raising the uninsured rate by 43%.

Mississippi Faces Steepest Health Insurance Coverage Loss if Subsidies ExpireA new report by The Urban Institute predicts a significant increase in uninsured rates in Mississippi if health insurance subsidies lapse without congressional extension. Over 100,000 residents could lose coverage, raising the uninsured rate by 43%.

Read more »