While buy now, pay later (BNPL) options seem appealing, research suggests they can lead to increased spending and financial strain. The convenience of spreading payments can mask the true cost, leading to overborrowing and difficulty managing finances.

If you're considering buying a new couch for $800, the option of spending $100 a month for 8 months with zero percent interest might seem appealing. However, research indicates that this approach can lead to challenging financial situations compared to paying for the couch upfront.You've likely encountered these options online. When making a purchase, instead of charging the entire amount to your credit card or debit account, you might see the option to buy now and pay later.

According to the Harvard Business Review, consumers who used buy now, pay later services were 9% more likely to make a purchase, and the number of items purchased increased by 10%. This trend was not just temporary; research examining the shopping habits of nearly 300,000 people showed that these increases continued for almost six months.'It's just the need.

BNPL Finance Spending Debt Budgeting

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

The Hidden Costs of Buy Now, Pay LaterThis article explores the potential financial risks associated with 'buy now, pay later' (BNPL) services, despite their seemingly attractive offers.

The Hidden Costs of Buy Now, Pay LaterThis article explores the potential financial risks associated with 'buy now, pay later' (BNPL) services, despite their seemingly attractive offers.

Read more »

Buy Now Pay Later: Convenient or Costly?While the allure of 'buy now pay later' options seems tempting, experts warn that this financing method can lead to financial strain and overspending compared to paying upfront. The ease of spreading payments can encourage impulsive purchases and mask the true cost of items, especially for lower-income individuals who perceive greater budgeting control.

Buy Now Pay Later: Convenient or Costly?While the allure of 'buy now pay later' options seems tempting, experts warn that this financing method can lead to financial strain and overspending compared to paying upfront. The ease of spreading payments can encourage impulsive purchases and mask the true cost of items, especially for lower-income individuals who perceive greater budgeting control.

Read more »

28 Years Later: Alex Garland Addresses Sequel's Connection to 28 Weeks Later EndingThe marketing campaign for 28 Years Later is in full swing, with interviews revealing insights into the film's direction and cast. Alex Garland, screenwriter of the original 28 Days Later, addresses the controversial ending of 28 Weeks Later and clarifies the film's connection to the previous installments.

28 Years Later: Alex Garland Addresses Sequel's Connection to 28 Weeks Later EndingThe marketing campaign for 28 Years Later is in full swing, with interviews revealing insights into the film's direction and cast. Alex Garland, screenwriter of the original 28 Days Later, addresses the controversial ending of 28 Weeks Later and clarifies the film's connection to the previous installments.

Read more »

Money can’t buy happiness, but it can buy the Supreme CourtThe specter of wealth looms large over the judiciary,

Money can’t buy happiness, but it can buy the Supreme CourtThe specter of wealth looms large over the judiciary,

Read more »

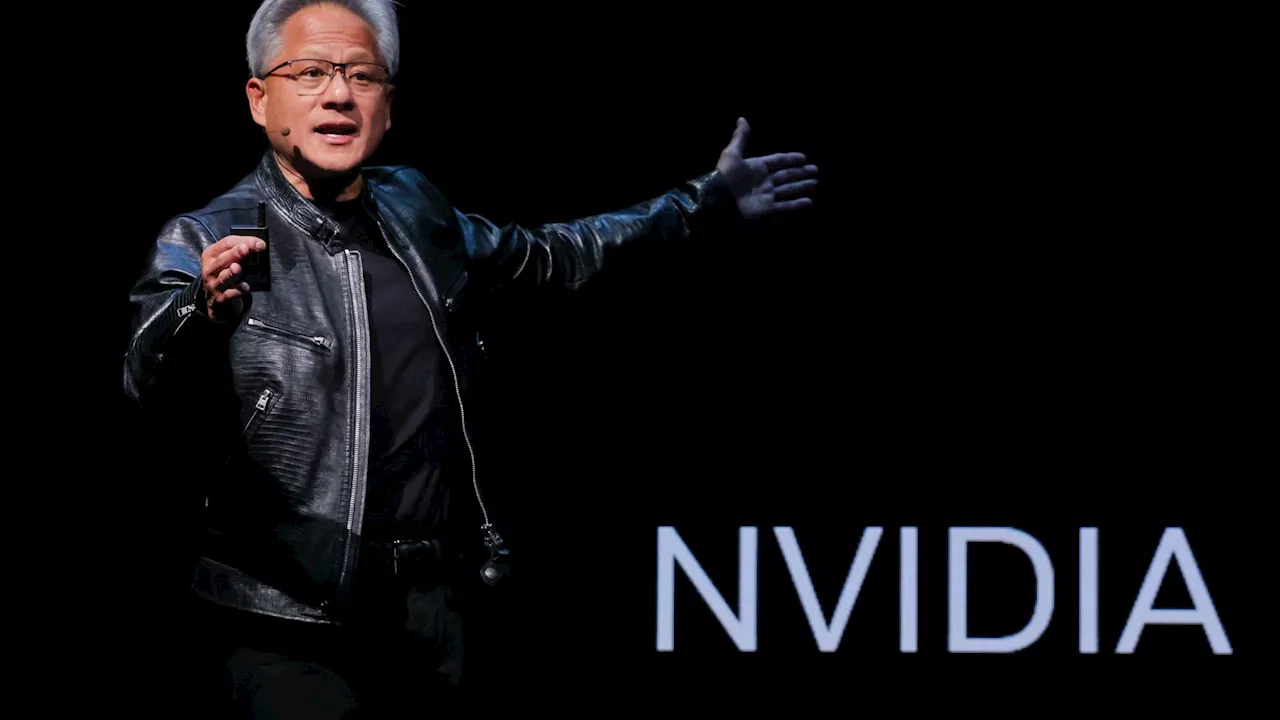

Wall Street's Biggest Calls on WednesdayLoop initiates Viking Holdings as buy, Bank of America reiterates Alphabet as buy, Wells Fargo reiterates Advanced Micro Devices as overweight, downgrades Snap to equal weight and American Eagle to equal weight, Barclays downgrades Ferrari to equal weight, Piper Sandler upgrades Simon Property to overweight, Jefferies upgrades Mattel to buy, JPMorgan upgrades Janus Henderson to overweight, Piper Sandler initiates Opera as overweight, Rosenblatt downgrades Spotify to neutral, Stifel upgrades Hayward to buy, Citi downgrades Warby Parker to sell and upgrades Molson Coors to neutral, JPMorgan reiterates Nvidia as overweight, reiterates Apple as overweight, UBS reiterates Chipotle as buy.

Wall Street's Biggest Calls on WednesdayLoop initiates Viking Holdings as buy, Bank of America reiterates Alphabet as buy, Wells Fargo reiterates Advanced Micro Devices as overweight, downgrades Snap to equal weight and American Eagle to equal weight, Barclays downgrades Ferrari to equal weight, Piper Sandler upgrades Simon Property to overweight, Jefferies upgrades Mattel to buy, JPMorgan upgrades Janus Henderson to overweight, Piper Sandler initiates Opera as overweight, Rosenblatt downgrades Spotify to neutral, Stifel upgrades Hayward to buy, Citi downgrades Warby Parker to sell and upgrades Molson Coors to neutral, JPMorgan reiterates Nvidia as overweight, reiterates Apple as overweight, UBS reiterates Chipotle as buy.

Read more »

European Payments Giant Klarna Says It Will Look To Integrate CryptoThe “buy now, pay later” company is backed by venture capital firm, Sequoia Capital, which has a 22% stake.

European Payments Giant Klarna Says It Will Look To Integrate CryptoThe “buy now, pay later” company is backed by venture capital firm, Sequoia Capital, which has a 22% stake.

Read more »