Underwriting losses would be partly offset for Morgan Stanley, Bank of America, and Barclays, which provided fees for M&A advisory services to Musk. Four other banks that only provided the debt – MUFG Bank, Mizuho, BNP Paribas SA, and Societe Generale ...

Banks are usually upset when large leveraged buyouts fall apart because of the hefty fees they generate. But Elon Musk’s decision toCredit markets have tumbled since banks first agreed to raise $13-billion tothe deal in April. The riskiest piece of the debt package alone would have caused losses of between $150-million and $200-million at current market levels, according to Bloomberg calculations.

If the debt yields more than 11.75%, banks eat into fees. They would incur outright losses if the rate exceeds 12.125%. The Twitter financing package – one of the largest in recent memory – also includes $6.5-billion of leveraged loans and $3-billion of secured junk bonds. Those types of debt have held up better than unsecured bonds – though the loan market has dropped– and it’s unclear how much of a loss, if any, banks would take at current market levels.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

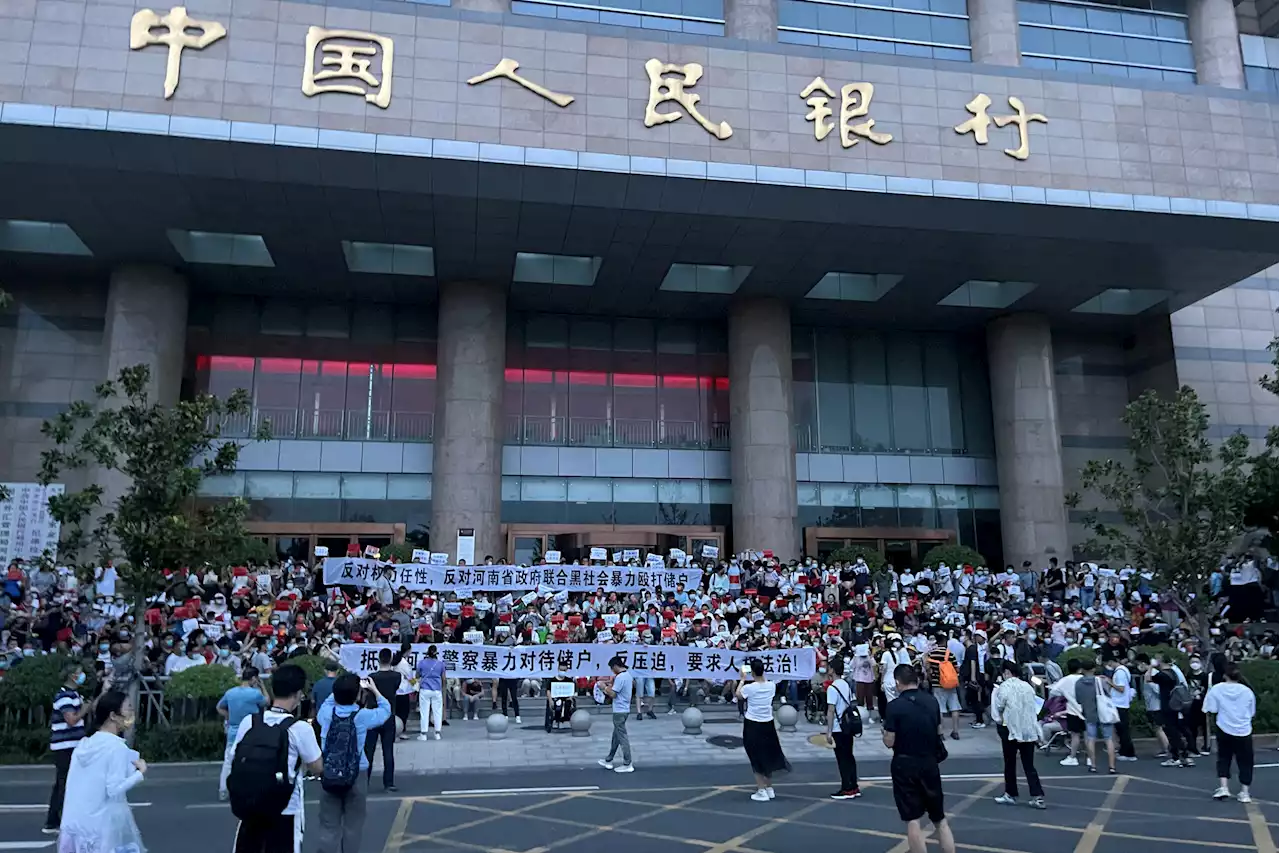

China detains alleged bank fraud 'gang' after rare mass protests | The CitizenThe demonstrators in Henan largely drew sympathy on Chinese social media on Monday, with many on the Weibo platform pointing the finger at local officials.

China detains alleged bank fraud 'gang' after rare mass protests | The CitizenThe demonstrators in Henan largely drew sympathy on Chinese social media on Monday, with many on the Weibo platform pointing the finger at local officials.

Read more »

BREAKING NEWS: Standard Bank repeals mandatory Covid-19 vaccination policyThe bank has cancelled its mandatory vaccination policy ‘with immediate effect’ and is revising its Covid-19 workplace protocols

Read more »

Reit funding model at risk as Europe’s central bank turns off the tapsEuropean debt issuance has fallen off a cliff in recent months after an eight-year borrowing binge

Read more »

Chinese authorities promise payments after bank fraud protests turn violentBank funds were frozen in connection with disappearance of the deposits worth up to $1.5bn

Read more »