From Breakingviews - Uniper’s gory details point to bigger German bill

a 40 billion euro net loss for the first nine months of the year. The key component: a 31 billion euro hit reflecting the future costs arising from replacing curtailed Russian gas with extremely expensive alternatives.

This is way north of the 8 billion euro capital injection from the German state announced in September. Since then Berlin has scrapped a levy on Germans intended to shield energy groups from most of their future pain, replacing it with a more generalised 200 billion euro support package. The upshot for Uniper is that its balance sheet equity has sunk from 6 billion euros as of December to minus 30 billion euros.

The scale of the expanded hole explains why JPMorgan analysts reckon Uniper might need another 28 billion euros. While that’s based on a 2023 European gas price forecast at 160 euros per megawatt hour, gas for delivery in a year’s time is currently only 130 euros per MWh. Yet cold weather could worsen the situation. With Uniper de facto nationalised, the 200 billion euro backstop will soon be called on.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Breakingviews - Europe’s diverging prices complicate ECB’s taskThe euro zone monetary policy debate may soon become more tense. The region’s inflation rate, at 10.7% in October, masks wide disparities among member states. Prices are increasing at an annual pace of 7% in France, 12% in Germany and 22% in Estonia. The European Central Bank’s policy of higher rates risks being too aggressive for some countries, but too timid for others.

Breakingviews - Europe’s diverging prices complicate ECB’s taskThe euro zone monetary policy debate may soon become more tense. The region’s inflation rate, at 10.7% in October, masks wide disparities among member states. Prices are increasing at an annual pace of 7% in France, 12% in Germany and 22% in Estonia. The European Central Bank’s policy of higher rates risks being too aggressive for some countries, but too timid for others.

Read more »

Breakingviews - Ocado’s South Korean deal is valuation rocket fuelOcado Chief Executive Tim Steiner is showing that growth stocks can thrive even in the most difficult of markets. Shares in the 5.4 billion pound ($6.2 billion) online grocer surged almost 40% on Tuesday after it inked a new deal with South Korea’s Lotte Shopping . Ocado plans to build six robotic warehouses for the grocer by 2028, with the first one due to go live in 2025. It looks like a great deal for the UK-based group: the hit to capital expenditures seems relatively small, partly because Lotte is covering some of the costs.

Breakingviews - Ocado’s South Korean deal is valuation rocket fuelOcado Chief Executive Tim Steiner is showing that growth stocks can thrive even in the most difficult of markets. Shares in the 5.4 billion pound ($6.2 billion) online grocer surged almost 40% on Tuesday after it inked a new deal with South Korea’s Lotte Shopping . Ocado plans to build six robotic warehouses for the grocer by 2028, with the first one due to go live in 2025. It looks like a great deal for the UK-based group: the hit to capital expenditures seems relatively small, partly because Lotte is covering some of the costs.

Read more »

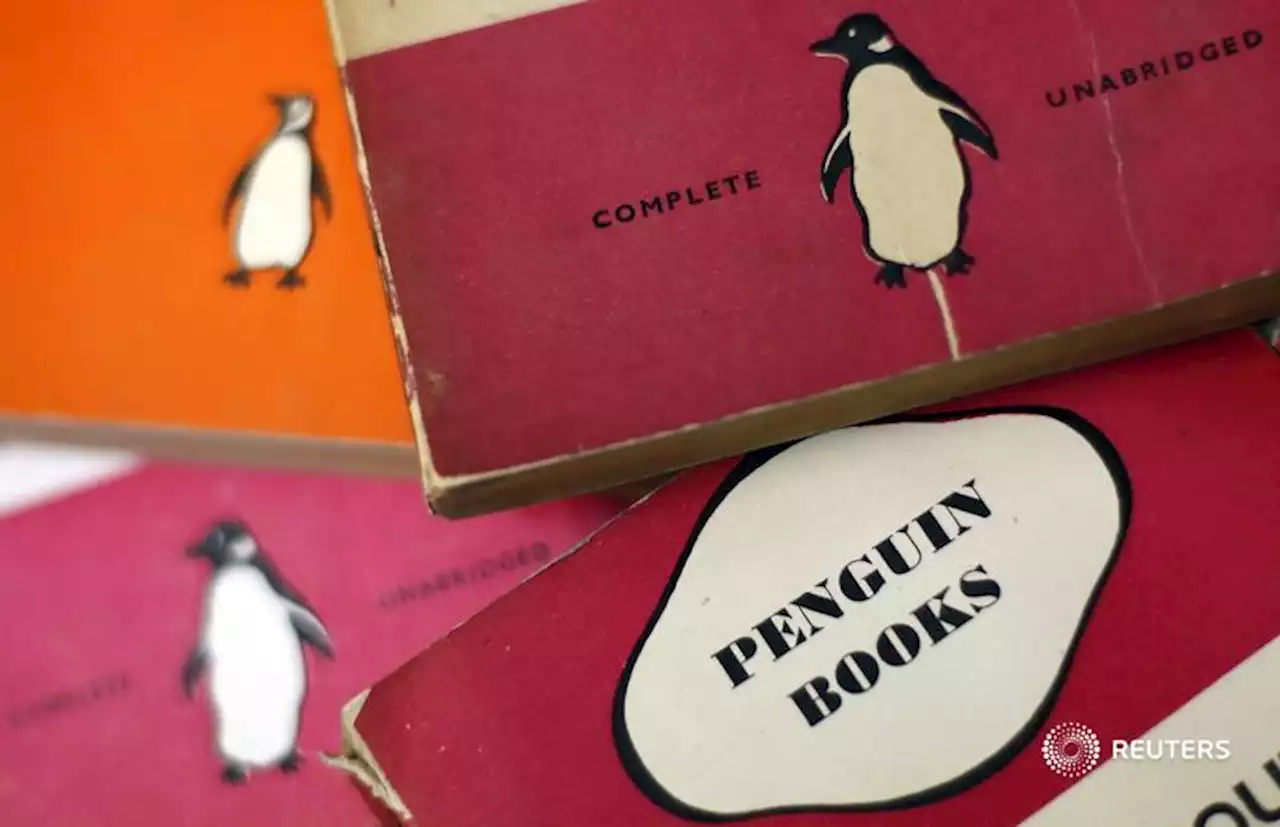

Breakingviews - Stephen King makes for unlikely antitrust heroA thwarted book publishing deal could open a messy chapter for mergers and acquisitions. A U.S. judge blocked Penguin Random House’s $2.2 billion acquisition of rival Simon & Schuster on Monday after the Department of Justice argued it would unfairly limit pay for top authors such as Stephen King. German media group Bertelsmann , owner of Penguin is going to appeal. But if the ruling prevails, future mergers may be vetted on their effect on workers as well as customers.

Breakingviews - Stephen King makes for unlikely antitrust heroA thwarted book publishing deal could open a messy chapter for mergers and acquisitions. A U.S. judge blocked Penguin Random House’s $2.2 billion acquisition of rival Simon & Schuster on Monday after the Department of Justice argued it would unfairly limit pay for top authors such as Stephen King. German media group Bertelsmann , owner of Penguin is going to appeal. But if the ruling prevails, future mergers may be vetted on their effect on workers as well as customers.

Read more »

Breakingviews - Bain gives India’s banking ball a time checkIndia’s banks are having a ball, and one foreign buyout prince that ensured a $32 billion lender made it to the soiree is dialling back on the dancing.

Breakingviews - Bain gives India’s banking ball a time checkIndia’s banks are having a ball, and one foreign buyout prince that ensured a $32 billion lender made it to the soiree is dialling back on the dancing.

Read more »

Breakingviews - China investors desperately seek market bottomThe Hang Seng index closed up 5% on Tuesday after a rumour that Beijing may relax Covid controls. Buying on internet scuttlebutt seems reckless. Yet Hong Kong-listed shares are so beaten up that it narrows the odds, says petesweeneypro

Breakingviews - China investors desperately seek market bottomThe Hang Seng index closed up 5% on Tuesday after a rumour that Beijing may relax Covid controls. Buying on internet scuttlebutt seems reckless. Yet Hong Kong-listed shares are so beaten up that it narrows the odds, says petesweeneypro

Read more »