From Breakingviews - Tui’s pandemic payback sets path for takeoff

releases it from government clutches and sets it up for brighter skies. The travel operator said on Friday it plans to issue new stock to raise 1.8 billion euros, at the high end of the 1.6 billion to 1.8 billion eurosin December by Chief Financial Officer Mathias Kiep. Like many travel companies Tui required funds to keep it afloat during the pandemic when holidays were cancelled and flights were grounded. The 2.7 billion euro company received a staggering 4.

Storm clouds are parting for the travel industry. Tui’s revenue is expected to soar by over 17% this year to top 19 billion euros, according to Refinitiv estimates. Meanwhile, its 2024 sales are forecast to exceed pre-pandemic levels. The company plans to fully repay a German government stake of 750 million euros and redeem its credit line from state lender KfW, while also paring down its use of a cash facility.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

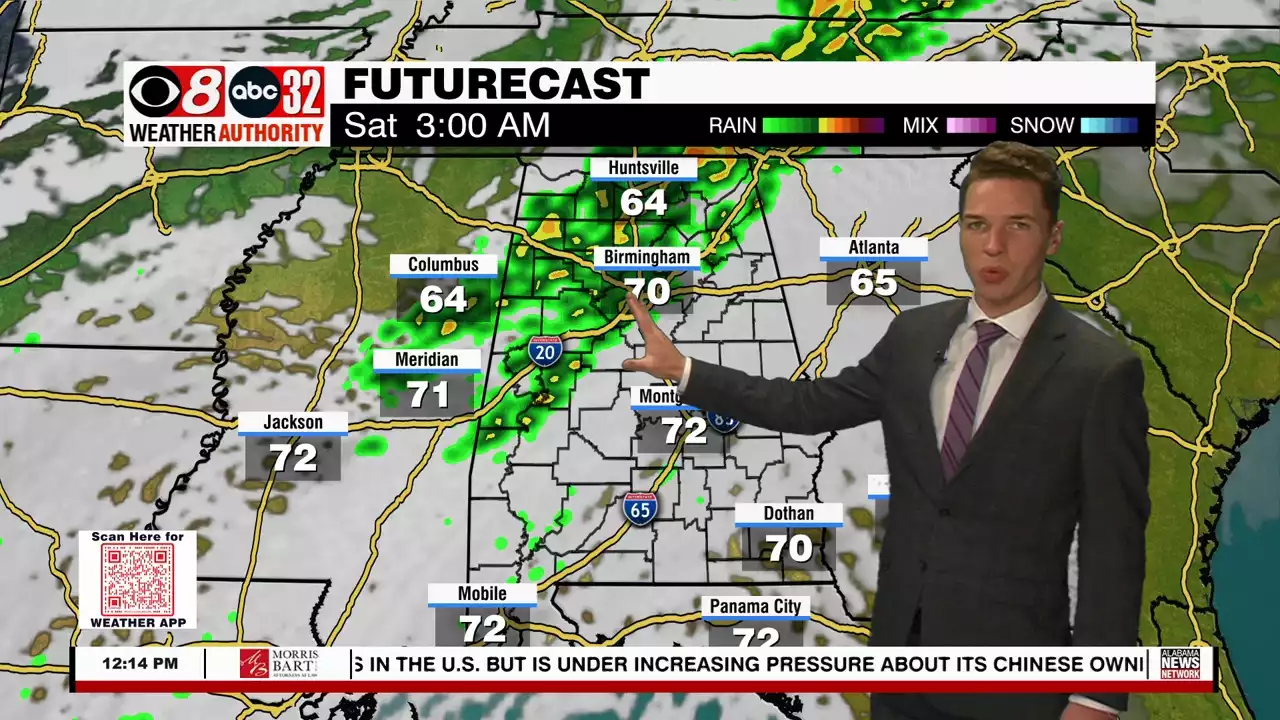

Sunshine Thursday, Friday; Severe Potential Friday Night - Alabama NewsTemperatures surge into the low and mid 80s Thursday afternoon and the sky remains mainly sunny. Thursday night remains mild with lows near 60°, while low clouds and fog likely develop again.

Sunshine Thursday, Friday; Severe Potential Friday Night - Alabama NewsTemperatures surge into the low and mid 80s Thursday afternoon and the sky remains mainly sunny. Thursday night remains mild with lows near 60°, while low clouds and fog likely develop again.

Read more »

Breakingviews - Syngenta’s weakening crops may dim IPO prospectsSyngenta’s earnings hit comes at an unfortunate time. The Chinese-owned pesticides-to-seeds maker, once listed in Zurich, is preparing a stock market comeback in Shanghai this year, hoping to fetch a valuation as high as $60 billion. Yet a 25% fall in fourth-quarter EBITDA may dim owner ChemChina’s hope for a bumper valuation. Chief Executive Erik Fyrwald blamed higher energy and raw materials costs for the hit, which shrank the company’s EBITDA margin to 12% of revenue in the last quarter compared to the nearly 17% it delivered for the year.

Read more »

Breakingviews - Swiss CoCo shakeout may yet help bank regulatorsSwitzerland’s forced merger of Credit Suisse with UBS has caused a real stink. The $250 billion market for contingent convertible bonds is reeling after the stricken Swiss lender was obliged to wipe out its own ones. Yet if the ensuing higher cost of issuing these “CoCo” securities means banks roll over their maturing debt rather than replace it, bank supervisors may still get a silver lining.

Read more »

Breakingviews - Just Eat’s employment U-turn won’t travelJust Eat Takeaway Chief Executive Jitse Groen is speaking out of both sides of his mouth. His 3.8 billion euro food delivery company on Tuesday said it will stop offering UK couriers minimum full-employment benefits including paid sick leave and holiday pay. That marks a U-turn from Groen’s 2021 claim that the gig worker model “led to precarious working conditions”. Just Eat Takeaway will employ food-delivery drivers in the UK as independent contractors or through third party agencies.

Breakingviews - Just Eat’s employment U-turn won’t travelJust Eat Takeaway Chief Executive Jitse Groen is speaking out of both sides of his mouth. His 3.8 billion euro food delivery company on Tuesday said it will stop offering UK couriers minimum full-employment benefits including paid sick leave and holiday pay. That marks a U-turn from Groen’s 2021 claim that the gig worker model “led to precarious working conditions”. Just Eat Takeaway will employ food-delivery drivers in the UK as independent contractors or through third party agencies.

Read more »

Breakingviews - Fed’s self-scrutiny starts off on the wrong footThe collapse of Silicon Valley Bank came as a shock to many of its customers and investors. It ought not to have surprised the Federal Reserve, though. Central bank staff had flagged in January that the tech-adjacent lender was at risk of possible cash shortages. The Fed is now investigating how its supervision of SVB could have been better. But it’s a stretch to think the institution, with its tangled, partly centralized structure, can conduct a warts-and-all review.

Breakingviews - Fed’s self-scrutiny starts off on the wrong footThe collapse of Silicon Valley Bank came as a shock to many of its customers and investors. It ought not to have surprised the Federal Reserve, though. Central bank staff had flagged in January that the tech-adjacent lender was at risk of possible cash shortages. The Fed is now investigating how its supervision of SVB could have been better. But it’s a stretch to think the institution, with its tangled, partly centralized structure, can conduct a warts-and-all review.

Read more »

Breakingviews - All’s fair in love and stablecoinsIf a stablecoin isn’t first, it’s last, as Circle has learned this month. The company that issues USDC lost its peg to the dollar earlier this month because of worries about the $3.3 billion it held at Silicon Valley Bank. Though Circle recovered the funds from the bank, customers pulled $6 billion from it, according to Bloomberg. Competitor Tether’s flows went up by as much.

Breakingviews - All’s fair in love and stablecoinsIf a stablecoin isn’t first, it’s last, as Circle has learned this month. The company that issues USDC lost its peg to the dollar earlier this month because of worries about the $3.3 billion it held at Silicon Valley Bank. Though Circle recovered the funds from the bank, customers pulled $6 billion from it, according to Bloomberg. Competitor Tether’s flows went up by as much.

Read more »