From Breakingviews - Man mixes risk and reward in private credit bet

the fray. However, it may face choppy waters now as high interest rates trigger defaults. That also makes it a good time to buy into the sector, if you can find the right manager. Varagon, which specialises in mid-market buyouts, has a strong record: its loans have suffered an annualised default rate of just 0.05% since 2014, versus the 1.6% average in the Cliffwater Direct Lending Index.

One wrinkle: over half of Varagon’s client commitments come from just three insurers including AIG who were its owners and are now selling out. They will be rewarded with further payments if they extend their commitments, and Man hopes to use its network to broaden Varagon’s investor base. Overall, after factoring in Varagon’s management’s 23% stake, the deal values the whole group at $250 million, equivalent to about 2% of Varagon’s nearly $12 billion of assets under management.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Man impersonating police allegedly harassed group of cyclists for monthsFor the first time, a witness shared what she knew about the man who allegedly impersonated a police officer last week.

Man impersonating police allegedly harassed group of cyclists for monthsFor the first time, a witness shared what she knew about the man who allegedly impersonated a police officer last week.

Read more »

![]() Breakingviews - Ghost of Silicon Valley Bank turns up in ItalyA crisis at a small Italian insurer has rekindled concerns about the effect of rising rates. The rapid collapse of Silicon Valley Bank earlier this year was largely down to an ill-advised bond portfolio and liabilities that were less sticky than assumed. While Italy’s Eurovita isn’t a bank, its demise has some similarities with events across the Atlantic.

Breakingviews - Ghost of Silicon Valley Bank turns up in ItalyA crisis at a small Italian insurer has rekindled concerns about the effect of rising rates. The rapid collapse of Silicon Valley Bank earlier this year was largely down to an ill-advised bond portfolio and liabilities that were less sticky than assumed. While Italy’s Eurovita isn’t a bank, its demise has some similarities with events across the Atlantic.

Read more »

Breakingviews - Why central banks cannot relax in inflation fight: podcastWestern policymakers have frantically hiked interest rates to dampen consumer prices. In this Exchange podcast, Claudio Borio, a top official at the Bank for International Settlements, argues that rate-setters need to keep going to ensure costs of living won’t stay elevated.

Breakingviews - Why central banks cannot relax in inflation fight: podcastWestern policymakers have frantically hiked interest rates to dampen consumer prices. In this Exchange podcast, Claudio Borio, a top official at the Bank for International Settlements, argues that rate-setters need to keep going to ensure costs of living won’t stay elevated.

Read more »

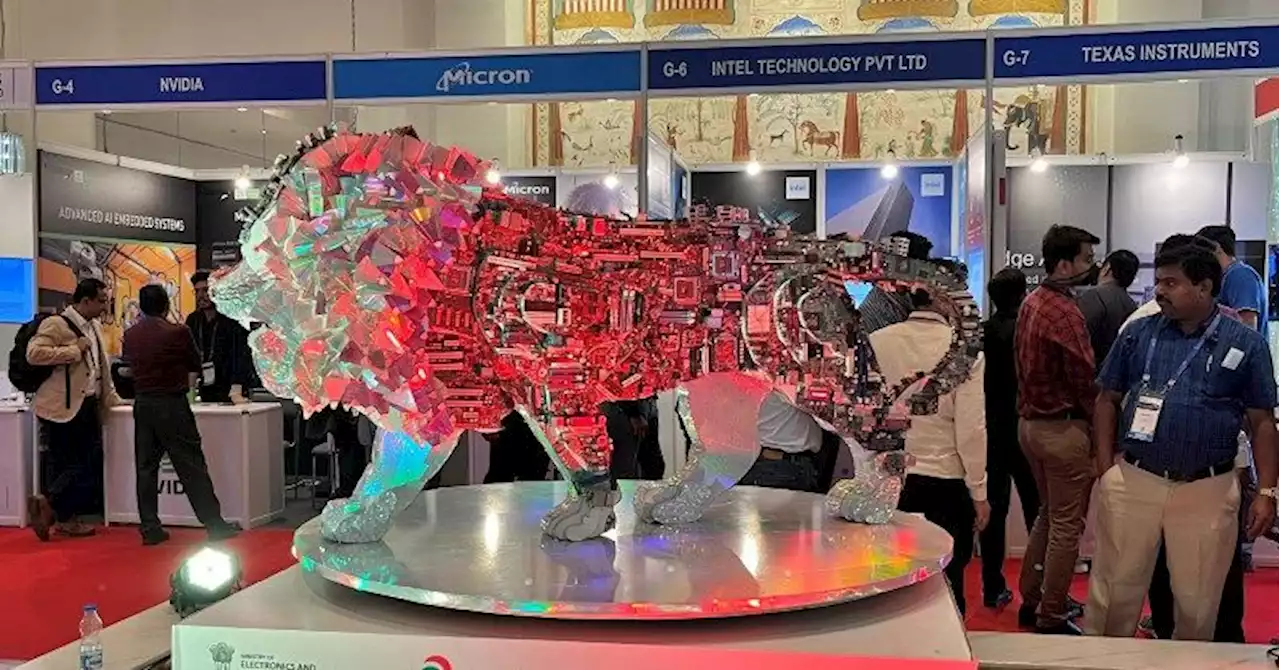

Breakingviews - India can aim lower in its chip dreamsIndia’s semiconductor dreams are facing a harsh reality. After struggling to woo cutting-edge chipmakers like Taiwan Semiconductor Manufacturing to set up operations in the country, the government may now have to settle for producing less-advanced chips instead. Yet that’s no mere consolation prize: the opportunity to grab share from China in this commoditised but vital part of the tech supply chain could pay off.

Breakingviews - India can aim lower in its chip dreamsIndia’s semiconductor dreams are facing a harsh reality. After struggling to woo cutting-edge chipmakers like Taiwan Semiconductor Manufacturing to set up operations in the country, the government may now have to settle for producing less-advanced chips instead. Yet that’s no mere consolation prize: the opportunity to grab share from China in this commoditised but vital part of the tech supply chain could pay off.

Read more »

Breakingviews - Europe's biggest IPO prudently tests the waterEurope’s biggest listing this year is off to a cautious start. Hidroelectrica, Romania’s top hydropower producer, priced on Wednesday its initial public offering (IPO) at 104 lei ($22.87 per share, the middle of a proposed range, raising 1.8 billion euros. That values the whole utility at 46.8 billion lei, or 9.4 billion euros. It also suggests the company would trade at 10.5 times its 2022 earnings per share, a multiple 30% lower than the 14.8 times Austrian peer Verbund is currently trading at.

Breakingviews - Europe's biggest IPO prudently tests the waterEurope’s biggest listing this year is off to a cautious start. Hidroelectrica, Romania’s top hydropower producer, priced on Wednesday its initial public offering (IPO) at 104 lei ($22.87 per share, the middle of a proposed range, raising 1.8 billion euros. That values the whole utility at 46.8 billion lei, or 9.4 billion euros. It also suggests the company would trade at 10.5 times its 2022 earnings per share, a multiple 30% lower than the 14.8 times Austrian peer Verbund is currently trading at.

Read more »