From Breakingviews - If Credit Suisse loves its bankers, set them free

That could fund retention payments for managing directors in the bank’s strongest areas, like consumer staples and materials. Credit Suisse could also offer them private stock in a focused dealmaking unit, rather than the struggling mothership, so they eat more of what they kill, in Wall Street parlance.

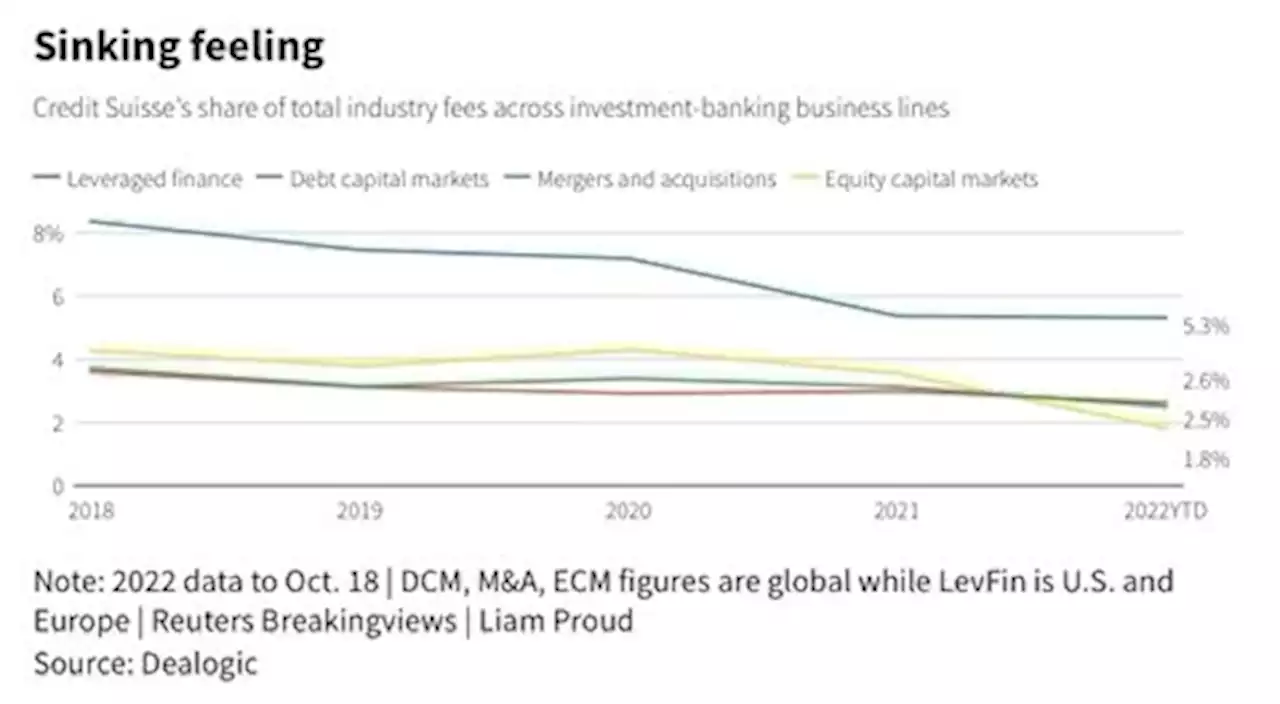

eventually went public. That would leave Lehmann under pressure to float the carved-out unit, giving the bankers and external investors a way of turning their holdings into cash.Imagine, then, that Credit Suisse spins out its advisory and capital-markets business. Call it Second Boston. If the independent firm can grab a little more than 2% of total industry merger and underwriting fees, roughly what it does now according to Refinitiv data, it might have $3 billion of annual revenue.

That could give it a chunky value relative to Credit Suisse’s own market capitalisation. Rival Perella Weinberg

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Gold Price Forecast: XAU/USD to come under renewed pressure, next support at $1,614 – Credit SuisseGold has reinforced its “double top.” Strategists at Credit Suisse expect the yellow metal to suffer further weakness. Only a convincing weekly close

Gold Price Forecast: XAU/USD to come under renewed pressure, next support at $1,614 – Credit SuisseGold has reinforced its “double top.” Strategists at Credit Suisse expect the yellow metal to suffer further weakness. Only a convincing weekly close

Read more »

Credit Suisse currency rigging claims go before U.S. juryA U.S. jury began deliberating on Wednesday at a civil trial where Credit Suisse Group AG stands accused of conspiring with the world's largest banks to rig prices in the foreign exchange market between 2007 and 2013.

Credit Suisse currency rigging claims go before U.S. juryA U.S. jury began deliberating on Wednesday at a civil trial where Credit Suisse Group AG stands accused of conspiring with the world's largest banks to rig prices in the foreign exchange market between 2007 and 2013.

Read more »

Credit Suisse scrambles to finalise revamp as deadline loomsCredit Suisse is racing to firm up sales of part of its business that could limit the cash it needs from investors, a person with direct knowledge of the matter said, with just days to go before the bank unveils an overhaul.

Credit Suisse scrambles to finalise revamp as deadline loomsCredit Suisse is racing to firm up sales of part of its business that could limit the cash it needs from investors, a person with direct knowledge of the matter said, with just days to go before the bank unveils an overhaul.

Read more »

If Credit Suisse loves its bankers, set them freeThe Swiss bank may bring outside investors into its dealmaking unit, to insulate it from parental turmoil. The business could be worth up to $6 bln, valued in line with boutique advisory shops. Yet the best way to hit such a price tag is for Credit Suisse to cut it loose.

If Credit Suisse loves its bankers, set them freeThe Swiss bank may bring outside investors into its dealmaking unit, to insulate it from parental turmoil. The business could be worth up to $6 bln, valued in line with boutique advisory shops. Yet the best way to hit such a price tag is for Credit Suisse to cut it loose.

Read more »

NZD/USD: 0.5798/5813 to hold current correction to avoid a stronger upmove towards 0.5978 – Credit SuisseNZD/USD is seeing a minor recovery, which economists at Credit Suisse look to be held at 0.5798/5813. Move below 0.5510 needed to turn near-term risk

NZD/USD: 0.5798/5813 to hold current correction to avoid a stronger upmove towards 0.5978 – Credit SuisseNZD/USD is seeing a minor recovery, which economists at Credit Suisse look to be held at 0.5798/5813. Move below 0.5510 needed to turn near-term risk

Read more »

Brent Crude Oil to suffer further weakness, potentially to the March 2021 low at $60.27 – Credit SuisseBrent Crude Oil is back below key averages. Strategists at Credit Suisse expect further weakness from here. Only a solid rise back above $93.78/102.57

Brent Crude Oil to suffer further weakness, potentially to the March 2021 low at $60.27 – Credit SuisseBrent Crude Oil is back below key averages. Strategists at Credit Suisse expect further weakness from here. Only a solid rise back above $93.78/102.57

Read more »