GlaxoSmithKline’s personal health spinoff is beginning life with a target on its back. Haleon, maker of Advil painkillers and Sensodyne toothpaste, will next month list in London, and could be worth 42 billion pounds. But with two large shareholders keen to sell out, lots of debt and a challenging consumer backdrop, it may not stay single for long.

for Haleon in January on the grounds that it undervalued the business. Assume new Haleon CEO Brian McNamara grows revenue by 5%, the middle of his 4% to 6% target range, and sales for this year will reach 9.5 billion pounds. On the division’s historic 25% margin, EBITDA could total 2.5 billion pounds. Put that on the same 17 times multiple as Colgate Palmolive

, which has a similar growth profile, and the business would be worth around 42 billion pounds including debt.Still, Haleon has some unique risks. Pfizer and GSK both plan to offload their stakes in coming years. That roughly 40% share overhang will depress its stock. Haleon will also be shouldering a heavy debt burden, worth 4 times its expected EBITDA in 2022, compared to Colgate which operates on just 1.

on 2 times. That extra debt may make it hard for Haleon to invest in brands like Advil, which were slowing before the pandemic, or defend market share if cash-strapped consumers choose to dump pricey branded products. Those factors may lead some investors to steer clear, depressing Haleon’s valuation. It could prove more appealing to a rival. Unilever may struggle to mount another bid, given its shareholders’ opposition to the last one, but Procter & Gamble

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Proposition roundup: What passed, what failedELECTION: Voters have given broad support to a number of ballot measures. As of now, the only prop we are still waiting to call is Prop. A, the Muni bond, which needs 2/3 of votes (66%) to pass.

Proposition roundup: What passed, what failedELECTION: Voters have given broad support to a number of ballot measures. As of now, the only prop we are still waiting to call is Prop. A, the Muni bond, which needs 2/3 of votes (66%) to pass.

Read more »

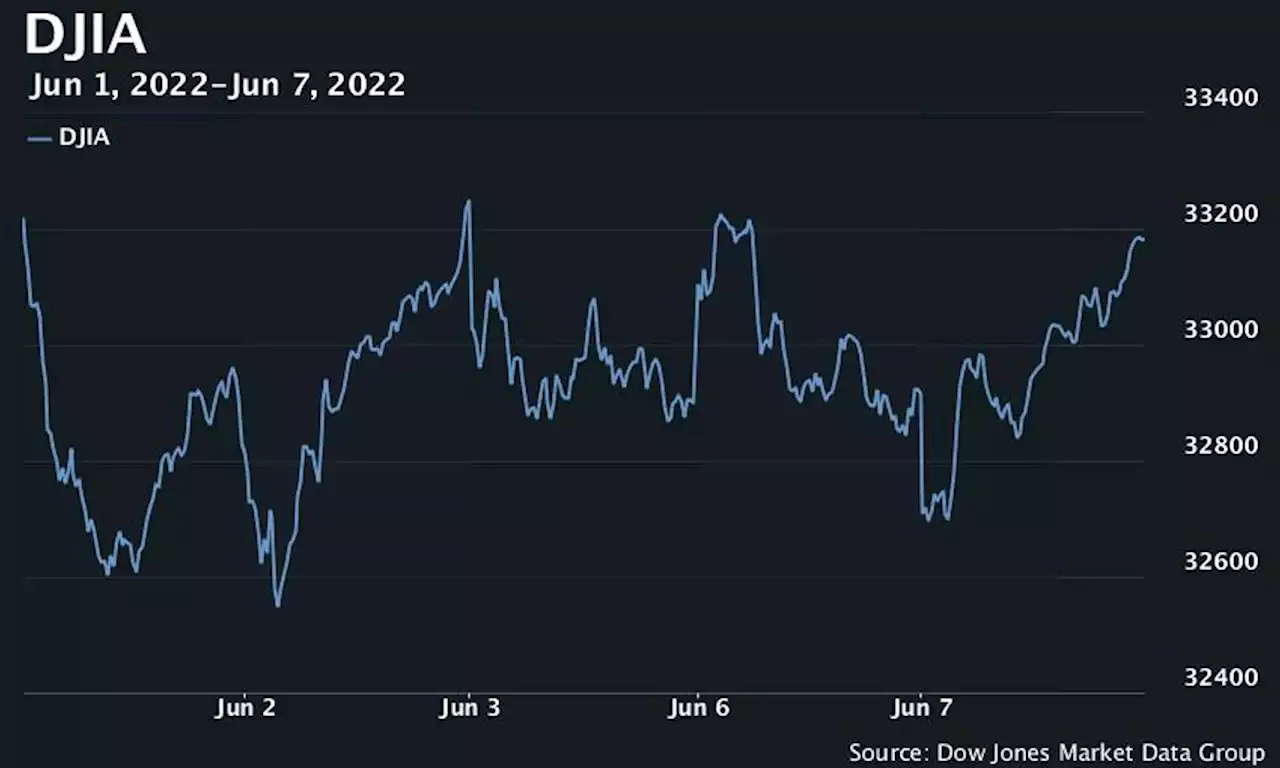

Dow ends about 260 points higher Tuesday, stocks book back-to-back gainsMajor U.S. stock indexes booked back-to-back gains on Tuesday, erasing earlier weakness after big-box retailer Target Corp. lowered its operating-margin guidance. The DJIA rose about 264 points, or 0.8%, ending near 33,179.

Dow ends about 260 points higher Tuesday, stocks book back-to-back gainsMajor U.S. stock indexes booked back-to-back gains on Tuesday, erasing earlier weakness after big-box retailer Target Corp. lowered its operating-margin guidance. The DJIA rose about 264 points, or 0.8%, ending near 33,179.

Read more »

Ukraine’s Cinemas, Museums And Theaters Start Reopening As Russia’s War Targets Cultural SitesTickets to Kyiv's Theater on Podil are sold out for the next few weeks as it became the latest cultural institution to reopen over the weekend.

Ukraine’s Cinemas, Museums And Theaters Start Reopening As Russia’s War Targets Cultural SitesTickets to Kyiv's Theater on Podil are sold out for the next few weeks as it became the latest cultural institution to reopen over the weekend.

Read more »

Breakingviews - Target joins the growing bad forecasters’ clubKnow your customer: it’s the golden rule of retail, and one that U.S. store chain Target seems to have flunked. The company slashed its forecast operating margin by more than half on Tuesday because of an excess of unsold goods. It’s one of many companies whose outlook has gone awry since the start of the Covid-19 pandemic. For retailers, the consequences of getting it wrong are especially painful.

Breakingviews - Target joins the growing bad forecasters’ clubKnow your customer: it’s the golden rule of retail, and one that U.S. store chain Target seems to have flunked. The company slashed its forecast operating margin by more than half on Tuesday because of an excess of unsold goods. It’s one of many companies whose outlook has gone awry since the start of the Covid-19 pandemic. For retailers, the consequences of getting it wrong are especially painful.

Read more »

Target warns profits will take short-term hit as it cuts back on excess inventoryTarget, which is facing excess inventory in several categories, said it's planning serval actions during the second quarter to 'right-size its inventory for the balance of the year.'

Target warns profits will take short-term hit as it cuts back on excess inventoryTarget, which is facing excess inventory in several categories, said it's planning serval actions during the second quarter to 'right-size its inventory for the balance of the year.'

Read more »

Bank of America downgrades Target as consumers pull back discretionary spendingBank of America on Wednesday downgraded Target to a neutral rating from buy.

Bank of America downgrades Target as consumers pull back discretionary spendingBank of America on Wednesday downgraded Target to a neutral rating from buy.

Read more »